What sets the most successful credit unions apart in today’s financial landscape? With insights from more than 300 financial leaders and 1,700 members, this article presents a proven roadmap to success, detailing five strategic approaches to enhance customer engagement in 2024.

Strategy 1: Leverage AI For Enhanced Customer Engagement And Operational Efficiency

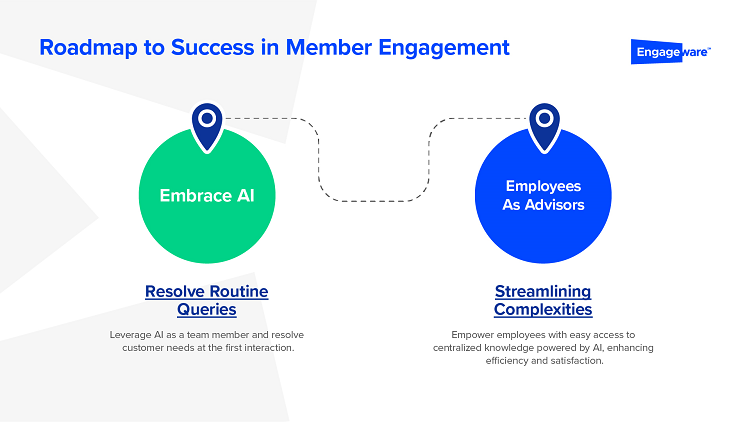

In 2024, credit unions face the dual challenge of enhancing member services and increasing back-office efficiency. Engageware obtained valuable industry insights from more than 300 financial leaders. 88% of these leaders expect AI to manage all customer engagement interactions within the next two years, revealing a significant push toward AI integration. This shift toward automated, yet personalized, services is not only a trend but also a strategic imperative, as Gartner predicts more than 80% of enterprises will have implemented AI or AI-enabled apps by 2026.

Embracing AI can transform these challenges into opportunities. By integrating AI, credit unions can streamline complex customer service operations into a single, efficient workflow. This not only simplifies access to information, thus improving employee experience, but also ensures members receive quick and accurate responses, enhancing overall satisfaction. AI’s role extends beyond automation, fostering a symbiotic relationship between technology and human agents, enabling credit unions to remain resilient and member-focused in a rapidly evolving financial landscape.

Strategy 2: Adapt To Evolving Customer Expectations

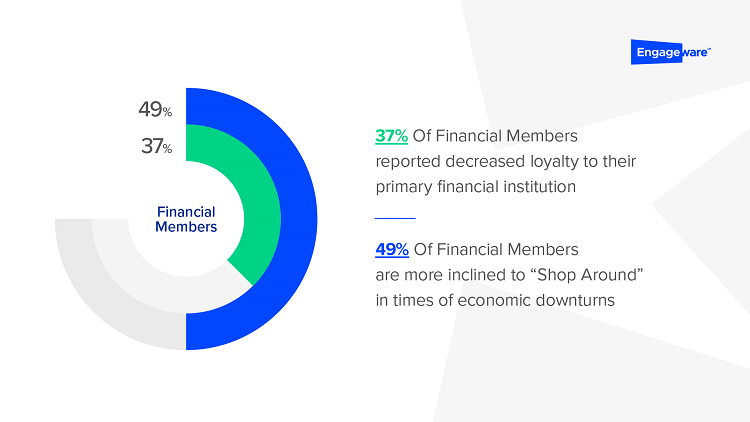

Insights from more than 1,700 members from financial services reveal 37% of them have reported decreased loyalty to their primary financial institutions, with nearly half likely to shop around for better rates during economic downturns. This trend is accentuated among younger members who demonstrate less loyalty and a marked openness to switching providers in search of enhanced services and greater demand for technological advancements.

To remain competitive, credit unions should continually adapt their offerings to meet these evolving preferences. Integrating continuous feedback loops and robust market research into their strategies allows them to stay closely aligned with member needs, securing long-term engagement and loyalty in an increasingly changing banking environment.

Strategy 3: Focus On Employee Satisfaction And Retention

Credit unions are increasingly recognizing the critical link between employee satisfaction and exceptional customer service. 80% of financial institutions consider high employee turnover a significant challenge to customer engagement in 2024. To counter this, financial institutions are investing in technologies that enhance both customer engagement and employee satisfaction.

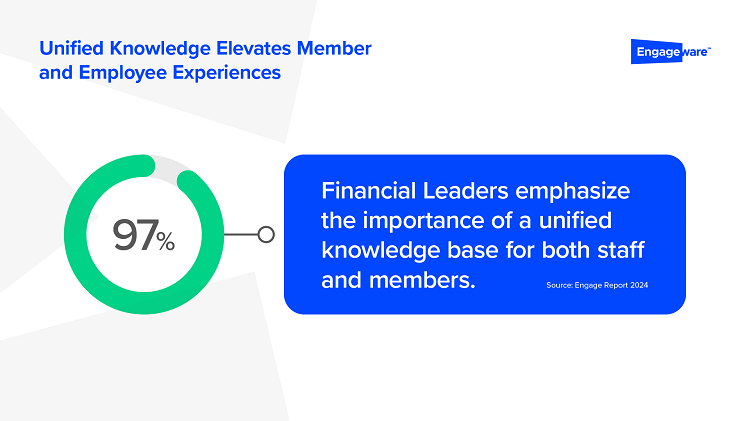

By equipping staff with tools that simplify tasks and ensure access to the latest, most accurate information without discrepancies, credit unions can significantly reduce complexities and stress in daily tasks, optimizing operational efficiency and retaining top talent. Central to this strategy is the establishment of a unified knowledge base.

A unified knowledge base is the backbone for ensuring consistency and accuracy across all customer interactions. Integrating comprehensive knowledge management platforms reduces misinformation, streamlines training, boosts morale, and enhances customer service, strengthening the credit union’s competitive edge in a complex service landscape.

Strategy 4: Keeping The Human Touch In Digital Interactions

In an era dominated by digital interactions, maintaining a human touch in customer interactions remains a critical differentiator for credit unions. Despite advances in technology, the essence of member service still revolves around personalization and convenience, which are not merely appreciated but expected.

Recent insights indicate banking leaders prioritize 24/7 access to their financial services; meanwhile, members value the ability to easily transition between digital channels and human support, emphasizing the need for personal interaction, especially when dealing with complex or sensitive issues, and highlighting a need to adopt an omnichannel approach that harmonizes digital tools with human interactions.

This strategy ensures a consistent, reliable member experience across all touchpoints where members can navigate seamlessly — whether through a virtual assistant’s self-service, an agent on live chat, or a face-to-face interaction.

Strategy 5: Streamline Technology Systems

By adopting integrated systems such as customer engagement platforms, credit unions can manage customer relationships and data across all touchpoints. This strategic integration not only enhances operational efficiency but also elevates member satisfaction by providing personalized and seamless end-to-end customer engagement.

Credit unions should consolidate their technology platforms to be more manageable and effective, to reduce complexity and improve efficiency. These efforts ensure that technology serves as an enabler rather than an obstacle, supporting a streamlined, efficient service model that adapts to both employee and member needs.

With 95% of banking leaders recognizing the necessity for an integrated customer engagement strategy, credit unions are tackling common sector challenges such as disparate systems and departmental silos in a digital-first environment.

For more than 20 years, Engageware has been helping credit unions deliver a better member and employee experience. Engageware’s end-to-end customer engagement platform helps credit unions automate member service, reduce call center workload, improve employee efficiency, increase sales, and improve member satisfaction resulting in:

- 50% increase in self-service rates.

- 40% reduction in call volume.

- 30% reduction in handle time.

- 22% increase in sales.

Visit Engageware.com to learn why more than 400 financial institutions partner with Engageware.