Opportunity abounds in credit cards. The credit card market can be a credit union’s highest earning asset when done right, according to credit card guru Tim Kolk. As of fourth quarter 2014, the average interest rate of credit union credit cards was 10.5%, according to Peer-to-Peer Analytics by Callahan & Associates. Compare that to their 1.9% net charge-off rate and that’s a nice margin.

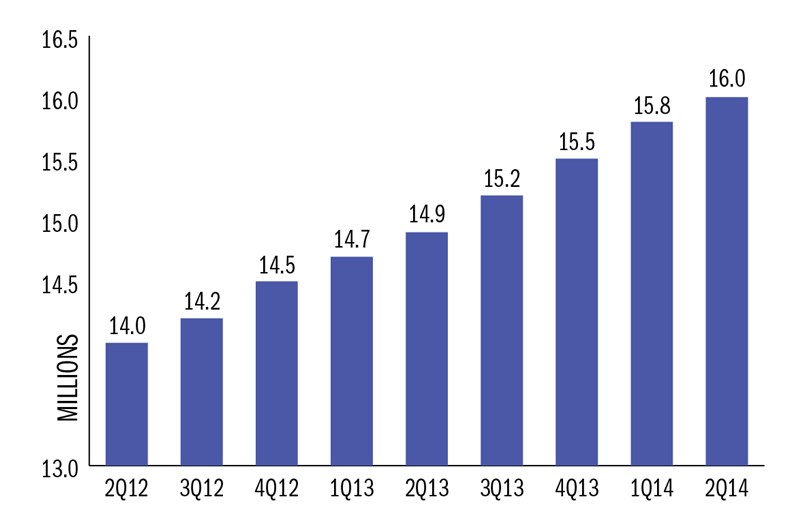

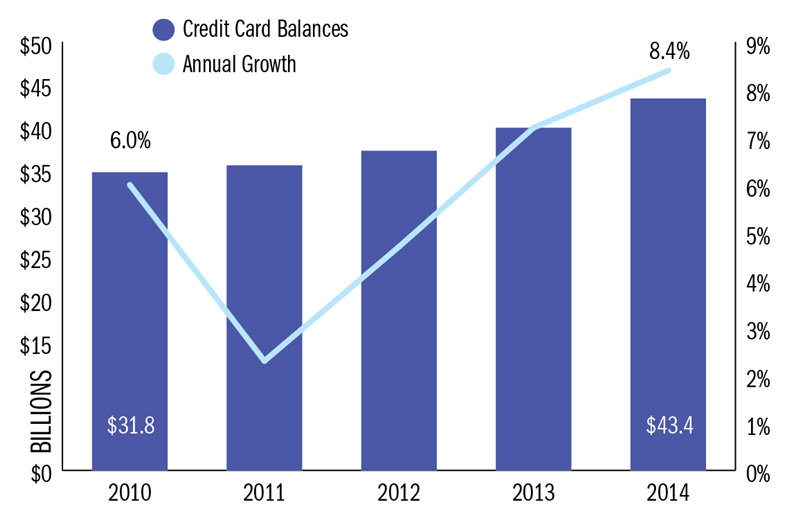

Credit risk and charge-off rates are at 20-year lows and margin and return on assets are at historic highs. And since the recession, credit unions have increased their credit card market share nearly 50%. There were 14 million credit union credit card accounts in the second quarter of 2012. That reached 16 million as of second quarter 2014. Likewise, card balances were up 8.4% annually and hit $43.4 billion at midyear.

Credit UNION CREDIT CARD ACCOUNTS

For U.S. credit unions | Data as of 06.30.14

Source: Peer-to-Peer Analytics by Callahan & Associates

CREDIT CARD BALANCES

For U.S. credit unions | Data as of 06.30

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

If you’re not in the credit card business, it’s time to reconsider it. A performing card program generates three to four times more income dollar-for-dollar than other loan products, reported Kolk in the November 2013 piece for CreditUnions.com How To Build A Successful Card Program.

The archives of CreditUnions.com contain actionable credit card case studies that are as relevant today as when they were written. The top choices outlined below include how to use creative marketing plans to introduce members to credit cards, how to think outside the box to engage Gen Y, and the pros and cons of affinity programs.

One Loan Leads To Another

In 2013,Credit Union 1 ($888.4M, Anchorage, AK) did a lot of auto lending. Auto loans made up 40% of the institution’s portfolio, nearly 10 percentage points higher than credit unions of a similar asset size. Despite the strength in auto lending for Alaskan credit unions, auto lending makes up 63% of the loan portfolio Credit Union 1 struggled with its credit card program.

The cooperative faced stiff competition from Bank of America, whose credit card incentivizes customers with air miles redeemable at Alaskan Airlines, the airline of choice for Alaskans. So Credit Union 1 looked to a strength to bolster a weakness and used its healthy auto lending program to inject life into its flat credit card program.

Now, members who qualify for an auto loan with Credit Union 1 automatically qualify for the institution’s credit card. Whether the member accepts the new card or not, the offer starts a dialogue about the value of a Credit Union 1 credit card. Before the institution introduced the paired program, its credit card penetration hovered in the range of 14%-15%. As of June 2014, penetration was 25.0%, according to Search & Analyze data on CreditUnions.com. Read more in One Loan Leads To Another.

How The Credit Card Crumbles

The heart wants what it can’t have. In financial services, that is Gen Y credit card users. According to 2012 FICO statistics, the average credit card balance of individuals 18 to 29 dropped roughly $1,000 from 2007. In addition, 16% of consumers in this group don’t have a credit card at all compared to 7% in 2005. FICO attributes the lack of interest to requirements on young borrowers introduced by the Credit CARD Act as well as the sometimes suffocating burden of student loan debt.

But there are ways into the hearts and wallets of Gen Y, namely through prepaid cards, young-member credit cards, and philanthropic rewards programs.

But it’s not only young members who are avoiding credit cards. The retailers they visit are also shying away from credit. According to an Intuit Go Payment survey, roughly 55% of the country’s small businesses do not accept credit card payments. How can a credit union facilitate that activity? America First Credit Union ($6.3B, Ogden, UT) began offering a cobranded mobile payment processing device to its small business clients in September 2013. The device attaches to any tablet or mobile phone and allows the user to process card transactions. About half of the credit union’s 800 business members use the card processors.

This generation is the future. Read How The Credit Card Crumbles for more strategies on how to help them build credit.

Risk And Rewards In Credit Card Affinity Programs

Dominant card issuers are allowing affinity card contracts to expire, which opens an opportunity for credit unions to create partnerships with organizations such as colleges or alumni groups to offer cobranded credit cards. Such efforts build new accounts for credit unions and provide a service for local organizations.

Large credit card issuers have traditionally dominated the affinity market. But a changing credit card market is causing many issuers to end those relationships. In a piece written in December 2012, Kolkoutlines the pitfalls and potential benefits of establishing an affinity partnership.

The local angle is an advantage many credit unions have over larger credit card issuers, Kolk reports. The best affinity program for a small issuer is one that is in-market, based on existing relationships, and managed by local people. For more best practices from Kolk, read Risk And Rewards In Credit Card Affinity Programs.

Bonus: What To Know Before You Grow

Credit unions interested in opening more credit card accounts better have a solid reporting structure in place. Read this article about tracking and reporting on a credit card program for measurementexamples and best practices.

Credit card charge-offs reached 4% in 2009 and 2010 but have fallen to less than 2% amid improved economic conditions. Bank credit card charge-offs peaked at more than 9% in 2009, but that, too, is coming down. As credit union and bank credit card risk draws closer together, credit unions must use better analytics to maintain the advantage over banks, Kolk says.