Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: PRODUCTIVITY & EFFICIENCY

NCUA’s third quarter revisions to Section 4 of the 5300 Call Report requires credit unions to segment member business and member commercial lending into separate buckets. The changes are in response to credit unions not consistently applying the safety and soundness risk management requirements contained in the former MBL rule to commercial loans not qualifying as MBLs.

As the NCUA shifts its focus to commercial lending, the charts and analysis in this section will mirror this dynamic.

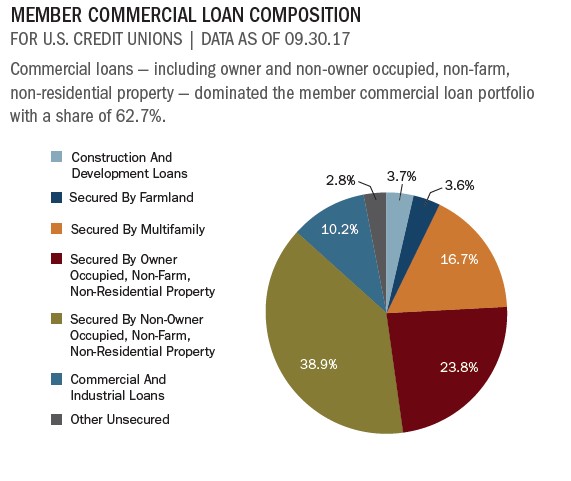

In third quarter 2017, total credit union member commercial balances topped $54.5 billion. Member commercial loans classified as owner and non-owner occupied, non-farm, non-residential property made up 62.7% of the total member commercial loan portfolio.

Curious how your loan portfolio stacks up to credit union and bank peers? Callahan analytics gives you answers fast. Learn more.

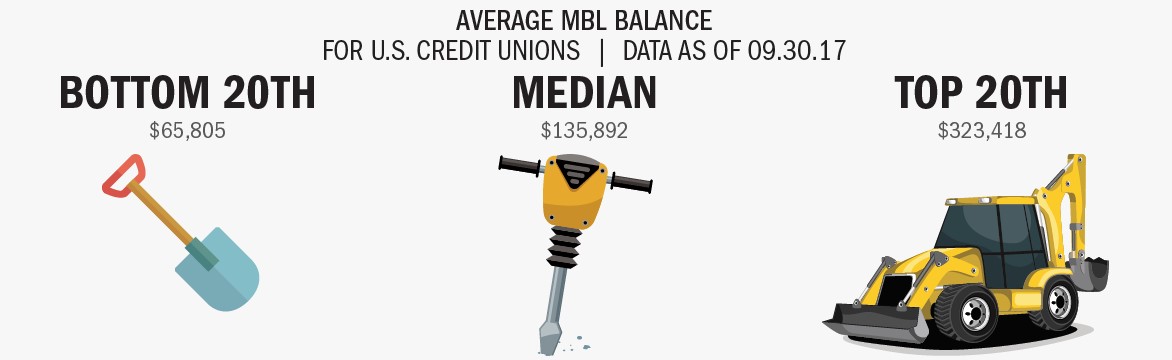

The average member commercial loan balance as of Sept. 30, 2017, was $283,200. On the non-member commercial loan side, non-owner occupied, non-farm, non-residential property commercial loans represented nearly half of the total non-member commercial portfolio. They held 49.3% of a portfolio that totaled $9.3 billion in the third quarter.

Credit unions across the nation have helped drive their local economies by increasing their investments in small business. The average SBA loan reached $325,3000 in the third quarter that’s a 69.7% year-over-year increase. These figures exemplify the cooperative nature of the credit union industry.

Despite the deteriorating credit quality of taxi medallion loans and the subsequent negative implications on the default rates at a handful of New England credit unions, member commercial lending asset quality across the industry remained manageable. The Western region posted the lowest member commercial delinquency rate. The region’s 0.94% rate was 2.87 percentage points lower than the national average of 3.88%.

Despite the reporting challenges of the newly imposed distinctions between commercial and member business loans, credit unions are taking full advantage of the statutory cap flexibility by investing in their surrounding communities to help stimulate the economy.

Click the graphs below to enlarge and then continue reading to see how Sticking together through thick and thin has helped Community Choice Credit Union build a decade-long record of member business lending growth

Member commercial loan balances in the third quarter totaled $54.5 billion. The average balance was $283,200.

CASE STUDY

COMMUNITY CHOICE CREDIT UNION

Sticking together through thick and thin has helped Community Choice Credit Union build a decade-long record of member business lending growth.

CCCU’s MBL portfolio was at $106.5 million as of the third quarter, only $27 million less than the average for credit unions with than $1 billion in assets, although CCCU is just barely over that asset line.

During the darkest days of the Great Recession, MBL activity sharply rose at CCCU, which serves one of the hardest-hit areas of the country. A more recent growth in MBL activity is the result of the suburban Detroit credit union adding three business lenders to bolster its activities in central and western Michigan.

When the downturn happened, we were there for our members, says Teresa Mayer, the credit union’s chief lending officer. We kept producing loans even in those rough times.

CCCU serves 12 counties across the Lower Peninsula, as well as SEGs that include Kelly Services and some General Motors divisions. MBL growth parallels the overall loan growth at the credit union.

MBL is just one part of our strategy, Mayer says. We like to see consumer and indirect and mortgage growth, too.

Serving businesses includes more than just lending them money, and Community Choice is continuing to grow out its business services, which now includes checking programs, remote deposit capture, money market accounts, and business debit and credit cards.

Strategy & Performance 3Q 2017

Credit unions have made significant gains since the Great Recession started 10 years ago. Third quarter credit union growth trends surged past that of community banks and the overall banking industry. Measures such as loans, shares, capital, andmembership have all reached new levels. These gains are all notable and meaningful; however, they are backward-looking. The important question to ask is: Where will credit unions be in the next 10 years? In this issue of Strategy & Performance,learn why now is the time for credit unions to challenge themselves.

Read More

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 3Q 2017