Top-Level Takeaways

-

- The business transformation team at Grow Financial includes product owners, technologists, front-line managers, and efficiency experts.

- The team has tackled the onboarding process for indirect members, the implementation of a digital online platform, and the credit union’s electronic filing system.

Business transformation is a team effort that requires time and resources. All too often, major initiatives fail or are abandoned in the face of organizational inertia.

Grow Financial Federal Credit Union ($3.5B, Tampa, FL) is taking on the challenge of transformation with a cross-functional approach in which a group of Agile teams focus on projects while Lean Six Sigma black belts study metrics and refine processes to drive efficiency.

The business transformation team at Grow Financial includes product owners (known internally as product owners), technologists, front-line managers, and efficiency experts from automakers Volvo and General Motors. And under the leadership of Kent Paro, a 31-year veteran of the U.S. Navy, the 12-member team is showing Grow what it takes to make a change.

“We have people who’ve been here for years and have heard, ‘We’re going to change, we’re going to fix this, we’re going to improve this,’” says Paro, who has served as the credit union’s first vice president of business transformation since 2022. “Their attitude is, ‘Sure, I’ve heard this before.’ But what’s different now is there’s a part of the organization responsible for that.”

Agile Journey

Grow Financial began its Agile journey in 2015 when it formed a team to focus on a backlog of IT projects. By 2017, the team was overwhelmed and not making much headway, so the credit union brought in an Agile consultant who recommended Grow create a cross-functional scrum team to tackle the onboarding process for indirect borrowers new to the credit union. The scrum team brought together a mix of skills from software developers to front-line managers to work full time on transformation.

DID YOU KNOW

Agile project management is an iterative approach to planning in which a company breaks down a project into smaller cycles, often called sprints, which allow the organization to make incremental steps toward completing a project.

“We had a cross-functional swath of experience and ability, and the team itself was incredibly engaged,” Paro says. “They were happy, and they were focused on being a successful, cross-functional team. Almost to a person, everyone on that team was promoted up or out and moved on to bigger things.”

Grow formed new teams and went on to tackle major technology projects including the implementation of a digital online platform and, more recently, the addition of Synergy to streamline the credit union’s electronic filing system and a new automated workflow platform to reduce manual processes.

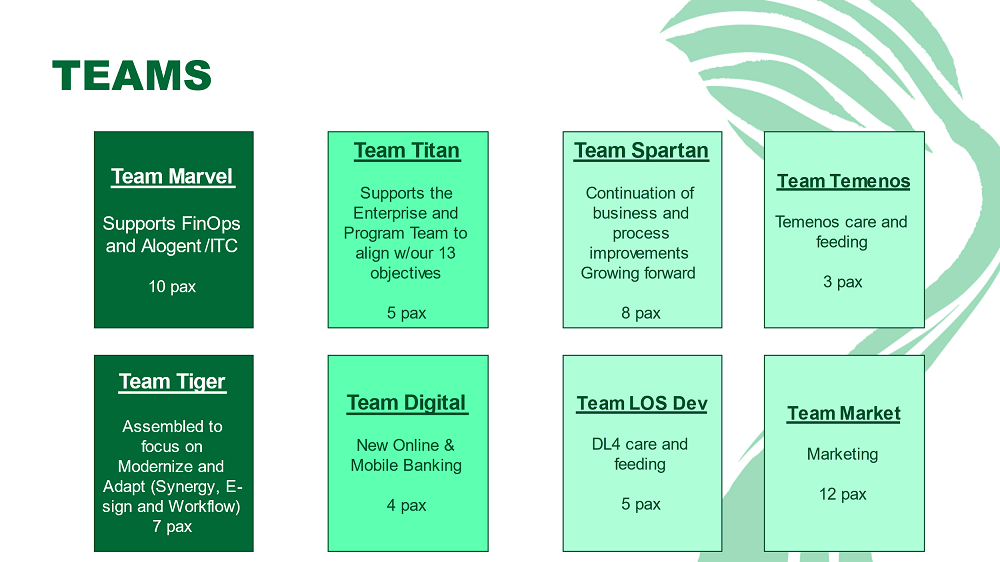

Today, the business transformation team works with eight Agile teams focused on a variety of projects including modernization, digital and mobile banking, FinOps, business process improvement, and marketing.

In late 2022, the organization added a dedicated Lean Six Sigma team that is focused on business process improvement. Paro says this team will play a key role in analyzing and rethinking business processes.

“Our purpose is to foster a continuous improvement culture and facilitate the daily effort to improve all elements of Grow’s processes, tools, products, and services to make Grow better for both members and team members,” Paro says, quoting the organization’s mission statement.

The Right Team

Finding the right people to lead and participate in the Agile teams is crucial, Paro says. Grow pulls employees from other parts of the organization to work full time on projects and transfer their old responsibilities to others. Rule No. 1: They need to be natural team players.

“Generally, they’re extremely focused on team performance and making teams and team members better,” Paro says. “They’re very collaborative. They are obviously professionals and have a wealth of experience in the financial industry.”

In contrast, the Lean Six Sigma specialists are new to financial services. Team members have backgrounds in the manufacturing industry, which has decades of experience in process improvement.

“They’ve been trained, they’ve been through a bunch of qualifications and courses and tests, and they have years of experience in improving and creating value for other companies in other industries,” Paro says.

Although Six Sigma specialists might not have all the answers to business issues, they are trained to coach others to analyze root causes and develop improvement plans.

“They don’t come into your business unit and solve your problem,” Paro says. “They come into your business unit and ask you questions so, together, you can solve the problem. They give you the tools, the focus, and the direction to gather the right information to come to a solution. Their whole purpose in life is to find the root cause and solutions for complex problems.”

Driving Toward Automation

Although Grow Financial’s Agile teams still deal with the day-to-day management of technology projects, they also are looking for ways to automate manual processes. One example is the workflow automation initiative.

CU QUICK FACTS

GROW FINANCIAL FCU

DATA AS OF 12.31.22

HQ: Tampa, FL

Assets: $3.5B

Members: 228,2823

Branches: 26

Employees:567

Net Worth: 9.8%

ROA: 0.86%

“We have a lot of manual processes that rely on a person to do something and send it to another person who then has to be there to do something,” Paro says. “If I send something to someone who’s on vacation for a week, nobody sees it for a week. We want to automate that so the person doesn’t have to be there and no one has to wait on it. That request can go to offices instead of people.”

Six Sigma team members also are looking at ways to streamline services, such as address verification, for members. If a member is trying to open a new account and the mailing address on an ID card doesn’t match, for example, does the credit union really need to send that person home to get documents to verify the address? There are various other ways to verify an address. Similarly, the credit union has a policy against cashing third-party checks. Members can ask for an exception, but that might require going to the originating bank to get a medallion stamp on the check to prove the funds are available.

“Nobody wants to do that,” Paro says. “For years we’ve been trying to minimize all risk so we’re not taking any risk at all. But, really, we could probably take a lot more risk, serve members better, and not affect anything.”

Lessons Learned

Establishing Agile teams with employees from across the credit union requires coordination with, and flexibility from, other departments. The transfer might be on the Agile team for six months, and the employee’s manager needs to make arrangements to cover their work.

“We kind of overburdened some of our departments unnecessarily,” Paro says. “But we’re getting better at that.”

Another lesson Grow Financial has learned is that primary managers need to stay connected with employees while they are on loan to the Agile team. Grow initially instructed managers to treat team members as if they were on family medical leave, but in some cases, the manager severed communication with the employee.

“Between the two of them, there was a total breakdown of communication,” Paro says. “When it came time to do performance reviews, the relationship had been broken. It wasn’t appropriately dealt with upfront when it should have been.”

Communication throughout the Agile team assignment goes a long way toward alleviating that tension.

Finally, says Paro, it is important to keep the team motivated. He’s got advice on how to do that, too.

“Make the job of the team something important and provide a scoreboard that shows they’re playing a winnable game,” he advises. “If they know something really matters to the organization, and they can see their impact, you get more bang for your buck.”

Although Grow Financial’s Agile journey is still in progress, Paro says the organization is getting better at managing and completing projects.

“This is something we’ve never done,” he says. “We’ve never reinforced the fact we’re an Agile organization. We’re trying to iterate on this stuff; we’re trying to fail fast, learn a lot, and shift our focus. It’s a little daunting to look at the list of things we’re trying to do. It’s a huge list. But slowly but surely, we’re building the muscle memory to do things better with more of the Agile mentality around them.”

Business Transformation At Grow Financial

- Who We Are: Business transformation is composed of Agile leaders, product owners, scrum masters, and continuous improvement professionals. We help teams deliver value in an iterative and incremental way. We learn as we go and create value by eliminating waste and creating flow in the process to delight both members and team members.

- Purpose: To foster a continuous improvement culture and facilitate a daily effort to improve all elements of Grow — processes, tools, products, and services — to make Grow better for both members and team members.

- Goals: Help Grow align strategy to execution, improve and focus teams, create and measure value for members and team members, and facilitate collaboration across the entire organization. Provide an exceptional member and team member experience, create organizational agility to meet the changing environment and market needs, and create seamless improvement across the organization.

- How We Do That: We work together to focus teams, align strategy to execution, create and measure value for members and team members, and facilitate collaboration across the entire organization. We provide clarity and direction; we promote awareness and use of Agile and Lean Six Sigma (LSS) practices. We champion ownership, critical thinking, and continuous process improvement. We use the Strategy Map, Member feedback, and data for direction and collaborate across the organization to build a culture of problem solvers and make Grow better.