Making a positive difference for members and communities is at the heart of every credit union’s mission, but how do cooperatives track their progress and assign quantitative measures for something that is so subjective?

Marine Credit Union ($1.0B, La Crosse, WI) built a mission dashboard to identify how well it’s living its mission.

It Started With A Survey

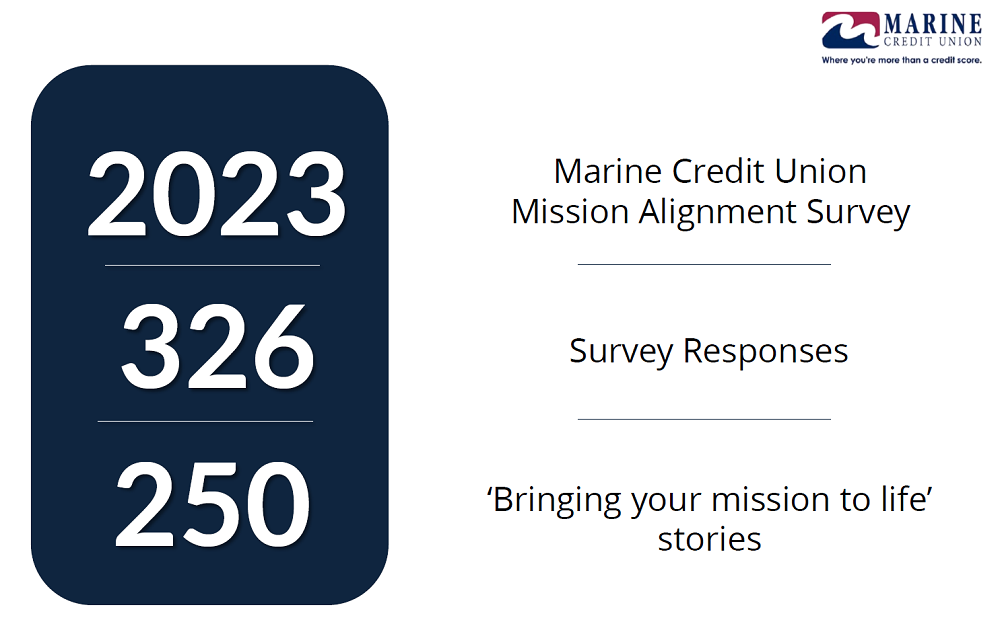

Marine Credit Union conducted a survey in the spring of 2023 to determine how employees personally identified with the credit union’s mission. After collecting the results from the all-staff survey, the credit union invited 22 leaders from across the cooperative to participate in a half-day, in-person workshop facilitated by Callahan & Associates to discuss the survey and identify metrics that fell under the categories of financial wellbeing and resilience, financial inclusion and capability, and workplace impact.

“We chose the three categories based on our mission statement and the spend, save, borrow, plan assessment categories of the Financial Health Network,” says Steve LeJeune, business intelligence manager for Marine Credit Union.

During that workshop, the leadership team identified more than 80 potential metrics to track Marine’s mission and impact. A smaller sub-group — which included LeJeune, the credit union’s senior vice president of member analytics, mortgage and communications leaders, and branch leadership — then further narrowed those metrics, selecting the best and creating a one-page mission dashboard.

Let Callahan help your organization assess its alignment around purpose and mission. Learn more today.

Metrics For Mission

Marine Credit Union’s Mission Statement

We are on a mission to advance the lives of people from a place of financial need to a life of ownership and giving back in our communities.

To simplify the process of narrowing the metrics, the credit union eliminated what it couldn’t track easily or accurately. For example, how much money Marine Credit Union saved someone on a refinance would be more difficult to report in the credit union’s system than other metrics.

In the end, the smaller team whittled the list of more than 80 ideas down to just eight metrics for the mission dashboard.

These include: (1) the percentage of members using payday lenders, (2) number of employees trained in financial counseling, (3) “Get Credit” CD secured loan usage, (4) percentage of active members with at least $400 in savings, (5) families who have moved from renter to homeowner, (6) credit score improvement, (7) financial counseling and member education, and (8) volunteer time off hours per employee per quarter.

Unlike traditional scorecards, which can be sales- or product-driven, the purpose of Marine’s mission dashboard is to ensure the entire organization focuses on its impact on members and the community.

The Right Data To Make A Difference

Leveraging data already available or easily trackable allowed Marine to begin publishing its mission dashboard in June. Initially, it shared the dashboard with executives and board members only; now, it publishes the dashboard every quarter for all the staff to see. It makes the dashboard available on the credit union’s intranet and CEO Darrick Weeks incorporates it into his quarterly blog that disseminates important updates to the entire organization.

CU QUICK FACTS

MARINE CREDIT UNION

DATA AS OF 09.30.23

HQ: La Crosse, WI

ASSETS: $1.0B

MEMBERS: 77,878

BRANCHES: 20

EMPLOYEES: 417

NET WORTH: 11.1%

ROA: 0.88%

LeJeune expects the credit union will need to continually tweak the dashboard as it gains insight into trends. And that’s OK because that leaves the door open to adding or dropping metrics down the road, if needed.

So far, feedback has been positive and Marine has already noted some early success from the dashboard’s soft launch. For example, training employees in financial counseling and encouraging members who need to establish credit to take advantage of the “Get Credit” secured loans are both long-term strategies for which the credit union was reporting dwindling activity. The dashboard has reinvigorated those strategies by bringing them back to the forefront of team members’ minds, and the downward trends are already turning around thanks to the renewed focus.

The credit union also has created outbound call lists for lending officers to proactively reach out to members using payday lenders and encourage them to use consumer-friendlier, more responsible credit union products. Volunteer time off usage is also now trending up, as the mission dashboard helps emphasize the importance of this optional employee benefit.

“It validates the idea and underscores the importance of going out and using your paid time off to volunteer,” LeJeune says. “It’s good for you and great for the community.”

Lessons And Advice

LeJeune says there are no plans to change any of the metrics in the near-term, but the credit union does plan to add the results of an annual Financial Health Network survey to the bottom half of its one-page mission dashboard.

And in terms of advice, the BI manager says executive leadership support and simplicity are key.

“We’ve spoken with other credit unions who are nervous about jumping in, and there was some hesitancy from our group as well,” LeJeune says. “Having our leadership team involved in the introduction and regularly sharing the dashboard gave everyone a better feeling about where this goes.”

At the end of the day, the Marine Credit Union team tried to create something it felt good about and that the cooperative could measure easily and keep uncomplicated. By keeping it simple, the credit union is already reporting progress and moving the needle in key areas.

How Are You Measuring Member Value?

Find out how much value your credit union returns to its members and how you rank against your peers. Callahan’s credit union advisors will walk you through your score, how it’s calculated, and you’ll get to keep your report free of charge.

I Want My ROM Score