Help with housing, finance, and essential services is just a phone call or text away in North Florida, and Hello Credit Union ($164.9M, Panama City, FL) is working to ensure as many people as possible have access to that assistance.

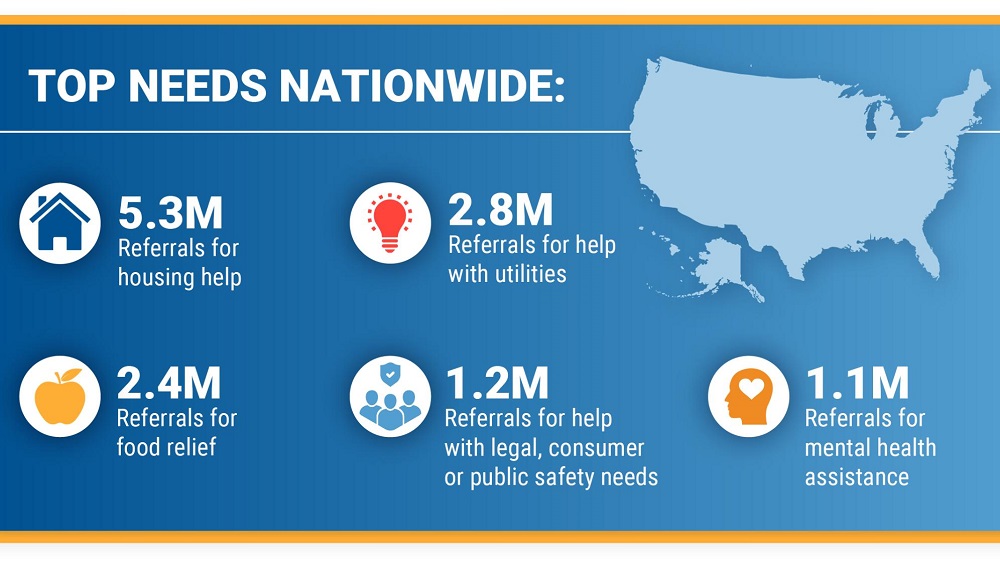

United Way launched 211 in the late 1990s to connect consumers more easily with various community services. The service, available in most parts of the country, received more than 42,000 inquiries per day on average in 2023, according to United Way, and fielded nearly 13 million requests for assistance with housing, food access, mental health, utility payments, and more.

In 2019, Hello kicked off its partnership 211 Big Bend — named for the region of Florida where it’s based — as an extension of the work it was already doing as a low income-designated institution. The credit union’s website also features a “Homegrown Help” section that highlights local partners that provide assistance with everything from housing to elder abuse, memory care, domestic abuse, veterans’ needs, and more.

What makes the partnership valuable, says Hello CEO Mike Akers, is that it’s not just one-way traffic.

“I want to make sure we’re holding up our end of the bargain,” he says. “I want them to be comfortable referring people to us. It’s created reciprocity and a symbiotic relationship.”

How does that look in real life? If someone struggling with a financial need calls 211, and 211 thinks the credit union can help, then 211 refers the caller to Hello for credit counseling, budget assistance, or more.

Hello’s reputation as a low-income credit union and Community Development Financial Institution helped build trust that it was a reliable partner, but Akers says the real differentiator was simply being willing to offer a helping hand.

“We just asked to help,” he says. “I don’t think any other institution had ever told them before, ‘We’ll send people to you, but the phone works both ways — we can call you and you can call us.’”

Nationwide Number. Local Impact.

The credit union bolstered its reputation by investing in its local 211 and showing up for events where the service had a presence. Some staff members even spent half a day at the 211 confidential call center to gain a better understanding of the service and its impact. Akers says that was particularly powerful because it made consumer struggles real for those staffers and helped them empathize.

“This isn’t just something you see on social media or the news,” the CEO says. “These are people in your community. These are your neighbors. There are people in your community who are struggling.”

All calls to 211 are anonymous, and the credit union doesn’t share information on the referrals it receives from the service, but Akers says it’s a fairly modest figure — maybe just a few every month. More important than the number of referrals, he says, is the fact they’re coming in at all. Credit counseling is the most common service needed, followed by savings plans, and Hello representatives are sure to emphasize that putting away even $25 per paycheck can have a big impact.

There are no specific goals associated with the partnership. Rather, the aim is simply to help community members improve their financial lives. In fact, one top loan officer referred a member to 211 rather than take the application for a small personal loan — bringing in the assistance of outside help rather than putting them further into debt.

That approach is typical of how Hello helps promote the service. Although 211 and other resources are listed on the credit union’s website, those referrals frequently happen in conversations in the wake of a crisis or when disasters strike the area.

A Natural Fit

Some large banks in the region also sponsor 211 Big Bend, but Hello is its only credit union partner. Because both parties are focused on improving peoples’ lives, the pair are a natural fit, says Kay Meyer, interim CEO of 211 Big Bend and a former staffer at what is now Loyalty Credit Union.

CU QUICK FACTS

HELLO CREDIT UNION

HQ: Panama City, FL

ASSETS: $164.9M

MEMBERS: 11,621

BRANCHES: 5

EMPLOYEES: 40

NET WORTH: 13.0%

ROA: 0.37%

That’s especially important in a political climate where certain vulnerable populations could lose access to social safety nets, she adds.

“It’s a different climate out there,” Meyer says. “Every choice has a repercussion, just like dominoes, and it’s important to support those causes that you believe in. Hello Credit Union has decided it’s going to invest in a nonprofit like 211 Big Bend.”

For the credit union, some of the biggest challenges it has faced have been around ensuring members, staff, and the community are aware of the service and that help is available, regardless of political climate and what folks are going through.

And 211 is just the tip of the iceberg. Hello also uses United Way’s ALICE data set — short for Asset Limited, Income Constrained, Employed — to inform its work and keep staff mission-focused. [Learn more about ALICE in “GreenState Foundation Invests In Data To Improve Its Community.”]

Five years into the partnership, Akers says Hello staff has a better understanding of what community members are going through and is better equipped to assist them. That, in turn, has informed some of the work the credit union does, including understanding whether it needs to dig deeper into subprime credit for its auto loans or if its payday alternative loan is adequately meeting the needs of those it was designed for.

“We’re all getting through this crazy life together, and this helps reinforce that sense of community,” Akers says. “People are struggling. As a credit union, we offer things like checking accounts and car loans. It’s not glamorous, and it doesn’t always feel philanthropic in nature, but it helps refill our cup. We’re not just hocking checking accounts — we’re actually helping people.”

What Can You Learn From Like-Minded Leaders? Credit unions are responding to the evolving needs of members with a variety of products and services, including for assistance to tackle social challenges. What’s more, they are using expertise from one another to do so. Callahan Roundtables put leaders in the same room to share solutions, solicit feedback, pose questions, and more. Inspiration is a Roundtable away. Learn more today.