During the second quarter of 2020, the national economy drudged through widespread lockdown and unemployment reached levels not seen since the 1940s. Consumers turned to their financial institutions for help. Although government relief programs helpedmany people stay afloat, banks and credit unions also stepped in to store deposits and distribute loans. Cash balances surged as consumers looked to alleviate risk. Additionally, consumer demand for mortgage refinances, PPP business loans, and creditlines was heavy, which worked to enhance the relationship between institution and consumer.

Key Points

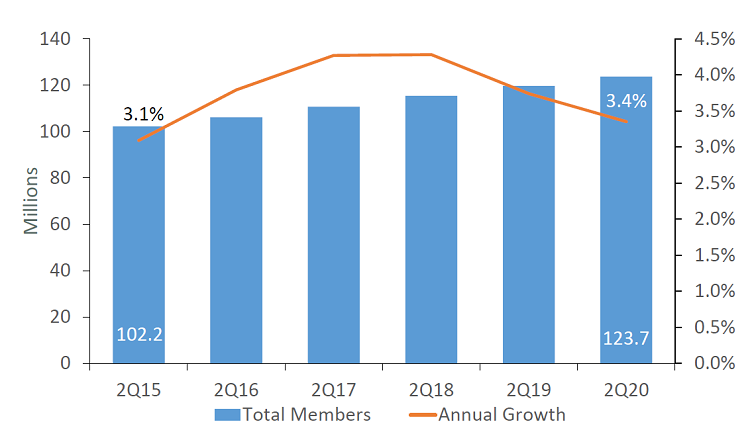

- Membership at credit unions across the country reached 123.7 million, a 3.4% annual increase.

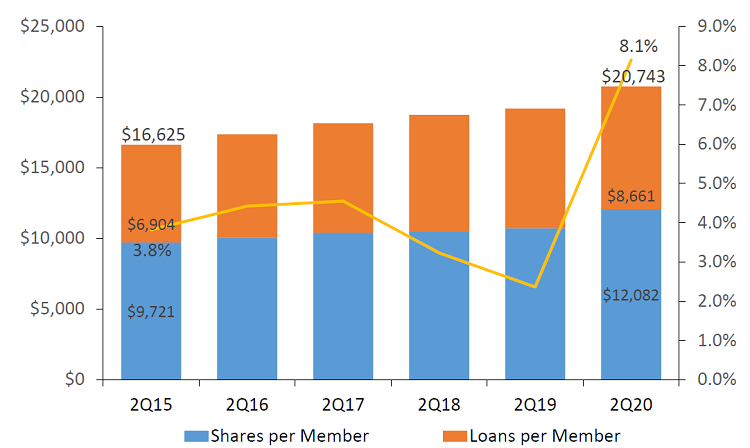

- Following 8.1% annual growth, the average member relationship surpassed $20,000 for the first time ever. Average share balances were the driving force. They were up 12.7%; loan balances grew 2.4%.

- Dividends per member increased $1 year-over-year to $48 during the first six months of 2020 as the sheer volume of new shares countered falling deposit rates.

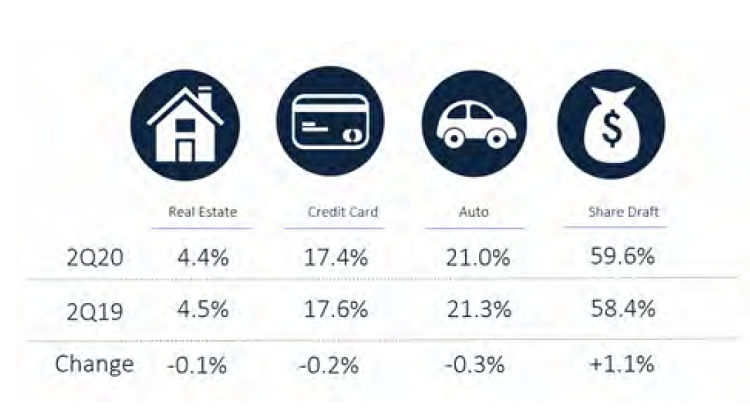

- Consumer lending slowed and penetration rates declined annually in most categories. Despite the boom in first mortgages, increased sales to the secondary market led to a 7-basis-point drop in real estate penetration to 4.4%.

MEMBER GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Membership growth dropped 11 basis points from March 2020, marking seven consecutive quarters of deceleration.

AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Led by record share growth, the average member relationship increased $1,562 from the second quarter of 2019.

PENETRATION RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Penetration rates across all loan products fell from last year. Share draft penetration, a key metric for member engagement, continued to grow.

The Bottom Line

The past few months have tested the credit union member-first model, but these cooperative institutions have continued to provide services to those in need. Mortgage lending, particularly refinances, were in high demand through the second quarter. However,credit union support appeared most strongly in the form of loan forbearance policies. Supported by the CARES Act, credit unions across the country deferred payment on billions of dollars’ worth of loans. Asset quality issues might appear inthe next few months, but the financial relief credit unions were able to provide many members during the COVID-19 pandemic is a testament to how the industry remains an important player in today’s financial services.

This article appeared originally in Credit Union Strategy & Performance.