Top-Level Takeaways

-

FCFCU focuses on analytics to tell a story about member needs and perceptions.

-

The credit union’s strategic plan includes predictive abilities for data to inform tactics.

Predictive analytics is a hot topic. Crunching numbers to extract actionable insight on what members are doing now and what they might do next is an expertise in great demand.

Financial Center First Credit Union ($570.4M, Indianapolis, IN) has been involved in data analytics since 2010. Its chief strategy officer, Cam Minges, has been at it since 2008.

He says data analytics, and then making it predictive, is about context.

ContentMiddleAd

In our shop, we tend to look at analytics as if we were telling a story, Minges says. There’s no shortage of information that tells what’s happening. The question of Why is this happening?’ is too often missing from the dialog.

Minges says much of FCFCU’s analytics work focuses on answering two challenges from CEO Kevin Ryan. First, tell him what he doesn’t know, and, second, tell him where the credit union needs to play.

Here, the 30-year veteran of credit union technology shares how he views data and predictive analytics and how FCFCU uses them across the enterprise.

Is predictive analytics different from data analytics?

Cam Minges, Chief Strategy Officer, Financial Center First FCU

Cam Minges:I think so. Predictive analytics is an evolution not a starting point. You have to start with the data, with data analytics, because there is so much more of it. That requires understanding and to some extent interpretation.

So, what is predictive analytics?

CM:To me, it’s the process ofturning data into action. As with anything new, there are missteps when embarking on a predictive analytics journey, and we certainly have made our fair share of them.

I think where most fall short is that the definition of predictive analysis ends with why is it happening? That often results in detailed analysis that looks awesome because everyone likes charts, graphs, and infographics, but it begs the question: Now what?

Done right, predictive analysis should result in a decision to do something or to stop doing something. Turning that decision into action is the hardest thing to do. We certainly were no exception to that.

Can you give an example of an early misstep in predictive analytics at FCFCU?

CM: A few years back, we made a couple of missteps with inactive checking accounts that resulted in a high number of other accounts being closed. It was easy to plan for the loss of these dormant accounts because they were creating expenses that were affecting our bottom line. However, many members saw it differently and closed out all their accounts. We focused the initial analysis on the account and not the relationship, and we lost member relationships.

Thisis a classic case of what versus why. We knew our checking accounts were being closed. That’s the what. We assumed we knew why, but the answer was much different.

We were just getting our feet wet with analytics, and we weren’t able to perform what if scenarios like we can today.

How did the credit union respond?

CM:I took the analysis to my boss and later to the entire executive team. Certainly, there were thoughts on just letting the thing ride because the account closures were actually performing better than the proforma.

Our analysis didn’t focus on that, we focused on the loss of relationships. We were able to explain why it was happening: the timing of decisions we made on other account types that these same members had. Our analysis linked them, and we were able to present a compelling reason why we should stop doing some of the things we were doing in these other accounts.

Using analytics, we put together a comprehensive strategy that not only dug us out of the hole but also turned our checking account strategy into the core competency it is today.

We decided to examine behaviors happening within the accounts and identified more than 12 indicators to track. During a period of several weeks, we learned a great deal about behaviors that occur prior to a checking account closing.

Today, we take that information and apply predictive models to existing accounts to determine which of our active checking accounts have similar behaviors. We then disseminate that information to our front-line operations through the CRM system we built for this purpose. Call lists show up in our team’s inbox every morning. The goal is to intervene and engage with the member before the account relationship gets to a point of closing.

This process has been instrumental in our overall account retention strategy. We are closing fewer accounts today in terms of percentages than we were in 2015.

Members whose dormant accounts were closed often ended their membership entirely. FCFCU used analytics to discover that issue and then solve it, resulting in a turnaround in new account openings and retention.

Where is FCFCU now in regard to predictive analytics as a core strategy?

CM:Predictive analytics is a core driver for development and execution of our strategies. We built an online guide, Six Steps to Creating a Strategic Plan, for us and, potentially, other credit unions.

Our approach was certainly an evolution that we built over time, and it continues to evolve.

Want to see FCFCU’s strategic guide? Click here.

What specific processes, hardware, and software do you have in place?

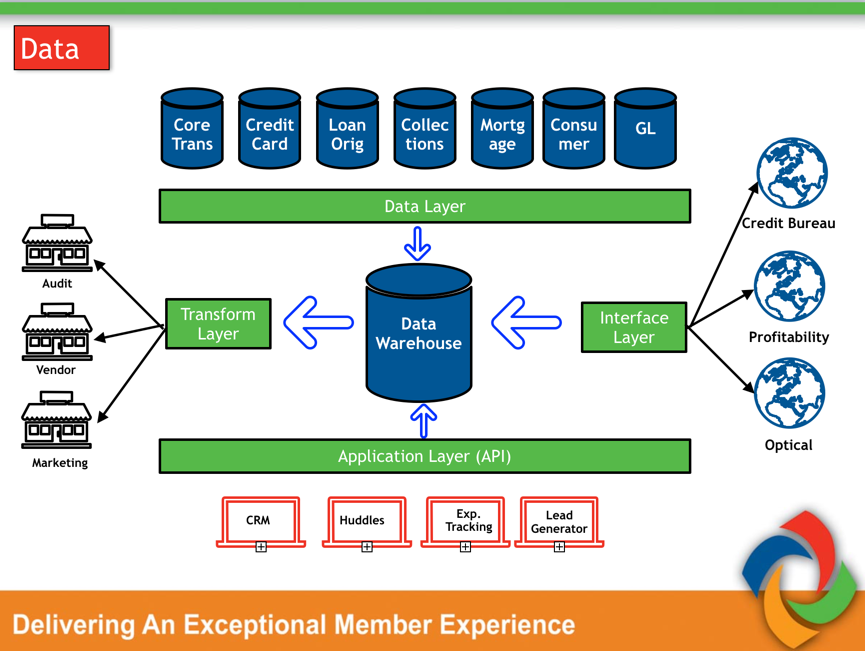

CM: We separate our data needs from our analytics needs and have an entire department that is focused on analytics and execution.

We use a data warehouse that is built off a robust relational database technology. We then divide our data into structured and unstructured and build pointers and bitmap indices so that, where applicable, can bind the two together.

We have a data analyst who evaluates and builds databases and analytical cubes, monitors, and ultimately makes sure everything balances. We also have a business analyst who provides analysis, dashboards, and reports.

We use software from InterSystems.It’s a unified architecture that provides all the tools we need in one suite. For hardware, we use a virtual server that has several core processors, high-end storage, and throughput.

Clear organization around data management and infrastructure helps FCFCU deploy a sophisticated analytics program.

What kind of reports and other information do you provide?

CM:We try to stay away from just providing reports. We provide several tools to our teams that enable them to pull their reports. One of them called DeepSee is an easy-to-use analyzer that allows anyone to pull pivot tables and drill down on hundreds of different dimensions.

When we publish information, we always make it interactive. We don’t send information in the form of PDFs or spreadsheets. We view analytics as content much like a picture or video. We use content creation tools to present our information in an interactive and positive format, using an internal communications tool that we developed in-house.

Why do you do that?

CM:We use analytics to tell stories. Sometimes they’re stories people don’t want to hear, but if you present the analytics as content, then you’re sure to tell the whole story and not just part of the story. Context is so important.

I believe in using analytics to share more of what the credit union is doing right versus what it’s doing wrong. Of course, you want to know when bad stuff is happening, but it’s easy to fall into the trap of using analytics to be a constant reminder of what you’re doing wrong.

I would be remiss to say we don’t build dashboards. We do, but only on request. All of the other information we publish is focused on what we want to accomplish through our business strategy.

For example, we publish an executive daily flash briefing that highlights how the organization is performing. More importantly, we highlight the remarkable things our teams are doing to take care of our members.

Organizationally, who works with this technology?

CM: We don’t force the tools on anyone. Our executive management team tends to use our strategic development team to do most of the lifting.

What member products and services do these techniques drive?

CM: We focus on the core products and services outlined in our business strategy that came, in some part, from our analytics. We look for ways to better engage with members by driving more relationships to our retail channels.

A prime example of this is a strategy we use for two of our core products: checking and auto refinance. Instead of driving members to our website or toll-free phone number, we have product-focused microsites that enable members to get the information they need in a quick and easy format. They come with a call to action capability that allows the member fill out an application in less than five minutes.

What does FCFCU’s auto refinance microsite look like? See it here.

Our analytics engine then routes that application to our retail network. Often, our members receive a call back within five to 10 minutes.

This approach has yielded strong growth in core areas. Some readers might wonder if this takes analytics beyond its original core. Yes, but data and insight must be put into action, and that’s what we do.

Are you also working with AI and machine learning?

CM:As much as these intrigue me, we are relatively young in analytics and I would rather spend more time maturing what we already have.

This interview has been edited and condensed.