Credit cards play a critical role in the daily lives of many consumers, with an estimated 77% of adults in the United States holding at least one bank issued credit card.

Elan and PYMNTS’ latest study, Credit Card Use During Economic Turbulence, surveyed consumers to examine the evolving usage of credit cards in the face of inflation and found 33% of cardholders increased credit card spending in the past six months, showing how vital credit cards are in today’s economic environment.

Here are three takeaways you need to know.

1. Cardholder Types And Payment Habits

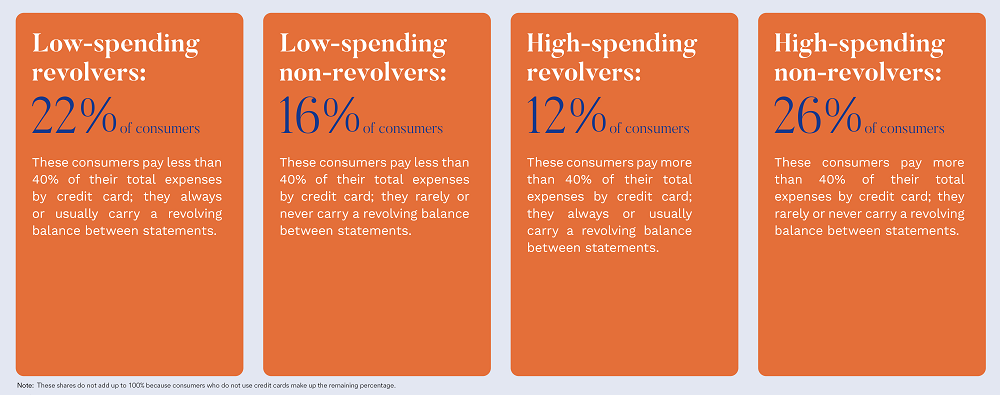

This study identified four distinct credit management personas based on two criteria: (1) the share of total spending paid by credit card, and (2) the tendency to revolve credit card balances rather than pay them off in full.

Of consumers with bank-issued credit cards, 55% always or usually pay off their card balances in full each month, while 45% carry revolving balances. Income level and impact of rising prices are two key drivers for consumers’ tendency to regularly carry revolving balances.

2. Consumers’ Reliance On Credit Card Spending Ramps Up

Across all demographic groups, 33% of cardholders increased the share of their expenses paid by credit card in the past six months, while just 15% decreased it.

Our research found the top three drivers of increased credit card spending include:

- Reward programs.

- An effort to improve credit standing.

- Reduction in income.

Focusing on consumers highly impacted by inflation, 24% cited reduced income as the top reason for doing so. Similarly, consumers who revolve their balances — both high- and low-spending revolvers — were much more likely than non-revolvers to cite reduced income as the top reason for increasing their credit card spending.

3. Value-Added Features

For consumers who already have credit cards, rewards and cash-back programs are the top reason for choosing one card instead of another (31%). Rewards and cash-back programs also appeal strongly to consumers who do not currently have cards (13%), although the most popular feature for that cohort is the ability to set spending limits (15%).

Consumers who currently do not hold a credit card are a potentially untapped opportunity — if the right features are available. Fifty-two percent of non-cardholders cite monitoring features that empower these consumers to stay within their personal budgets as a top feature.

As inflation continues to impact consumers’ purchasing power, credit cards will remain a key financial tool to offer to members. Whether you’re considering adding or exploring an agent credit card program, Elan offers the products, rewards, and technology members desire — without the risk for your credit union.