As financial institutions compete for customer relationships and wallet share, products and services tend to prioritize one feature: convenience. Whether through new technologies, reimagining branch services, or other strategies, institutions have focused on providing accessible, cost-effective banking. Although these changes are appealing to many, not all customers are on board. In a poll from Adobe Analytics and CNN, 72% of Gen-Z and 60% of millennials reported visiting traditional bank branches at least monthly. Clearly, institutions need to balance new technology with traditional services to serve a wider audience.

Key Points

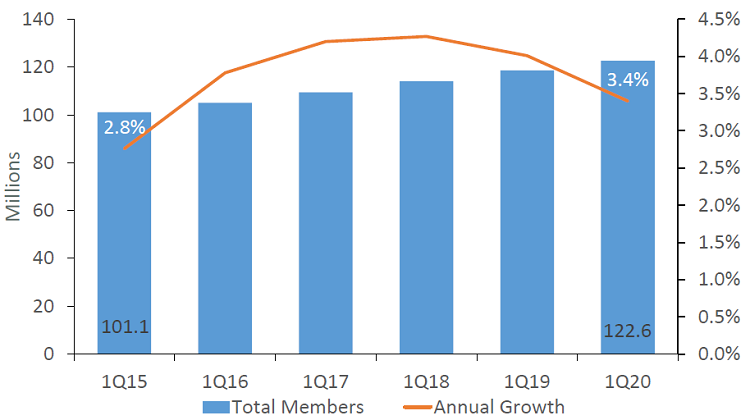

- Credit union membership grew 3.4% annually to 122.6 million members as of March 31, 2020.

- The average member relationship increased 3.5% annually and topped $19,800. This is the fastest growth rate since the third quarter of 2017.

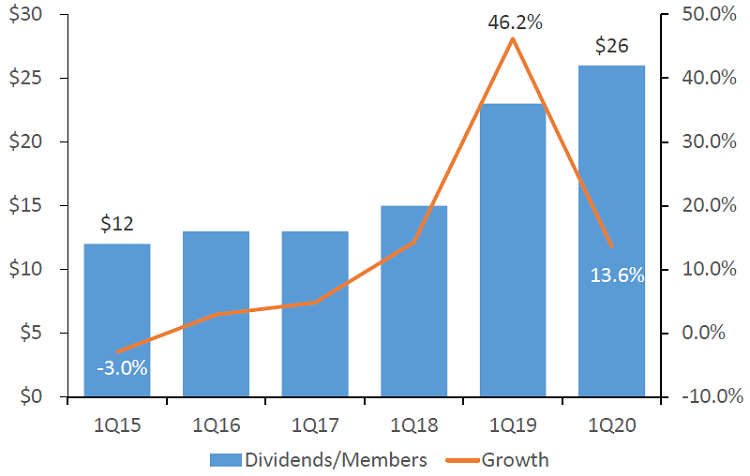

- When it comes to dividends per member, credit unions paid $26 during the first three months of 2020. This is the most paid in the first quarter since 2010.

- Real estate penetration remained flat at 4.4%. However, penetration rates increased annually across all other major products. Share draft penetration was up 1.7 percentage points to 59.9%, the highest rate on record.

MEMBER GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates |CreditUnions.com

Credit union membership grows each year, but annual growth has now slowed for five consecutive quarters.

AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Credit unions continue to attract business from both new and existing members.

DIVIDENDS PER MEMBER

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Year-to-date dividends per member shot up in 2019 as the Federal Reserve raised interest rates, but growth slowed dramatically in the first quarter of 2020 following late-2019 rate cuts.

The Bottom Line

Member service is of utmost importance for credit unions, and data from the past decade shows how a growing membership base has acknowledged and affirmed this priority. Engagement rates have steadily risen across all major metrics, including average balances and product penetration. Although the fallout of COVID-19 is looming, credit unions have built a strong base in the past decade and will have the opportunity to continue to prove their value to members in the coming quarters. Many FOMs otherwise resistant to technology have been forced to embrace it during stay-at-home orders. Whether and how this will change these members’ behavior and relationship with their credit union remains to be seen.

Without official data from the NCUA, Callahan is reporting first quarter data trends from institutions that represent 99.7% of the industry’s assets.

This article appeared originally in Credit Union Strategy & Performance.Read More Today.