How and why a credit union selects its core processor is an important decision for the foundation of that institution, and an evolving industry landscape makes that choice more crucial than ever.

Credit union consolidation has continued in the past year, with 161 institutions closing their doors or merging, bringing the total number of active shops to 4,631. Five new credit unions have also opened their doors, offering new opportunities for consumers to find affordable, accessible banking options.

Amid that consolidation, membership growth continues, with more consumers keeping credit unions top of mind and top of wallet. In the past year, membership has risen by 2.4% — a whopping 3.3 million new members — for a total of 142.4 million. That’s another high-water mark, and with new technologies and competitors emerging, a shifting interest rate environment, and more, consistent membership growth is vital for the industry.

The fact Americans are still turning to credit unions for savings and loans despite changing industry dynamics is a testament to how well-prepared credit unions are for the days ahead. And as the industry continues to grow, it fuels competition among leading core providers.

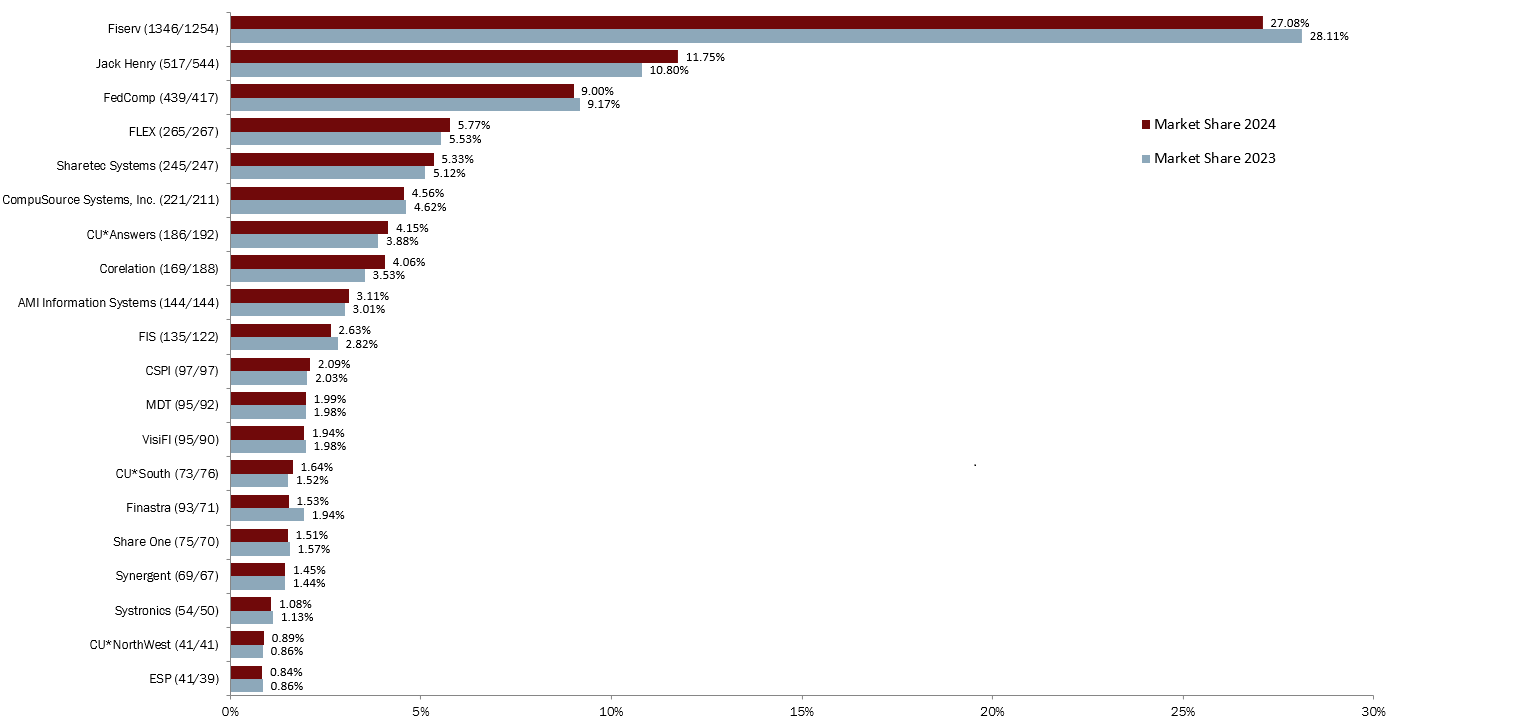

MARKET SHARE FOR TOP 20 CORE PROVIDERS BY NUMBER OF CREDIT UNION CLIENTS

NUMBERS REPRESENT TOTAL CREDIT UNION CLIENTS | PERCENTAGES REPRESENT TOTAL MARKET SHARE

SOURCE: Callahan & Associates

Market Share Shifts For Familiar Names

The same names that have dominated the core processing marketplace for years remain at the top of the list, but with a few changes. For instance, Fiserv still leads the pack with 1,254 credit union clients — accounting for 27.1% of the credit union market — but it lost 105 basis point of market share in the past year. Jack Henry and its Symitar platform gained 85 basis points of market share, reaching 11.8% with a total of 544 clients.

Together, these two leading core providers account for a combined market share of 38.8% of credit unions in terms of client numbers. Fiserv remains the market leader in client numbers across all asset categories, however Jack Henry’s Symitar continues to hold its position as the largest provider of core services to credit unions over $1 billion in assets, serving 212 of them — an increase of 19 from last year. In comparison, Fiserv claims 152 large credit unions — only a two-client increase over the same period. However, in the $250 million to $1 billion asset segment, Jack Henry and Symitar overtook Fiserv, serving 208 clients compared to Fiserv’s 193, which represents a decline of 21 clients from the previous year.

Market share is shifting beyond the biggest players. For example, although Fiserv remained the largest core processing provider, it also lost the most clients during the past year. Of the 161 credit unions that closed, 36 — 22.4% — were Fiserv users. When considering those who switched to other providers, Fiserv ended the year down a total of 92 clients. At the same time, Jack Henry made the largest gains, adding 27 new clients to its Symitar platform.

Although the industry adjusts to new headwinds, new tailwinds, and new trade winds, core processing platforms remain central to the business, acting as a vital link between transactions and technology.

In summary, of the 28 core platforms serving at least $400 million in total assets among their clients, eight gained clients, 15 lost client credit unions, and five maintained their client count.

Symitar remains the top platform in use, with 703 credit unions across three providers: Jack Henry with 544 clients, Member Driven Technologies with 92, and Synergent with 67. This year, 15.2% of credit unions nationwide use a Symitar platform. This represents an increase of 22 credit unions compared to last year, with Jack Henry gaining 27 clients, whereas MDT lost three and Synergent lost two. Portico, one of Fiserv’s platforms, came in second with 529 total user credit unions, posting a 11.4% market share. In the past year, the platform has added 178 clients, the largest gain of any platform.

Fiserv’s CUSA platform experienced the largest client loss, dropping by 80 clients as users. Following that, Fedcomp’s Platinum platform lost 22 clients.

The Winds Are Changing

Although the industry adjusts to new headwinds, new tailwinds, and new trade winds, core processing platforms remain central to the business, acting as a vital link between transactions and technology. This role has become even more crucial as members expect the better service that comes with a 21st century banking platform. In 2025 and beyond, this expectation will only grow.

This page is updated annually with market share figures available at midyear. For a look at last year and how things have shifted, click here.

Note: The market share data presented reflects the information submitted by participating companies. Following publication, some providers identified omissions in their submissions that understated their market share. Several additional credit unions have been identified who use those platforms as of the June 30th, 2024, submission date. The graph above reflects those changes.

Evaluating Core Processors? Peer Suite Has You Covered. Whether you’re a credit union evaluating core processing solutions or a supplier evaluating market share, Peer Suite is loaded with technology partner data that makes it easy to uncover deeper insights to fuel your strategies. Curious to learn more? Schedule a conversation with Callahan & Associates today. Learn more today.