Travis Credit Union($2.3B, Vacaville, CA) is leveraging immigrants’ customs to reach a large, underserved segment of the population. In mid-2012, the Northern California credit union worked with Latino community groups, the National Credit Union Foundation, and the Coopera consulting firm to pilot the New Era Tanda Loan Program.

Tandas are informal borrowing and lending circles used by Hispanic communities, but a closer look reveals the concept could also go by the trendier term crowdsourcing in the United States. In this tanda, Travis serves as the depository andlender and has added financial education and consumer protections to the mix.

The tandas are already here, says Sherry Cordonnier, TCU’s director of corporate communications. So we decided we might as well work with the concept.

CU QUICK FACTS

TRAVIS Credit Union

data as of 12.31.14

- HQ: Vacaville, CA

- ASSETS: $2.3B

- MEMBERS: 167,048

- BRANCHES:23

- 12-MO SHARE GROWTH: 6.07%

- 12-MO LOAN GROWTH: 22.47%

- ROA:1.24%

In the pilot program, which occurred from mid-2012 through mid-2013, six participants spent one year contributing approximately $100 a month each to a joint savings account. The savings then qualified them for share-secured $600 loans.

The six participants also attended monthly meetings hosted by the Yolo Family Resource Center that featured Spanish-language financial education provided by TCU staff.

Today, five of the six participants are still Travis members and three of them have credit cards. But the benefits extend beyond TCU’S tanda.

They have a better sense of how money and credit work in the United States, Cordonnier says. That includes how to balance a checking account and use services such as direct deposit, online and mobile banking, and bill pay. They also understandhow to build the credit they need to buy a car or home.

Kicking Around A Good Idea

To find culturally relevant and thus, effective ways to build trusted relationships with a fast-growing immigrant community, the credit turned to industry experts and then to a local non-profit agency. And it turns out a soccer leaguewas a fertile field for finding willing participants to try out the credit union’s new tanda program.

That’s typical of how the word gets spread around about resources in the community, says Miriam De Dios, CEO of Coopera, the Iowa-based, Hispanic-focused consultancy. Travis is great at understanding cultural and financial needsand working with community partners.

Travis has been focusing on the immigrant community in its market for years. It provides products and services specific to Hispanics, Filipinos, or whoever else comes here and needs to know how the system works, Cordonnier says. Thereare organizations and financial institutions that will take advantage of them. That goes completely against our mission and our vision.

That mission and vision has led the credit union to offer such products as Deferred Action for Childhood Arrivals (DACA) loans to help cover the $465 fee to apply for two-year deportation relief. Options like this are vital for a community in which arecent study found many eligible immigrants couldn’t afford the fee. The same study found the same group showeda high propensity for work and education.

Travis offers other small-dollar lending products as payday lender alternatives and even one focused on family fun: a signature loan for traditional Quinceanera celebrations marking a girl’s 15th birthday and coming of age.

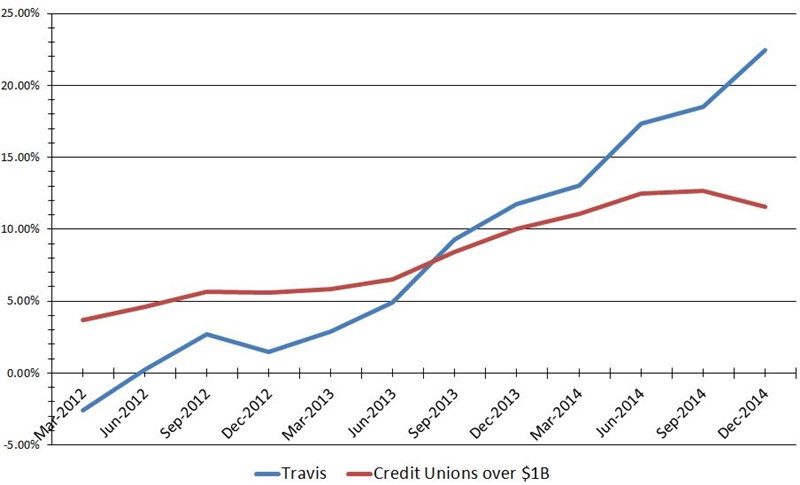

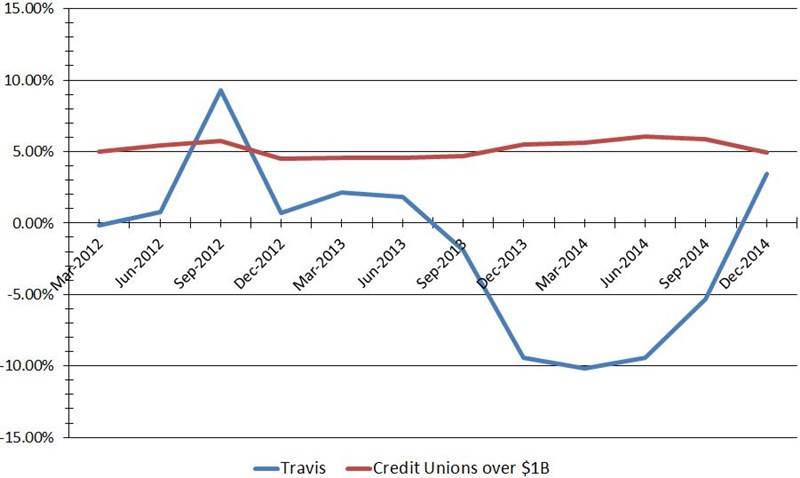

Cordonnier says the loans follow the credit union’s existing risk pricing. TCU knows how to lend, showing loan growth well above its peer group of billion-dollar credit unions around the country. And it knows how to attract members, growing at arate just below its nationwide peers in a market that’s 21% Hispanic right now and adding to that at a clip of 5% a year, Cordonnier says.

TRAVIS LOAN GROWTH

Compared to all U.S. credit unions | Data as of 12.31.15

Callahan & Associates | www.creditunions.com

Source: Callahan & Associates’Peer-to-Peer Analytics

TRAVIS MEMBER GROWTH

Compared to all U.S. credit unions | Data as of 12.31.15

Callahan & Associates | www.creditunions.com

Source: Callahan & Associates’Peer-to-Peer Analytics

Taking Off From The Pilot

To attract more members and loans, Travis has hired a community outreach officer tasked with developing the relationships and other legwork needed to launch the New Era Tanda Loan Program as an ongoing offering.

We don’t want it to be a pilot this time, Cordonnier says. Developing the program takes resources, including someone focused on talking to community groups and individuals to find out their needs and dreams.

It also takes time.

It’s going to take her a good year just to align herself with those organizations that share our commitment to the welfare and success of our community, Cordonnier says of the new outreach manager. But it’s worth it. Helpingour immigrant population is healthy for them and for our entire community. It’s what our credit union is all about.

3 Tips For Successful Connection

Travis Credit Union has learned from experience how to serve underbanked populations in its market. Here are three interconnected tips.

- Identify The Need:

Find out what the community needs. Some things are fairly universal reliable transportation, payday lender alternatives but others can be specific to an ethnic group, such as Quincinearaloans for Latino families with adolescent girls. - Community Partners:

Nonprofit community service centers typically share the credit union philosophy of people helping people and already have relationships with the word-of-mouth leaders of the immigrantgroups they serve. - Grassroots Marketing:

Grassroots marketing is proving to be the most effective route for connecting with immigrant populations. Going to where they are is absolutely the best way to build the trust factor,says corporate communications director Sherry Cordonnier.