Credit unions face the challenge of balancing two realities.

On one hand, members expect smooth, digital-first loan experiences. On the other hand, members carry real worries about what happens if life doesn’t go according to plan. A sudden lost job, health crisis, or an accident could make meeting payments a struggle.

For lending leaders, bridging that gap can feel daunting. Technology projects have a history of being complex, costly, and disruptive, and caution often comes from experience, not hesitation. But standing still isn’t an option because borrowers are looking for support that feels both modern and deeply personal.

The Member-Centered Disconnect

What we hear from members is simple: financial protection matters, but it is not always easy to understand or access at the right moment.

Listening to consumers reveals a clearer picture of their concerns. According to TruStage’s 2025 Consumer Lending Preferences Study:

- Life happens, and borrowers know it. — Nine out of 10 consumers are concerned that a life event could affect their ability to make loan payments.

- Protection is wanted but often not offered. — More than 80% of borrowers are interested in protection products, yet over half do not remember being offered them.

- One conversation isn’t enough. — Consumers are looking for an ongoing conversation and multiple touchpoints, not a “one and done” offer. Most want details before their loan is final, and nearly three out of four expect touchpoints throughout the process.

A single mention at the end of the loan process is not enough. We know borrowers want reassurance along the way, presented in a way that feels natural. They want to know their credit union understands their concerns, listens to their needs, and is ready with solutions at the right time.

This is where credit unions can stand out. By moving from simply offering protection to embedding it into the member journey, they can close the gap between what borrowers need and what they experience.

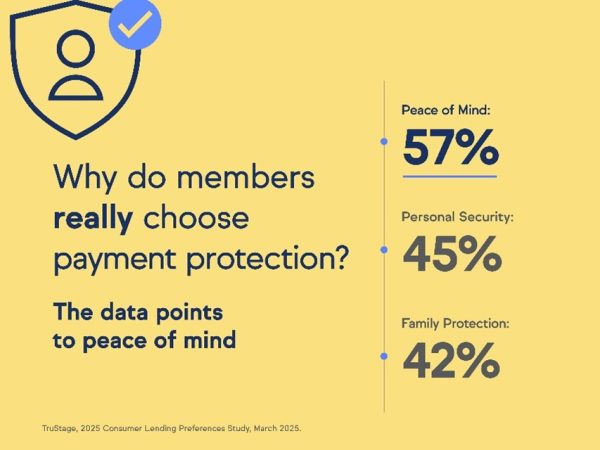

Members Choose Payment Protection For Peace Of Mind

At the heart of every loan decision is a human need: peace of mind. When members borrow, they are not just thinking about the present. They are also thinking about how they will handle the unknowns of the future.

Some worry about job loss or a medical event. Others wonder how a sudden repair could derail their budget. Many simply want the confidence of knowing their family won’t be left carrying the burden if something happens.

These are not abstract concerns. They are lived experiences that consumers bring into every financial decision. And when credit unions acknowledge them, when they offer protection that speaks to those very real anxieties, they build more than loyalty. They build trust.

Accessible Digital Solutions

This philosophy comes to life in TruStage’s integrated Purchase Solution. Instead of asking credit unions to overhaul systems, it fits seamlessly into the existing loan workflow.

- Background, Seamless Eligibility Checks — Members are only presented with personalized protection plans for which they qualify. They can review options and express interest without leaving the application.

- Designed For Simplicity — API integrates smoothly with existing lending workflows. There is no complex setup or manual re-entry of data required.

- Universal Awareness — 100% of online applicants are offered protection, closing the gap between interest and availability.

- Increased Elections — According to TruStage’s 2023 Lending Media Program May Campaign Results, credit unions using the experience saw a 13% increase in protection elections.

For members, it’s supposed to feel like part of the journey. For credit unions, it‘s a practical, scalable way to bring payment protection insurance into the digital age.

The Power To Be Transformational

Embedding payment protection into the digital lending journey is about more than improving efficiency. It is about showing consumers that their concerns have been heard and that their credit union has built a solution with them in mind.

When credit unions meet members where they are, and when they need it most, they create something far more valuable than a streamlined process. They create lasting trust.

And in today’s competitive lending environment, that trust is the true differentiator.

Credit unions don’t need to choose between digital progress and member-first values. With integrated payment protection, they can deliver both.

Corrin Maier is Vice President of Lending Payment Protection at TruStage.

TruStage is the marketing name for TruStage Financial Group, Inc. its subsidiaries and affiliates. Corporate headquarters are located in Madison, Wis. TruStage.

LPS-8340998.1-0825-0927