Community development credit unions commonly use advisory boards to demonstrate they are serving a defined target market, which is a requirement of CDFI certification. Indeed, advisory boards can be a powerful tool in ensuring vulnerable demographics are represented, but they also can help

any credit union improve their member experience, foster innovation, build community connections, and more.

“Our advisory board members play a crucial role in upholding our mission and amplifying the voices of our membership,” says Leigh Anne Bentley, chief marketing officer at Leaders Credit Union ($1.1B, Jackson, TN) in western Tennessee.

What started as a singular advisory board in 2017 has expanded to three, each focusing on a specific geographic part of the credit union’s market: the Cornerstone Advisory Board, the Memphis Advisory Board, and the Northwest Advisory Board.

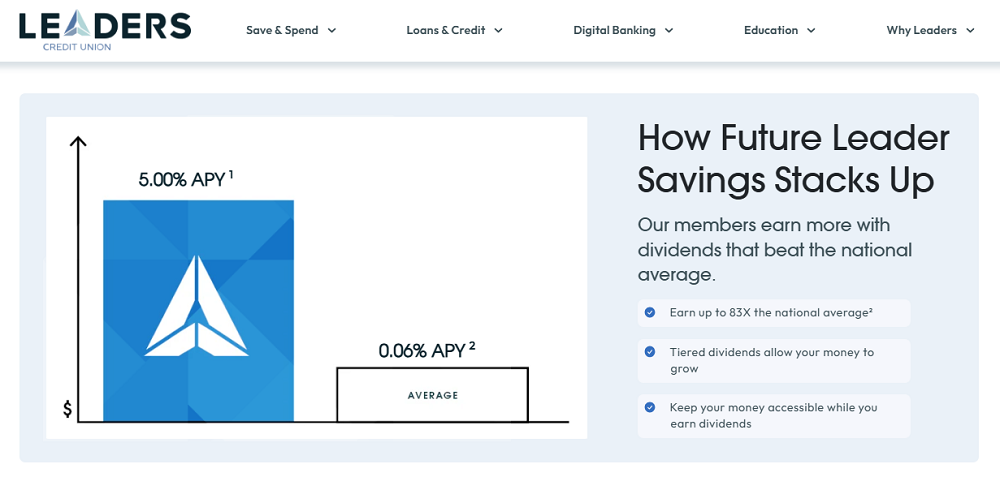

Advisory board feedback has helped Leaders improve the member experience for all, and they proved instrumental in the ideation of a savings account that promotes good financial habits among young members with deposits for good report cards and perfect attendance, among other tools and perks.

According to Bentley, advisory board feedback has become critical for ensuring the credit union is fulfilling its obligations as both a CDFI and community partner.

“We always tell them we love to hear the good things we do, but we really want to hear the things we can improve on,” she says. “Do our services properly address the community’s specific needs? Are we participating in nonprofits to make the biggest difference? We take it very seriously, and we make adjustments where we can.”

Cost-Effective Insights

Across the country in California, Southland Credit Union ($1.2B, Los Alamitos, CA) established a student advisory board in 2022 to make inroads with and better understand the young adults it serves.

“Colleges, universities, and students are unique, and it takes some time to build trust in those areas,” says Michelle Rose, vice president of marketing at Southland. “This advisory board is just one way we’re taking steps to improve that.”

Southland is not a CDFI, but that doesn’t stop it from realizing the benefits of an advisory board. Every year, the credit union encourages member as well as non-member students to apply, ensuring a variety of students have a voice at the credit union. In turn, these participants serve as an in-house focus group for new products and services, marketing, and more.

“Having student voices brings us back down to reality and helps us gauge what is important to them,” Rose says. “Our first advisory group gave us feedback on how we were offering Zelle, and we made some changes based on their feedback.

Advisory board members don’t have to have a background in finance or marketing, but a lot of applicants do. According to Rose, the current board has served as a test group for the credit union’s new financial literacy app, which is available to all members but has been in beta testing for some time now. The advisory boards also have played a part in new advertising initiatives.

“Peer recommendations are especially influential to them,” Rose says. “We took that advice directly from the student advisory board and have started experimenting with NIL promotions with student athletes.”

Advisor. Influencer.

Even as advisory boards provide a direct line of communication to a given community, advisory board members can serve as advocates for the institution.

“We have a referral program where we give them a little business card with a QR code on it,” says Bentley at Leaders. “If someone brings in one of those business cards to a branch or goes online, then we waive that person’s membership and the board member gets a $25 bonus on their check.”

Advisory board members at Leaders represent variety of sectors and organizations across the region, including St. Jude Children’s Research Hospital, Junior Achievement of Memphis, and the Carl Perkins Center for the Prevention of Child Abuse. This diversity helps the credit union network better than ever before.

And working with local students has underscored the importance of word-of-mouth marketing at Southland Credit Union. Its current advisory board members want to use their position to make a positive impact among peers.

“This group of students is very focused on gaps in financial education,” Rose says. “They’ve been looking at how they might play a role in lifting up their peers to be more financially secure, knowledgeable.”

This is a worthwhile goal considering recent research suggests financial literacy among college students is disappointingly low.

Celebrate The Good. Learn From The Rest.

Leaders and Southland might have different goals for their advisory boards, but they both cite the importance of gathering feedback and adjusting when necessary.

At Southland, the biggest challenge is balancing priorities and individual schedules.

“We try to find meeting times that will accommodate their schedules,” Rose says. “We take extra steps to do that recognizing, of course, that their education comes first.”

Working with younger adults also means the credit union must occasionally be more hands-on than it might be with a board composed of older professionals.

“I see an opportunity for the board to become a little bit more self-directed,” Rose says. “We could empower students to take on leadership roles within the group.”

With approximately 70 miles between Jackson, TN, and Memphis, Leaders also has had to overcome challenges related to availability and geography. Bentley says making some meetings virtual has helped overcome those hurdles. So, too, has meeting more often.

“We used to keep the three boards completely separate,” the CMO says. “Now, we do meetings with individual boards every other month with a joint meeting with all three in between.”

Performance Benchmarking Made Easy For CDFIs. Are you a CDFI struggling to find meaningful comparisons for performance benchmarking? Callahan’s Peer Suite allows users to create a custom peer group of CDFIs in minutes and compare key metrics like membership, loan, and share growth. Let us show you how. We’ll even provide a free performance report for you to keep at the end of the session. Learn more today.