Callahan FirstLook data indicates Arrowhead Credit Union is continuing its turnaround, and the San Bernardino cooperative is back in the spotlight after news reports of its first quarter 2011 profit. There is debate within the industry about NCUA’s actions to speed up that turnaround by slashing costs and decreasing the value of the Arrowhead franchise. The following article first appeared on CreditUnions.com in July 2010.

On Thursday, July 22, the NCUA released June 30 call report details to support its conservatorship of Arrowhead Credit Union and issued a press release in which it repeated the assertion the credit union was in declining financial condition.

The June 30 call report released by the agency not only documents the credit union’s continuing recovery but it also raises serious questions about the agency’s regulatory judgments including the critical omission of relevant data in its July 22 press explanation.

The Facts At June 30, 2010 Using NCUA’s Call Report Numbers

Included with the following observations are graphs showing Arrowhead’s key trends over the past two-and-one-half years. The outcome at midyear 2010 is entirely the result of the management team and the Board,which NCUA removed on June 24.

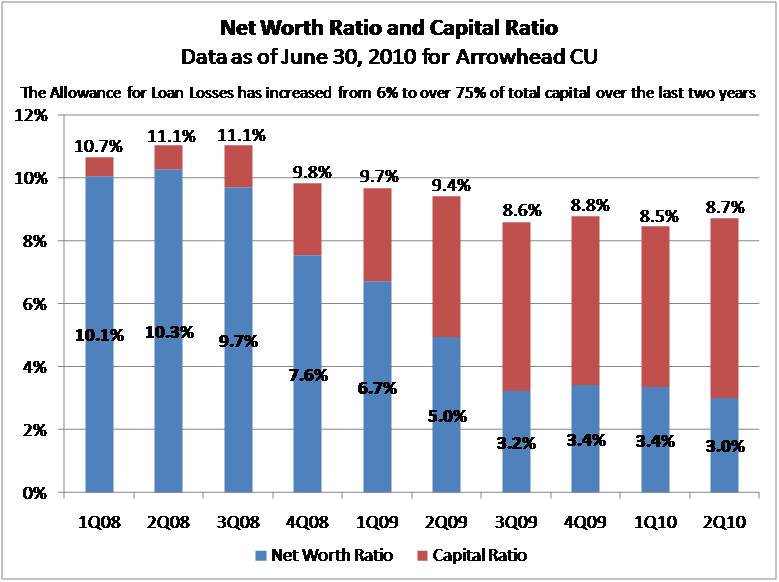

Total capital has increased to 8.7% from 8.5% at March 2010. The total dollar capital is $70.5 million.

The core earnings ratio at 3.91% of assets has increased from the 3.48% of just 90 days earlier. This is one of the highest ratios in the country and almost three times the credit union average. Earnings are the sole source of capital for credit unions.

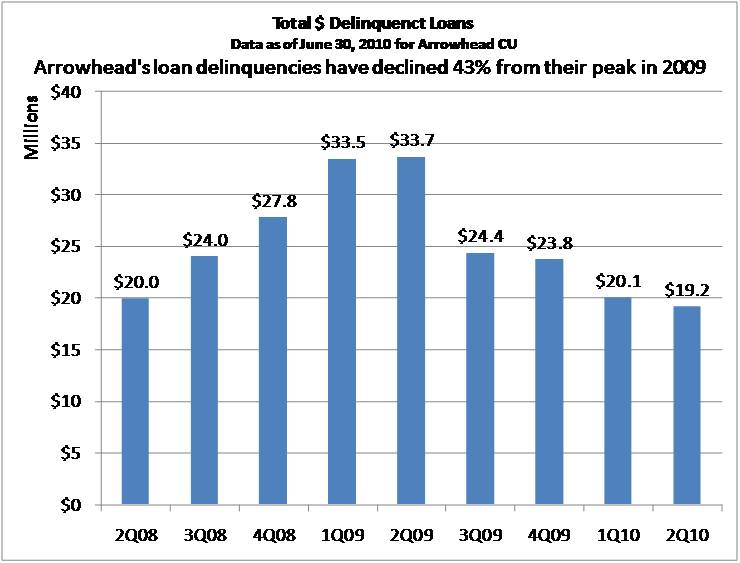

Total delinquentloans declined to $19.2 million, almost $1.0 million lower than the prior quarter end and the lowest amount in more than two years. In June 2009, just 12months earlier, the number was $34 million.

The allowance for loan losses increased to 8.59% of all loans, up from 7.47% at March 30. This allowance is more than two-and-one-half times the average of all Californiacredit unions and more than three times the industry average.

The credit union’s annualized net charge-offs are 5.49% of loans, an amount virtually identical to the first quarter number of 5.43%. The charge-offs are a full 300 basis points below the allowance account for loan losses(see prior data point);

Year-to-date net charge-off and provision expenses are virtually equal at $18 million, showing the credit union is recognizing loan losses in a timely manner. Moreover, the 2010 provision expense for the first six months was less than one-half the comparableamount ($43 million) for the first two quarters of 2009, showing further the dramatic improvement in the loan portfolio.

The coverage ratio (the allowance for loss account divided by total delinquencies) increased to 279%from 247% just 90 days earlier. This ratio is almost three times the average of all California credit unions.

The operating expenses for the second quarter are less than the first quarter and continue to fall from a peak at the end of 2008, again demonstrating management’s continued reduction in fixed costs.

These numbers are the fundamental facts used in making safety and soundness judgments about any financial institution’s trends. The balance sheet’s strength is the primary basisfor an analysis of a credit union’s financial condition and whether it is improving. The complete absence of any reference to these average ratio trends in NCUA’s press release raises serious questions about the agency’s supervisory analysis.

What About The Reported Negative Income?

The agency focused on the negative net income of $1.4 million for the first six months of 2010. This number is highly suspect, but even if it is accurate, it would represent an incredible improvement from the $29 million loss reported for the samesix months in 2009.

First, the conservator appointed by NCUA failed to include the gain on sale of four Arrowhead branches to Alaska USA Federal Credit Union, which was finalized on June 25 and would have added to net income an amount almost equal to the purported loss.The glaring omission of this transaction, reported as completed in NCUA press statements, suggests the agency is not accurately recording events for the credit union.

The second factor the agency cited for the negative net income is the assertion the credit union failed to follow a loan loss allowance methodology adopted in October 2009, which was itself based on numbers for the prior 12 months.

This old method was developed before the economic recovery was fully underway and was in fact modified by Arrowhead management an entirely appropriate and properchange in March of 2010 when the fundamental economic conditions that were the basis for the old process had altered.

This October 2009 estimation process was significantly outdated and has resulted in an extreme overfunding of the allowance account (almost 300% of total delinquent loans) by any objective standard.

All major financial institutions such as JP Morgan Chase, Citibank, and Bank of America that have reported June 30 results have recorded lower loan loss provisions compared to first quarter 2010.

This outdated approach does not even fit the published facts on the ground. On July 22, the same day the NCUA issued its press release, the Los Angeles Times published a lead business story: Mortgage defaults in California at 3-year low. The story reads in part:

The number of Californians entering foreclosure slid dramatically in the second quarter to a three year low as the fallout from the worst of the housing crisis has continued to abate. Default notices, the first stage of the foreclosure process initiated by banks on troubled homeowners, plummeted 43.8% in the second quarter over the same period last year. . . The plunge in default notices was experienced throughout California, including places such as the troubled Inland Empire and the state’s Central Valley, resulting in the fewest new defaults since the second quarter of 2007.

Arrowhead’s management had adapted its reserving method to fit these changing circumstances. NCUA is retroactively using a methodology from a period that reflects neither the region’s nor the credit union’s improving current circumstance.

The result is an overfunding of the reserve and an under-reporting net income. This under-reporting is a misleading presentation of the credit union’s actualfinancial performance and current condition.

For example, if Arrowhead’s allowance account were funded at the average of all California credit unions (which is 112% of total delinquent loans, the U.S. average is 90%), then the credit union’s net worth portion of capital would be $56.5million. The net worth ratio would be 7% at June 30 or well-capitalized by NCUA’s own regulatory criteria.

Asserting a net worth ratio of less than half that amount (3%), not recognizing income from a transaction in June, and completely omitting any reference to the improving balance sheet trends suggest NCUA’s conservatorship of Arrowhead was unfounded.

The Result Of NCUA’s Inaccurate Judgments

NCUA has unilaterally taken Arrowhead away from its 150,000 members at a critical time in the economic recovery a time when the members, their communities, and their businesses are most in need. Instead of knowledgeable, experienced managementmaking vital decisions about lending and serving the community, the agency has imposed its own version of events, which are out of touch with both economic factors and objective financial analysis.

In a conservatorship, the members have no say whatsoever in their credit union. NCUA has absolute control. Members’ savings and loans are now managed by the regulator.Having removed managers and the Board who had demonstrated consistent and documented results, the credit union’s members are now dependent on NCUA in Washington, DC, torespond to local press inquiries. Arrowhead’s interim management even told the press it is working for NCUA, not the members or the community.

The members’ only recourse is their freedom to speak out about this takeover with the press, Congress, and the credit union community.

But there is a bigger issue. The sequence of NCUA’s misleading press release assertions and retroactive efforts to produce the facts about the credit union’s alleged declining financial condition raise serious questionsabout the management of the federal agency.

The agency provided no facts to support its seizure in the first announcement on June 24. When confronted with the credit union’s own publicly available trends, NCUA then changed its story line, saying the management had provided incorrectdata. As shown above, the agency’s own June 30 call report figures document a record of continuing performance improvement, not decline.

The omission of these positive balance sheet trends and the agency’s own questionable accounting decisions in the July 22 press release reinforce the view that NCUA had madeup its mind, took an arbitrary action, and is now looking for facts to explain its takeover.

NCUA’s month-long efforts to justify its abrupt actions in the Arrowhead conservatorship point to a much broader issue.

On June 12, NCUA released audit reports for 2008 and 2009 by two independent auditing firms (KPMG and Deloitte). The NCUA’s four financial reports were a year-and-a-half late for the 2008 audits and cite significant and material weaknesses in theagency’s own financial management.

Material weaknesses were identified by Deloitte & Touche in both the NCUSIF and Central Liquidity Facility (CLF) in 2008. KPMG identified material weaknesses in the NCUA operating fund and Community Development Revolving Loan Fund (CDRLF) in 2009, alongwith significant deficiencies in the NCUSIF, CLF and CDRLF.

A significant deficiency is defined by the auditors as important enough to merit attention by those charged with governance, while a material weakness is defined as a deficiency, or a combination of deficiencies such thatthere is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis.

The Arrowhead situation is additional evidence that NCUA does not have its own house in order, including routine supervisory processes.

How many of Arrowhead’s 150,000 members will be shut off from essential financial services now that Washington, DC, is in charge? How many will be denied loans? How many savers will be sent out the door? How many staff will be laid off?

How many more credit unions will suffer from outdated and arbitrary regulatory judgments about their financial performance?

What can members do to regain the right to manage their own and the common wealth they have created over the past two generations?

Arrowhead is not just a case of the mistaken takeover of a credit union on its way back; it is an example of a government agency unable to manage its own responsibilities in an accountable manner.