In his bookThe Age of Paradox,author Charles Handy wrote: Unbalanced self interest can only lead to an environment in which any victory will mean destroying those on who our survival will ultimately depend … The tragedy of the commons, it was labeled, when individual farmers maximized their own short-term use of the common land only to find, that when everyone did the same, the land deteriorated until all grazing failed. (page 89)

On September 16, NCUA assessed credit unions another premium this one 0.124% of insured shares to bring an additional $933 million into the NCUSIF. This cash will be added to the NCUSIF’s $9.8 billion currently in cash or invested at the U.S. Treasury. This puts a total of $10.8 billion of credit unions funds now in Agency accounts in Washington DC.

It is clear the NCUSIF does not need cash, unlike the FDIC that levied and collected three and a quarter years of future premiums one year ago because that fund was running short of liquidity and is today insolvent. The NCUSIF, on the other hand, is stockpiling cash at an increasing rate and has an operating ratio of over 1.2%. This new premium requires credit unions to expense the transfer today based on projections of possible losses at some undetermined time in the future.

Note that this action has nothing to do with the Corporate funding and the earlier assessment except that credit unions pay all the bills.

The premium decision is a judgment made by the three Board members. There is no automatic formula. There is no consistent trail of information, data or methodology provided by staff. What we do know, however, is that the Board elected to assess the maximum amount allowed under the Federal Credit Union Act, increasing the fund balance to the 1.3% current operating ceiling. The law also explicitly provides an option of assessing any potential fund requirements over the next 8 years. This option was rejected.

So what is the basis for this judgment? What facts were used to support the maximum assessment possible? What is the Board’s track record in looking at staff’s previous reasons from one year ago? And what does the action say about the Board’s view of the credit union system and its role?

The Difference Between Loss Estimates And Actual Cash Losses

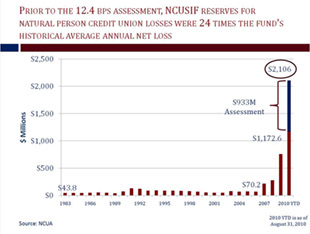

The most important financial fact to be aware of is that the allowance account is an expense today, for cashlosses that may occur in the future. At August 31, 2010, the allowance was $1.172 billion; if this new premium were expensed immediately to add to this reserve which is the justification for the action that would immediately bring the total allowance account to over $2.1 billion.

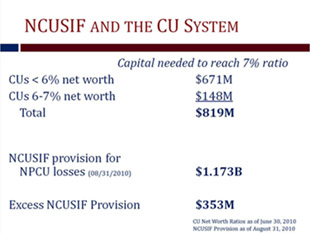

Before this assessment, if one reviews the June 2010 call report data, the existing allowance, if disbursed in cash, would bring every credit union with a net worth ratio of less than 7% up to this well capitalized level, and still leave over $350 million in the account. In other words, every current problem credit union would be well capitalized and the remaining 90% of credit union assets would remain above the well capitalized level. The critical question is whether the resources already on hand are more than adequate for problem resolution.

Click image for larger version.

Since the 1% deposit began in 1985, the fund’s loss experience versus the current allowance level shows that the balance at August 31 is 24 times greater than the NCUSIF’s historical net loss average. The NCUA’s September 16 action almost doubles the ratio, increasing the allowance to nearly 43 times that historical average.

Click image for larger version.

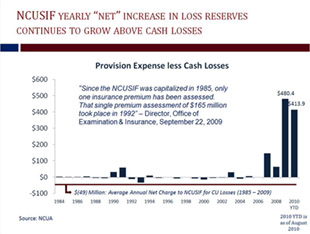

Moreover, actual cash losses this year are significantly below the amount in reserves. As NCUA adds to the reserve it reduces retained earnings (net income) thereby creating a declining ratio, which is then used to charge another premium before the losses are even incurred or known.

Click image for larger version.

Just like some credit unions, is it possible that the NCUSIF is over-reserved? And if so, does it really matter? Wouldn’t we rather be safe than sorry? What if this abundance of caution approach is really not the case? Instead, are the Board’s judgments indications of more serious shortcomings which are undermining the system’s future soundness? Is this an example of issues that are troubling many credit unions from their own experiences with Agency examiners?

First the facts. What data were presented to support this decision, and what interpretations were made about that information?

Three quick points of analysis.

-

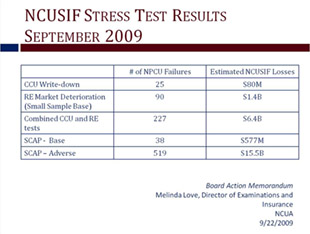

One year ago, September 2009, the board approved the first premium assessment since 1992. This action was supported by a staff memorandum which summarized five loss scenarios and the consequences to the NCUSIF. The NCUSIF losses ranged from $80 million to an apocalyptic $15.5 billion prediction. That methodology has somehow been forgotten or lost. No more Treasury stress tests. No more projections of $15.5 billion in NCUSIF losses due solely to natural person credit union problems.

Those scenarios and alleged risks were and are still widely circulated as proof of serious hidden system weakness by individuals within the industry and those trying to scare credit unions into looking at charter change. After all, the data came right from the government it must be right!

What happened to this analysis? Why didn’t we see it this year and compare the accuracy of those projections to what we know occurred just twelve months later? Or was this just a bogeyman trotted out to provide color for a decision that was made on another basis? The good news is that the bogeyman summarized in the slide is now off stage.

Click image for larger version. - One reason given for the premium is the lower earnings available on NCUSIF investments. Interest rates are at one of the lowest levels ever. However, NCUSIF investment income is actually upfrom $129.8 million in 2009 to $144.9 million for the first eight months of 2010. The NCUSIF yield was 2.21% in January and 2.25% as of August 2010. In addition, the fund is sitting on unrealized gains of $356 million in its portfolio. In 2008, the Fund took gains from early redemptions of investments in December and added over $106 million to revenue so no premium needed in 2008. So, lower earnings on the portfolio are not a factor. In fact, interest income is right on budget!

- Insured share growth, in the words of the memorandum, adversely impacted the direction of the equity ratio in 2010. Again, let’s do the math. The current 3.34% share growth equals a net gain of about $24 billion in insured shares. Multiply that by 0.03% and we arrive at a needed $72 million addition to retained earnings. That would account for about 8% of the $933 premium. However, the fund did not recognize the $356 billion in unrealized gains as part of retained earnings why not just take some gains and offset the growth? That was an action just over a year and a half ago.

The One Issue

The bottom line is that the allowance account’s adequacy is a judgment based on the outlookfor potential losses when resolving problem cases.

So how was that judgment made? What facts were offered now that the scenario analysis is no longer the centerpiece.

The primary logic and information used to justify the increased allowance are all based on one assertion that the credit union system is worse off today than one year ago, or even the year before that.Before looking at the information presented to support this judgment, ask a common sense question:

Could the credit union system actually be worse off today, ready for higher losses than were probable at the peak of the financial crisis? Or even a year ago? Yes, anything is possible; but what do we know from mid-year 2010 data? Is the probability of losses increasing? Or, in fact, has that crisis become so distant that most have forgotten that two years ago America’s financial markets were in cardiac arrest so that today someone believes the credit union system is headed for higher losses than were probable then or even one year ago?

The assertion that losses are heading higher flies in the face of every macroeconomic data point, not to mention credit union industry trends. On every dimension of credit union performance, trends are strong and improving. The 2Q Quarterly Report and the in-depth TrendWatch slides show improvements in asset quality, higher coverage ratios, increasing earnings and capital, lower expense ratios. This is data we can look at, drill down on and, if necessary, call up credit unions and get current information.

So where is the information that suggests this data is not correct? It is from examiner CAMEL ratings. The Agency presented summary information that shows the number of 4s and 5s are up for the year ending June from 291 ($28 billion assets) to 366 ($48.8 billion assets). Code 3 credit unions have gone from 1,485, with $86 billion in assets, to 1,739 and over $149.8 billion in assets in the same time frame.

Are these ratings supported by any objectively available data? Let’s look at the largest 25 problem cases, which reported a collective bottom line loss of $1.14 billion in 2008 at the moment of greatest crisis. What is their status at June 30, 2010?

Year-to-date they collectively report $51 million in net income and their total capital ratio is higher than at yearend 2008. The only one to have failed is Eastern Financial, which was merged otherwise, their overall asset levels are stable. These were the worst of the worst credit union performers two years ago and are still here, relatively stable and moving forward. (The September Callahan Report provides greater detail.)

The use of CAMEL trends is the most significant aspect of the premium decision. There is no objectively verifiable evidence to support the downgrades in CAMEL assessments. These ratings are themselves judgments imposed on credit unions by examiners. They frequently reflect efforts to force business decisions, to increase reserves above documented methodologies or to demand strategic changes by credit unions from examiners who are being pressured to get tough and show results. In other words, the CAMEL ratings are being used as a regulatory tool not as an objective assessment of financial condition.

That approach, with the resulting CAMEL judgments, is set by the Board. That is where policy is determined in the Agency. The premium is based on a circular pattern of reasoning we are saying you are declining, therefore you are.The core of the regulatory examination process is integrity and consistency. If that activity is fundamentally distorted what reasonable conclusions are possible with information created to satisfy a supervisory tactic?

Circular reasoning means that the conclusion one is seeking to prove is already contained in the premise to the situation. The premise that the credit unions system is worse off today is not objectively reviewed, but asserted: the system is worse off because we said it is. Therefore, the answer to the question, (premium or not) has already been determined by the process. With two lawyers on the Board, one would have hoped this flawed reasoning would have been self-evident.

One Final Issue: GAAP Made Us Do It

This is the ultimate justification when all other evidence fails. We are merely following GAAP rules. Two quick observations:

- Just 90 days ago NCUA released the last two years audits of all the funds. The NCUSIF was evaluated by the outside auditor as having a significant deficiency in internal control over financial reporting in 2009. The major accounting issue in the NCUSIF is the allowance account calculation. All the other numbers are simple addition and subtraction. NCUA has given no indication that its interim statements have been changed to respond to this extremely serious criticism, or if so, how.

- GAAP itself rests on judgment backed by verifiable assumptions and methodology. No credit union could defend its allowance accounts to either an auditor or the Agency’s examiners with the generalities used by NCUA. NCUA provides no details of specific losses, (such as how a $250 million apparent Code 1 credit union can disappear and be liquidated in 7 days), and no explanation why the allowance account continually grows above the actual cash losses to a level 43 times the credit union’s historical loss experience from both good times and bad.

(For an explanation of how allowance account estimates change during a crisis, read Mike Sacher’s article on credit union allowance and outdated methodology.)

The Premium And The State Of The NCUA

The premium is a Board decision. It reflects their leadership of the Agency. The outcome provides insight into the Board’s temperament, ability to use information wisely, identify key issues and most importantly, an awareness of how their decisions will affect credit unions. The Board memorandum states that 855 FICU’s may experience negative net income for 2010 due to the impact of the combined premium and stabilization fund assessment. The Board has the data that show their decisions will cause 11% of credit unions to show negative net income as a result of their decisions. Why exacerbate earnings challenges just as the recovery is underway?

But this is a bigger issue than money. It is about confidence in the judgments of the NCUA Board.

Sitting on record levels of cash, overseeing an industry showing documented improvement in every indicator of asset quality and performance, watching credit unions provide American consumers billions of dollars of refinancing debt relief that will jump start local economies, the NCUA board took another $1 billion from credit unions. The money sits in an account at Treasury just in case there is a need to further fund an allowance account that is already 24 times greater than the long-term loss rate.

Is this action helping or hurting the soundness of the credit union system? The country’s economic recovery? Or does this stockpiling of cash reflect an Agency so unsure in its own analysis that it requires more cash to solve its own uncertainties?

There will be more opportunities shortly to learn about the Board’s judgments as decisions are announced about legacy assets and the Corporate rule. Will we see more unilateral actions justified with circular reasoning and vague assertions? Or is there recognition that NCUA’s success is a mutual effort based on analysis, methodologies and facts open to all, so that the credit unions which pay the bill and manage the consequences can have confidence in the process? And, most importantly, confidence in the leaders overseeing that process?

There is no longer a safety issue in credit unions or the country’s financial markets. The crisis is over. The recession ended in June 2009. Rather, this is about sound judgments about the future.

Charles Handy also commented on importance of this alignment of interests in The Age of Paradox: If there is no common cause, no agreement on the longer term goal, the more pressing priority then the most powerful party will win out … in the end for the long term to prevail over the short term, we must want what the long term promises. Where there is no vision, there you will find short-termism, for there is no reason to compromise for an unknown tomorrow. (pg 96)