During the first three months of 2013, credit unions outpaced lending records set in 2012. Credit unions originated $82.7 billion in loans, surpassing the $72.5 billion lent in the first quarter of 2012. If credit unions can keep this origination pacefor the remainder of 2013, they will slightly edge out the origination record set during 2012.

As was the case in 2012, first mortgages and consumer lending are driving loan originations. Credit unions lent $31.2billion to members in the first quarter of 2013, and first mortgage originations were up more than 19% over first quarter 2012. Although this includes loans granted for both purchases and refinancing, the majority of the activity is in refinancing.Credit union call report data does not break out refinancing and purchase mortgage activity, but according to the Mortgage Bankers Association, 74% of mortgage originations in the first quarter were refis.

YEAR-TO-DATE LOAN ORIGINATIONS

DATA AS OF MARCH 31, 2013

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates’Peer-to-Peer Analytics.

Consumer loans, which include credit cards and auto loans, hit $43.5 billion in first quarter 2013. That’s a 10.9% increase from the same period in 2012. New auto loans arereturning as the new car market rebounds. Outstanding new auto loans increased 10.6% annually while used car loans increased 8.2% annually. The overall credit union auto loan portfolio stood at $183 billion as of March 31, an annual improvement of 5.4%.

A Look At Loan Concentration Risk

Concentration risk is a hot topic within the credit union industry as well as in the larger financial services industry. Regulators have increased scrutiny of particular lending areas, such as fixed rate real estate, member business loans, and participationloans. A recent letter from NCUA’s Office of the Inspector General to Congressman Darrell Issa (available here) indicated the agencyis likely to issue guidance regarding how to evaluate and manage concentration risk on September 30. The letter also stated NCUA will set minimum net worth level for credit unions based on concentration levels in different credit areas.

Loan originations are increasing at credit unions nationwide, and credit unions must remain vigilant of concentration risk. Over the past 10 years, first mortgages have gone from comprising slightly more than 31% of the loan portfolio to 41.5%. This growthhas come largely at the expense of new auto lending, which has declined as a percent of the total portfolio from 17% to 9.5%. Other real estate is largely unchanged, comprising slightly morethan 12% of the portfolio then and now. It peaked at 16.5% during the real estate boom of 2007 and 2008. During the same era, used auto lending fell in total concentration to a low of 16.5% but has since rebounded to almost 20% of the total portfolio.

LOAN CONCENTRATION BY TYPE

DATA AS OF MARCH 31, 2013

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates’Peer-to-Peer Analytics.

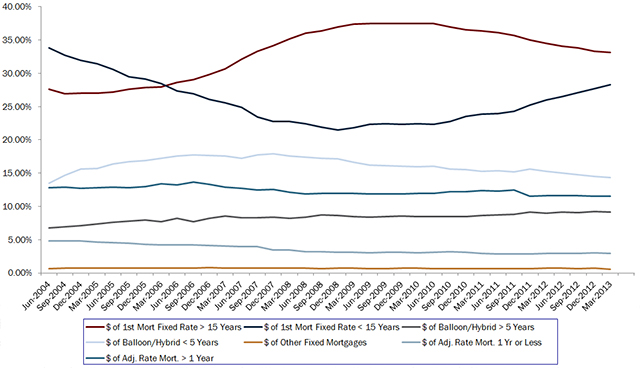

Roughly one-third of the first mortgages in portfolio today are longer than 15 years. Almost 30% of the portfolio is composed of fixed rate mortgages with terms less than 15 years and a mix of other products like balloon or hybrid loans and adjustablerate mortgages. The shorter term fixed rate loans represented more than one-third of the portfolio in 2004, when NCUA started categorizing the mortgage loan data on the 5300 Call Report. The concentration fell to just over 21% during the real estate boom as consumers locked in record low interest rates for longer terms. The 15-year and shorter mortgages have come back into favor in recent years, both for consumers who want to pay off their mortgages while rates are low and for credit unions that wantto manage their interest rate risk.

FIRST MORTGAGE BREAKDOWN

DATA AS OF MARCH 31, 2013

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates’Peer-to-Peer Analytics.

Credit unions are positioning short-term mortgages in creative ways. Wright-Patt Credit Union’s ($2.6B, Fairborn, OH) 2011 Retire Your Mortgage campaign offered two options that both included a 10-year amortization period. More recently, CitizensFirst Credit Union* ($382.3M, Oshkosh, WI) developed a product that allows members to select a fixed-rate mortgage with a term anywhere from five to 12 years.This targets members who want to retire without mortgage debt. Pentagon Federal Credit Union ($15.9B, Alexandria, VA) has built a considerable portfolio of adjustable rate mortgages with its 5/5 ARM, which meets the credit union’s asset liabilityneeds and works for consumers in a volatile rate environment.

*Update: In March 2015, CitizensFirst rebranded as Verve, A Credit Union.