Workers’ Credit Union($1.2B, Fitchburg, MA) started offering a patronage dividend to members in 2013, and 2015 marks the third consecutive year of what it calls its GiveBack Program. The Massachusetts credit union paid out $2.5 million in 2014 and plans to bump that up to $3 million for 2015.

In combination with the fact capital was growing, we thought it was a good idea and the right thing to do to give some of our profits and capital back to our members,the credit union’s chief financial officer, Tim Smith, says of Workers’decision to offer the dividend in 2013. Some folks might say we have too much capital, but we like the flexibility that allows.

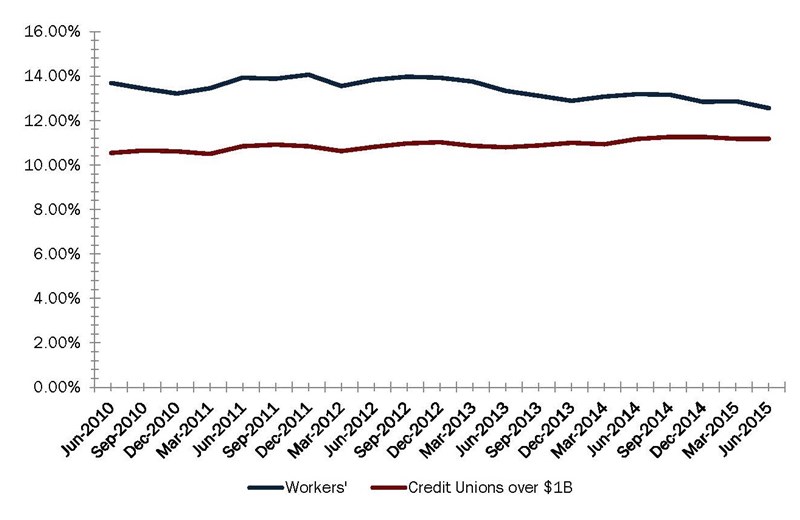

Workers’Capital Ratio

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

The Big GiveBack

CU QUICK FACTS

Workers’credit union Data as of 06.30.15

- HQ: Fitchburg, MA

- ASSETS: $1.2B

- MEMBERS: 85,162

- BRANCHES: 16

- 12-MO SHARE GROWTH: 9.19%

- 12-MO LOAN GROWTH: 15.74%

- ROA: 1.37%

Patronage dividends allow the credit union to fulfill a guiding corporate principle: members are owners of the institution, and when the credit union does well, its members reap the financial benefits.

This goes not only for competitive rates but also cold, hard cash.

And members that conduct more business with the credit union earn a higher dividend. Members earn a 10-, 20-, or 30-basis-point return on the average annual deposit and loan balances for the following accounts:

| 30 Basis Points | 20 Basis Points | 10 Basis Points |

|---|---|---|

| Personal Checking | Auto/ Personal Loans | Mortgages |

| Business Checking | Checking LOC | Finish Line Refi |

| Regular/ IRA Savings | Home Equity | |

| Money Markets | Regular and IRA CDs | |

| Business Loans |

New for 2015 are individual retirement accounts as well as business loans and deposits. Retirement assets under management, past-due loans, and student loans are some of the products not eligible for Workers’ GiveBack Program.

The credit union plans to return $3 million to its members in 2015. Beyond that, it wants to increase its dividend by $500,000 each year. The credit union has budgeted for the increase; however, the board makes the final decision every year and basesthat decision on Workers’ continual financial success.

We need to keep growing the business, growing capital, growing earnings,Smith says. Who knows which way the economy will go and what our ultimate profitability will be if there are hiccups on the way.

The Big Differentiator

Although Smith could not identify metrics that show a positive correlation between the GiveBack and the credit union’s growth or profitability as the dividend is designed simply as a member benefit.

We go out with the GiveBack in everything. It’s in almost every conversation we have.

Smith knows of one other financial institution in the area that makes a dividend, though it is not as large as Workers’ and that institution doesn’t advertise it, he says. Because of this, when the credit union started the GiveBack in 2013,it made a big splashin the market through advertisments and other awareness campaigns.

We continue to think it makes a difference,Smith says.

Today, Workers’ advertises its GiveBack Program online, in print, and on TV. Here’s a sampling of the credit union’s television advertisments.

The credit union has also incorporated member testimonials into its advertising:

And it’s had a bit of fun, wryly poking at the banking industry:

We go out with the GiveBack in everything, Smith says. It’s in almost every conversation we have.

That’s important because, in addition to the member benefit, the GiveBack Program is also a way for Workers’ to differentiate itself in the market.

Think of when a member comes in and says ‘I like your rates but you are the same as everyone else,’ Smith says. We ask, ‘Do you know about our GiveBack Program?’ We will match the market on price, but we will beat themarket with our GiveBack.

You Might Also Enjoy

- How Credit Unions Pay Out The Patronage

- Patronage Dividends: A Callahan Survey

- A Tradition Of Thanks Three Decades In The Making