Top-Level Takeaways

- Shuttered lobbies have forced members to adopt video channels that provide virtual service through a physical smartphone or computer.

- >Many credit union professionals predict members will continue to use these channels even after lobbies reopen; many are looking for ways to solidify that paradigm shift.

Virtual tellers are serving members with a smile, be it via stand-alone machines or handheld smartphones.

Shuttered lobbies have forced members into drive-thru teller lines and onto digital channels like mobile apps and online banking. Also surging is the use of interactive teller machines and their successor, mobile apps that provide a live teller experience.

Not on the forefront of this technological revolution? No worries, Pioneer FCU, Idaho Central, and Y-12 FCU offer best practices and lessons learned from their experience as early adopters.

Each has a different strategy for video technology. Pioneer uses both a video mobile app and ITMs. Idaho Central does it all with the app and no ITMs. Y-12, on the other hand, is all ITMs. But all three have shared the common experience of a huge surgein contactless banking as the pandemic shut down their lobbies. Here, they share some of that experience.

Pioneer: Using Two Platforms With One Goal

The COVID-19 resources landing page for Pioneer Federal Credit Union ($499.3M, Mountain Home, ID) includes a link that sends members directly to the institution’s myPioneer Personal Assistant app, where they can talk face to face with a credit union representative.

The video chat app doesn’t include self-service options. Those are on the digital banking platform itself and include check deposits, loan applications, new account openings and more, including answers to many product questions. For help beyond self-service, that’s where the video chat and ITMs come in, providing support for members and non-members alike. That also can include setting up appointments with in-branch experts or transferring calls to them.

Marketing collateral from Pioneer FCU shows how members can take care of finances from the comfort of their home with the credit union’s my Pioneer Personal Assistant app.

The shop was an early adopter of ITMs when it rolled them out six years ago. It introduced the mobile teller app in 2017.

Before coronavirus, Pioneer was averaging approximately 30 calls a day through the app. Now, it’s handling closer to 130 with a high of 162, according to Tracey Miller, Pioneer’s vice president of operations. Meanwhile, Pioneer’s fleet of 21 ITMs, including 17 in drive-thrus, are averaging 11,500 visits a month, a number that jumped by 5,620 in March.

The video team members all work at the credit union’s headquarters, joined by branch staff who were trained to help with the increased volume.

We’ve since moved most of them back to their regular job duties since we re-opened our lobbies, Miller says.

What hasn’t changed are the hours on the video channels. They’ve been Monday to Saturday from 7 a.m. to 7 p.m. since 2017.

At the end of their session, users of Pioneer’s video teller app can provide feedback on their experience.

Miller says feedback solicited at the end of each video teller app interaction shows members are satisfied with the combination of convenience and personal interaction these channels offer, and the credit union predicts a lot of the new users of the technology will remain on their devices after the pandemic passes. Miller, who’s been at Pioneer for 13 years and in her current position for eight, is optimistic.

The behaviors of our members will change, she says. Until you need something, you’re not always willing to try something different. The first interaction is the hardest, and a lot of our members have now crossed that obstacle.

Miller advises being open-minded about what video technology can accomplish. Also, have a strong strategic plan that aligns with mission and vision.

The true special sauce, she adds, is having amazing employees who are dedicated to helping others and see the video platforms as a way to provide amazing service.

Idaho Central: All App, All The Time

Idaho Central Credit Union ($5.6B, Chubbuck, ID) has gone all in with its app. The Gem State’s biggest financial cooperative doesn’t have a fleet ofITMs. Instead, it channels traffic through its video chat service ICCU VideoChat that it offers both online and on the phone.

Adding the video app to a 37-branch operation that relies heavily on the face-to-face teller model required more than the flip of a virtual switch. ICCU went all-in to ensure the member experience was as personal as possible, despite a smartphone or computer screen separating the member from the teller.

We hired dedicated staff and we put them in 20 video booths with professional lighting and backdrops, says Corey Dahle, the credit union’s chief experience officer. This is a full-time commitment and investment; we’re not going to use people who do this part-time.

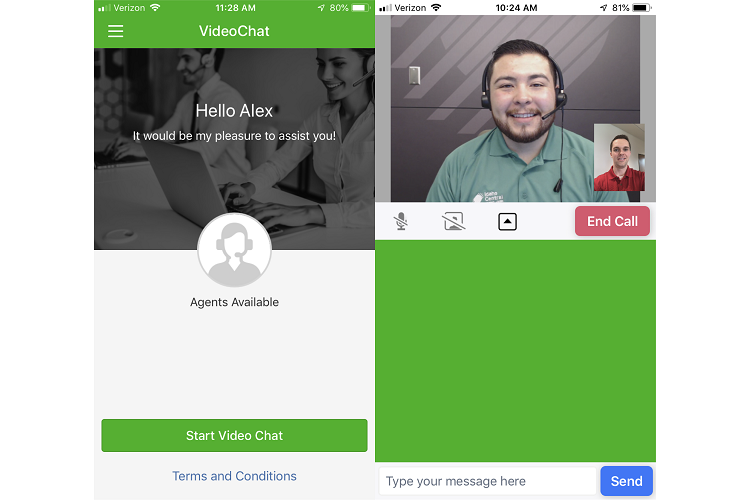

A welcome message on ICCU’s video chat app invites members to initiate a session. After they do that, a credit union agent is ready to serve the member.

The credit union piloted the program two years ago and fully rolled it out to all members last year. During the pilot, the credit union fielded a dozen or so calls every month. That jumped tenfold to approximately 125 a day after the full launch. Since the pandemic started, the credit union has been handling 500 to 650 calls every day predominantly through the mobile app with approximately 60% of those on Apple devices and 40% from Androids.

ICCU hadn’t planned for a pandemic, but its technological heft positioned it to serve members with little disruption. Dahle who’s been with ICCU for 13 years and in his current position for the past five doesn’t see the pivot the credit union has had to make in the face of COVID-19 as wasted energy. Much like Miller at Pioneer, Dahle predicts a permanent change in member behavior one that continues an established trend he’s noted of mobile surpassing any other technology.

We are pushing out to our members a fully integrated mobile experience that includes online banking, loan apps, wires, whatever, the chief experience says. It’s a branch in their pocket. No matter where they are, they can push a button and see us face to face and work with someone who has the experience to handle their needs. Our members love that.

Y-12: All In With ITMs

The video banking experience via ITM at Y-12 Federal Credit Union ($1.3B, Oak Ridge, TN) has been phenomenal during the pandemic, says chief experienceofficer Courtland Crouchet.

They’ve enabled us to serve members in a safe way that we couldn’t have done otherwise, says Crouchet, who came to Y-12 eight months ago after 30 years of executive experience with credit unions in Texas and Louisiana.

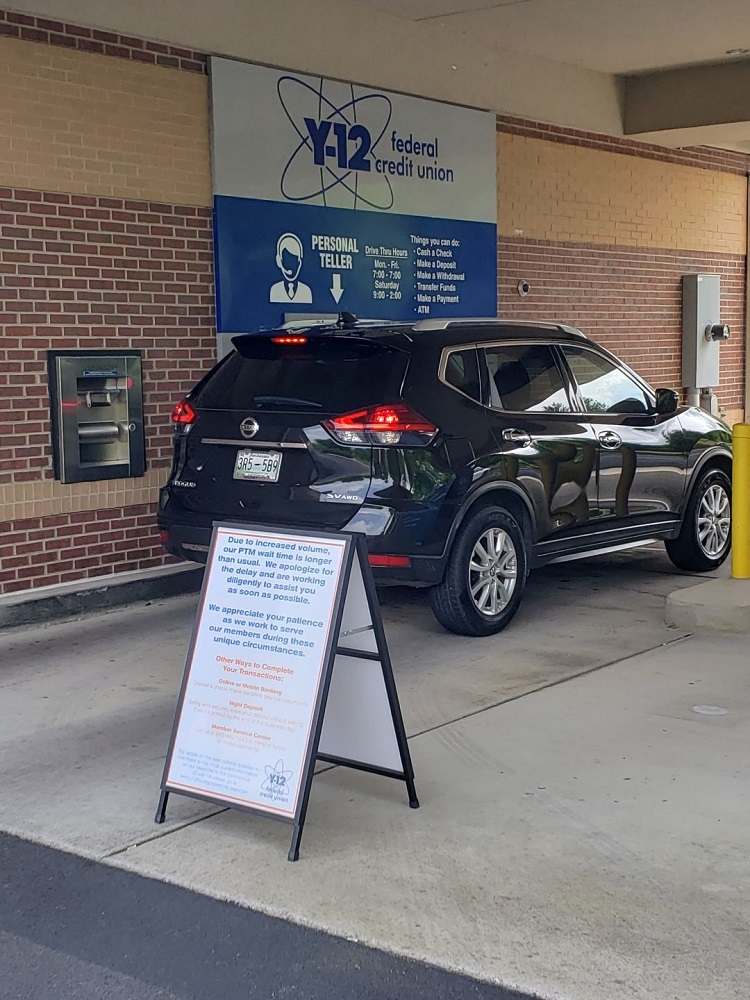

A large sign over an ITM in a Y-12 drive-thru shows members where to go. And while members wait, a sign on an easel provides reading material about available services.

Y-12 began installing its ITMs in 2016 and today has 34 of the machines, including 30 in drive-thrus.

We originally thought they would be an efficient, cost-savings way of serving members with expanded hours and a centralized group of staffers, Crouchet says. They’ve been that but now so much more.

Before COVID-19 closed down lobbies across Tennessee, members were conducting 1,500 to 2,500 daily transactions via ITMs. Today, that’s jumped to 3,000 to 5,000. The surge has caused some staffing challenges.

Refine your credit union’s response to COVID-19 using the Ideas In Action: Pandemic Response page, a hub for all of our articles, webinars, and policies concerning the COVID-19 outbreak.

We had 15 contact center agents and used a third party for overflow, Crouchet says. When our lobbies closed, we went to more than 80 agents in a week. It took a little work, but we knocked it out fairly quickly and it’s been a big success. We’ve even been able to keep call times under a minute with twice the call volume.

Y-12 has done that by targeting one staffer per ITM, instead of the usual two to three, Crouchet says, and by adding existing staff to the ITM team.

There’s significant overlap in the knowledge needed to do both roles, he says, although there are differences in systems and communications skills needed to guide members through ITM transactions, especially those who’ve never used one before.

We quickly covered the differences in phone service versus face to face, the Y-12 CXO says of the branch staff turned ITM agents. Our member experience and sales teams also listened to calls and coached the employees daily. Their skills improved rapidly through this process in a matter of days, although some were uncomfortable at first and we had to help them with this transition.

Tennessee is among the first states to reopen and as Y-12 prepares to admit members back into its lobbies, preparations include physical changes in the lobby as well as rethinking its future.

We’re discussing what our new service model will look like, Crouchet says. Do we go back to the old way? Or, now that members have made adjustments, do we try to make some things permanent?

Suppliers See Surge, Too

The largest provider of ITMs in the credit union space predicts a trend for the more than 500 credit unions and banks using its machines.

Members that use digital banking or ITMs for the first time will find it was a positive experience and continue to use these channels in the future, says Scott Sykes, executive director for corporate communications at NCR in Atlanta, GA.

Sykes cites data that shows adoption in other fields for example, 54% of first-time online grocery shoppers plan to keep doing it so why not financial services. As for NCR’s own business, Sykes declines to share specifics but says the company has seen a meaningful increase in demand since the pandemic struck.

Sykes did share that overall video call volume is nearly five times what it was before the pandemic. And with lobbies closed, 90% of that volume is coming from mobile and web users versus in-branch video rooms.

NCR bought the ITM business in 2013 from uGenius, whose founder went on to create a new company and the POPi/o mobile app now in use at Pioneer, Idaho Central and 82 other clients as of April 21.

POPi/o says its client count was 52 at the beginning of March and that company says its overall video call volume is nearly five times what it was before the pandemic, with 90% of them coming from mobile and web users.

Our video call mix has shifted dramatically away from in-branch video room calls, which demonstrates the closure of physical branches, a POPi/o spokesman says.