A networking and education program from Abound Credit Union ($2.3B, Radcliff, KY) is setting up small business owners for success in Central Kentucky.

The cooperative’s Veterans 2 Entrepreneurs program has helped approximately 500 would-be entrepreneurs since it launched eight years ago and is just one component of Abound’s broader commitment to serving members of the military. But growing the credit union’s commercial loan portfolio isn’t the primary objective; instead, the credit union is trying to help entrepreneurs evaluate possible opportunities.

“They want to be part of the network and talk through some of the things they need to be able to do [to start a business],” says Ray Springsteen, CEO of Abound. “If they want to start a running store, open a franchise, or maybe start some type of consulting firm, some of them need loans but many of them do not.”

Why It Matters

Approximately 200,000 people retire from the military every year and face challenges related to housing, work, education, and finance as part of that process. For those looking for work or to start a new business, networking and access to capital can be substantial hurdles.

Abound was founded in 1950 as Fort Knox Civilian Employees Federal Credit Union, and V2E’s genesis lies in the credit union’s proximity to the military installation. Approximately 20,000 people are on post every day, many of whom remain in the area after retiring.

“We found there was a need and an opportunity for us to be sure we’re connecting with veterans and providing support for those who want to make a big difference in the community,” Springsteen says.

CU QUICK FACTS

ABOUND CREDIT UNION

DATA AS OF 12.31.23

HQ: Radcliff, KY

ASSETS: $2.3B

MEMBERS: 134,931

BRANCHES: 16

EMPLOYEES: 354

NET WORTH: 16.0%

ROA: 1.33%

The program provides a space for 50 to 100 veterans — would-be entrepreneurs all — to come together every year around Veteran’s Day for networking, financial education, and more. With every cohort, Abound brings in a variety of participants, including elected officials, community partners, local small business owners, and even past V2E participants.

The central idea, says Springsteen, is to build a network of veterans who can collaborate and learn from one another while also making expertise available for those who need it. That can cover everything from marketing assistance to reflections on starting a business, working with the military community in the area, and more.

Of course, the past eight years have presented a host of macroeconomic changes — including the pandemic, rampant inflation, skyrocketing interest rates, and more — but the local market around the credit union and Fort Knox has shifted dramatically on its own. The introduction of Blue Oval, a new manufacturing facility led with a $5 billion investment from Ford and others, has brought thousands of new jobs and a host of new businesses to the area. According to Springsteen, these changes have presented an increased need for expertise in the small business sector and reinforced the need for Fort Knox to partner with local veterans groups to be sure the credit union is serving that community as best it can.

Successes And Lessons Learned

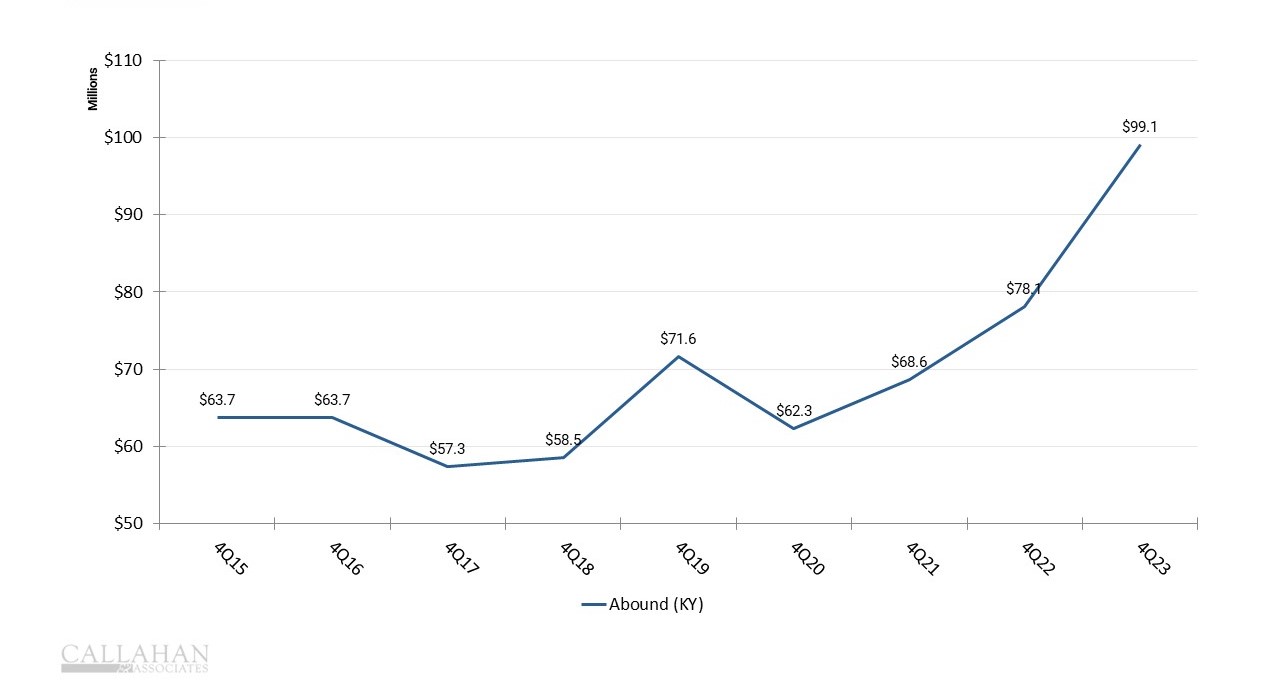

Boosting commercial lending isn’t the core purpose of V2E, but loan volumes at the credit union have risen substantially in the past several years. Although they comprise only 6.1% of Abound’s total loan portfolio, commercial loan balances are up 55% since the end of 2015.

COMMERCIAL LOAN BALANCES

FOR ABOUND CREDIT UNION | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

One of the biggest lessons from V2E’s success has been that the credit union doesn’t have to always have the answers.

“We’re comfortable getting expertise from outside the credit union,” Springsteen says. “That might include associations, others in the military, others who have been members here — we are not the experts in everything. We have to make sure we tap into the rest of the community to always provide some value.”

Abound has no plans to slow down the program, but it does have some changes in the works. V2E is just one of a slew of financial education and wellness programs Abound offers, but many of those programs are offered in a group setting. As more credit union employees complete various certification programs, Abound plans to conduct more of that education on a one-to-one basis.

“Credit unions work with one another; we share ideas,” Springsteen says. “That’s what we’re trying to bring to the Veterans 2 Entrepreneurs network. We share ideas with one another and it’s worked out very well in this case.”

Benchmark Your Commercial Lending Performance With Ease

Learn how your institution’s commercial lending performance stacks up against peers and the industry. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.

Request a demo