Relatively speaking, Alliant Credit Union ($9.1B, Chicago, IL) doesn’t generate a large amount of non-interest income. The Chicago credit union reported slightly more than $23 million in non-interest income in 2015, compared with $33.7 million for the average $1 billion-plus credit union.

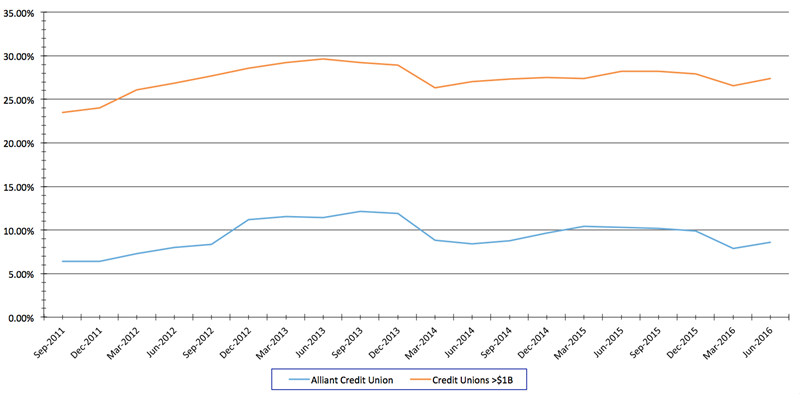

In 2015, only 9.9% of Alliant’s income came from non-interest sources. By comparison, its asset-based peer average was 27.9%. In the past five years, that proportion for Alliant has been as low as 5.8% in the first quarter of 2011 and as high as 12.13% in the third quarter of 2013.

NON-INTEREST INCOME/TOTAL INCOME

FOR U.S. CREDIT UNIONS $1B IN ASSESTS | DATA AS OF 06.30.16

Alliant Credit Union generated 9.90% of its income from non-interest sources in 2015, compared with 27.91% for the 266 credit unions of a billion dollars or more in the Callahan database. Callahan Associates | www.creditunions.com

But the big Plains State credit union with a nationwide, even international, membership plans to use technology and sales savvy to grow that business in the years ahead, says its president and CEO, Dave Mooney.

In the past, non-interest income has been a relatively small contributor to Alliant’s total income because we intentionally have few and low fees to provide consistently superior financial value to members, Mooney says.

|

| Dave Mooney, CEO, Alliant Credit Union |

We see NII as an opportunity for additional revenue over time and are looking to increase non-interest income in a way that adds value to our membership, he adds.

Mooney sees three paths toward that end goal:

- Provide value-add fee-based services, such as retirement investment services.

- Gain revenue by providing services to other businesses.

- Expand usage across products such as checking, debit, and credit cards.

Insurance

Insurance Alliant generated $2.9 million in income from insurance in 2015. Nearly $400,000 of that came from accidental death and dismemberment, life, and property and casualty policies from CUNA Mutual Group and its TruStage arm.

We’re on track to beat those numbers in 2016, Mooney says.

CU QUICK FACTS

ALLIANT CREDIT UNION

Data as of 06.30.16

- HQ: Chicago, IL

- ASSETS: $9.1B

- MEMBERS: 321,615

- BRANCHES: 12

- 12-MO SHARE GROWTH: 11.1%

- 12-MO LOAN GROWTH: 10.4%

- ROA: 0.7%

Alliant has increased its insurance business approximately 10% in the past two years, largely as the result of growing membership itself.

We’ve increased our auto and mortgage loans over the past few years, Mooney says. That’s enabled our sales teams to make more referrals to TruStage for policy coverage.

The credit union sells TruStage policies through direct marketing and in the case of PC via leads from Alliant’s sales team to the TruStage team, Mooney says. He sees more growth coming as the credit union integrates TruStage data into the credit union’s CRM and marketing automation software.

This should make it easier for our front-line personnel to understand these types of opportunities, Mooney says. It will also help them answer member questions and prevent the likelihood of members getting inundated with multiple marketing campaigns at one time.

In July 2016, Callahan Associates surveyed 170 credit union executives from 40 states to gain insight into their current and emerging sources of non-interest income. Read 3 Findings From Callahan’s Non-Interest Income Survey to learn more.

Investments

Alliant generated $2.6 million in investment fee income in 2015, all from the sale of stocks, bonds, and mutual funds. An investment services team of 15, including 10 financial consultants, oversees that line of business. Of the financial consultants, Mooney says, They are incented with a small base salary and a monthly commission grid based on production level. Alliant has collaborated with LPL Financial for the past four years, and Mooney cites scale, product lineup, and technology as keys to success in that partnership.

Alliant has collaborated with LPL Financial for the past four years, and Mooney cites scale, product lineup, and technology as keys to success in that partnership.

Alliant Credit Union uses insurance and investment products from CUNA Mutual Group and LPL Financial. Find your next solution in the Callahan Associates online Buyer’s Guide.

Ancillary

Mooney cites better oversight of partnerships and products as the reason Alliant has increased sales and profitability in its ancillary products.

In 2015, the credit union brought in $1 million in GAP sales, $388,000 in warranties, and $1.1 million in debt protection.

With increased consumer loan originations, our front-line staff has increased opportunities to sell our ancillary products, the Alliant CEO says.

Mooney also says Alliant isn’t concerned particularly about regulatory changes that could affect how credit unions generate fees from non-sufficient funds. Although the credit union generated $1.7 million in 2015 from such programs, they’re opt-in at Alliant and fees are less than those charged by other financial institutions.

We believe we’re in good shape with potential CFPB rulings, Mooney says.

You Might Also Enjoy

- The Year Of The Employee

- 3 Member Service Successes In Second Quarter 2016

- How This Small Single-Sponsor Credit Union Hangs Tough