Top-Level Takeaways

- Kern Schools FCU rebranded as Valley Strong after a state charter and multi-county FOM expansion.

- A new name and attitude has helped the credit union add members and recruit C-suite executives from outside the credit union space.

Just three years ago, Kern Schools Federal Credit Union had 15 branches, $1.7 billion in assets, and 160,000 members.

Now, with a new name, a new charter, and a lot of new leadership, Valley Strong Credit Union ($4.0B, Bakersfield, CA) is a shining example of a powerful rebrand that’s far more than skin-deep.

The credit union’s February 2020 name change was simultaneous to the cooperative receiving a state charter that expanded its field of membership from Kern County alone to 11 counties stretching nearly from Sacramento to Los Angeles.

Today, two mergers and a lot of organic member growth has helped the cooperative cross $4 billion in assets and serve more than 260,000 members through a network of 31 branches in four counties, soon to be five.

But Valley Strong’s success is not just about the numbers.

“Qualitatively, we are a far-better organization,” says Nick Ambrosini, who assumed the role of CEO in July 2021 after nearly 15 years with the Central Valley cooperative. “We have improved our service to members, elevated our staff quality, and have an exciting, growth-oriented future. We are becoming that destination workplace. Short of a cataclysmic event out of our control, our trajectory is nothing short of explosive.”

What’s In A Name?

The name “Valley Strong” reflects not only the credit union’s geographic footprint but also a new field of membership and focus on relevancy.

“We wanted to expand beyond Kern County into other parts of the Central Valley,” Ambrosini says. “But with our name recognition and the brand’s limitations, we needed to refresh.”

The credit union couldn’t get the geography expansion it wanted through its federal charter, so it converted to a state charter. The name change also allows it to operate more freely and break out of the pigeonhole potential new members might associate with the name ‘Kern Schools.’

Adrenaline, an Atlanta-based consultant with both Fortune 500 and credit union experience, was brought in to assist in the rebranding process, conducting several months of focus groups and other research among members, potential members, and staff. Eventually, and after several iterations, it settled on 18 different variations of Valley Strong and presented the short list to key stakeholders. Soon after, the 18-month process culminated with the launch of the Valley Strong brand.

After 18 months and several iterations, Kern Schools FCU settled on a new name: Valley Strong Credit Union.

As Kern Schools FCU, the credit union served only Kern County, CA. As Valley Strong, the credit union serves an expanded field of membership, which includes 11 counties, under a state charter.

Valley Strong isn’t just a new brand, it’s a new attitude. The credit union has improved member service, elevated hiring, and embraced a growth-oriented future in service of its core values.

“Valleys are almost everywhere in California, so that sells well, but there’s more to it here,” says Jim Lawitz, the credit union’s vice president for culture and communication. “The name ‘Valley Strong’ recognizes what the credit union means to our original SEG and the community, so it does a great job of both honoring our past and branding us for our future aspirations and growth.”

Expanding Services For A Growing Population

Valley Strong is coming off three straight years of record loan growth, and the completed mergers of the former Solano First Federal Credit Union and Financial Center Credit Union added approximately 40,000 new members in 2022. The cooperative expects continued growth to be fueled by expanded services and population.

“We’ve long had the image of being a place for hard-working people with a good quality of life,” Ambrosini says. “Now there’s a massive migration into the Central Valley because we’re one of the last affordable areas in the state, so we’re getting a lot of blue-collar workers coming to us from the major metros with their version of the American Dream, a house, and a yard for the kids to play in.”

Despite the credit union’s vast geographic expansion, it hasn’t severed its hometown roots. In fact, it played a role in the recent rebrands of both Bakersfield and Kern County. Bakersfield’s “The Sound of Something Better,” which offers a nod to its music heritage, as well as Kern County’s “Grounded and Boundless” themes will aim to pull in outside business and local tourism, according to The Bakersfield Californian.

“We were one of the few private partners that helped fund these initiatives,” Ambrosini says. “We had a front-row seat and were able to incorporate some of the aspects they were looking into our own rebranding work.”

In addition to a new name, Valley Strong has adopted a new attitude. It has sharply expanded its management team, reduced a dozen fees and other member charges, expanded its contact center hours, enhanced its ATM network, and added business products and services as well as niche lending products and fintech partnerships.

But as much as things change, some things stay the same. According to Lawitz, the new name underscores the credit union’s continued commitment to supporting a community that’s widely diverse both ethnically and economically.

“When you look at our track record of donations and support, you can see we’ve always tried to punch above our weight class across multiple spectrums,” the Valley Strong vice president says.

A C-Suite Built For Growth

Another way Valley Strong is punching above its weight is by expanding its C-suite to include leaders with the experience to help Valley Strong reach $10 billion in assets and handle the challenges that come with managing a much-larger cooperative.

In a six-month hiring spree that ended this past spring, Valley Strong’s C-suite grew from eight to 14 executives, including a chief strategy officer with broad, international experience who held key roles with American Express, JPMorgan Chase, and MetLife. The credit union’s first-ever chief product officer also came aboard, as did new C-level managers of marketing, business intelligence, and compliance. A new chief retail officer, chief lending officer, and vice presidents in consumer and mortgage lending also are part of the bolstered team.

Although Ambrosini and his COO are both long-time Valley Strong executives, many of the credit union’s new hires are from either large banks or completely outside the financial services industry, the idea being their experience and fresh ideas will inject new energy and fresh thinking.

Ambrosini is fighting to ensure Valley Strong doesn’t slumber along “in the sleepy mold” in which some credit unions find themselves. He’s betting investments now will stave off complacency later.

“Do you build it now or do you try to grow into it?” the CEO asks rhetorically. “We decided to build the team now that can take us to $10 billion by 2030. We know we’ll be a little top-heavy, but let’s build the team now rather than incrementally as we go.”

Growing Pains And Future Plans

Such a rapid expansion of accomplished executives who bring big ideas from outside the industry, much less outside the Central Valley, doesn’t come without growing pains.

CU QUICK FACTS

Valley Strong Credit Union

Data as of 06.30.22

HQ: Bakersfield, CA

ASSETS: $4.0B

MEMBERS: 284,356

BRANCHES: 29

12-MO SHARE GROWTH: 48.3%

12-MO LOAN GROWTH: 69.1%

ROA: 0.71%

“When you bring that many high-powered people into the room, you’re going to have to spend a lot of time getting everyone comfortable in their lanes,” Ambrosini says. “They typically had much larger purviews, and it’s taking a little time to get everyone on the same page.”

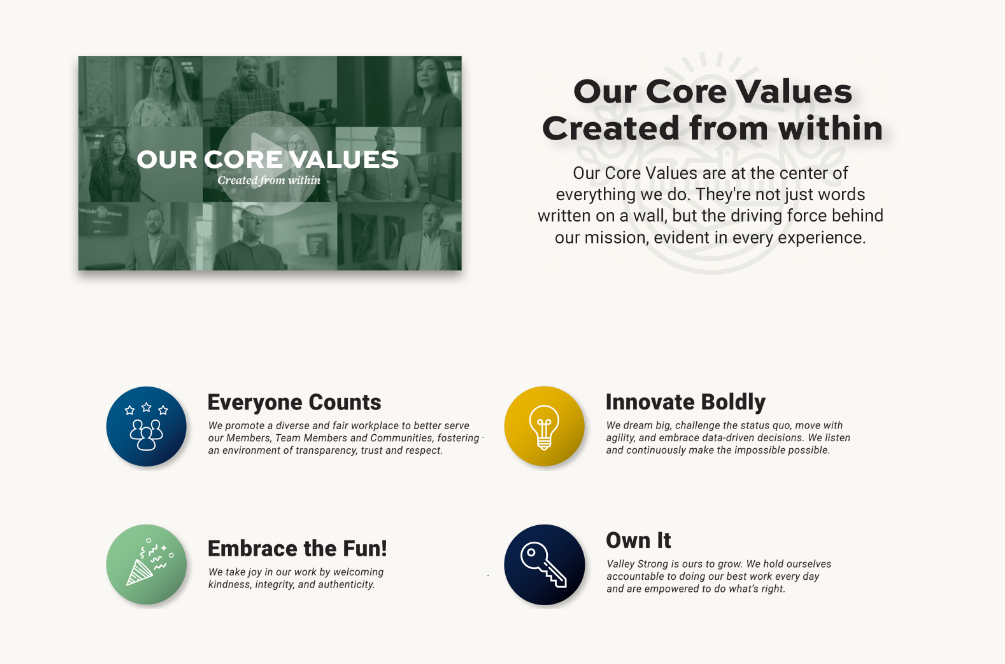

To help smooth that process, the new team has worked with a culture consultant. Leaders participated in off-site sessions that Ambrosini says proved uncomfortable — even raw and painful at times — but also resulted in the creation of a set of core values the senior managers can use to guide their tactics and strategies for growth ahead.

That growth will likely come both from de novo members and mergers “for the right reasons,” Ambrosini says.

“We have set our course and our culture,” the CEO says.

Now, it’s time for Valley Strong to be bold and follow its instincts.