Newly published data from Celent shows that 80% of DDA, savings, and non-mortgage loan accounts originate in a physical branch. Credit unions may rightly wonder if digital is as important as everyone keeps saying it is, or if it’s a me too competitive offering that will never be fully used.

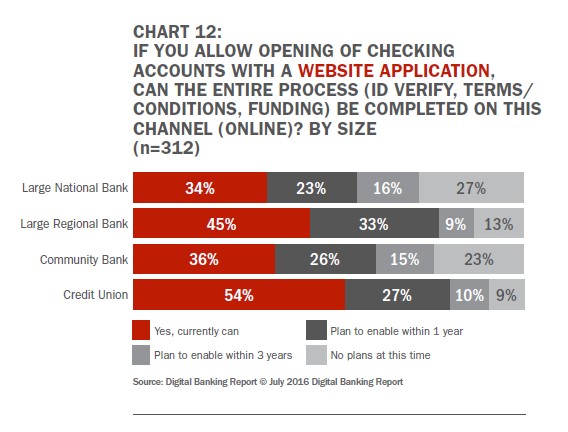

It’s a meaningful question for credit unions, which have invested significantly in digital offerings and are ahead of the pack among financial institutions in website account opening. You’re not just inviting new members to start the process online, 81% of you according to the latest Digital Banking Report already offer or plan to offer complete account opening online within a year.

This landscape is changing fast, and things aren’t always what they seem.

Five powerful recent indicators point to the strength and urgency of keeping the focus on digital membership acquisition.

- More than two-thirds of consumers right now at least 67% according to Celent are using digital channels to research and make buying decisions. That’s about twice the number who visit branches, so this preference is indisputable. And although many institutions don’t yet track the number of applications that are started but not finished, data from several studies show its upward of 30% and potentially as high as 50%.

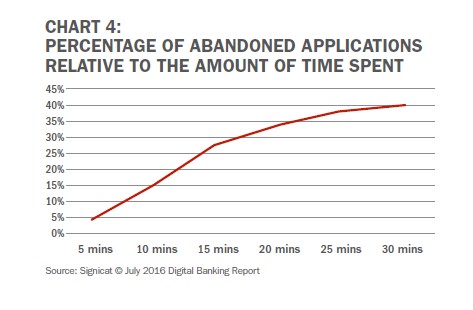

- Nearly twice as many digital applicants abandoned their attempt to open an account online this year than last year (45% vs. 26%). Either the number of attempts to apply online jumped materially this year, or their digital experience in other industries has taught consumers to be less patient when they encounter friction or delays or both. But it doesn’t mean that fewer people are interested in applying online.

- We know that consumers find it increasingly unacceptable to complete a process that takes too much time. The new Digital Banking Report study found that abandonment rates soared as applications time increased from the industry low of under five minutes. Since the average time is currently 30-plus minutes, it’s no wonder so many starts are being abandoned.

- Requirements for additional, offline steps form another barrier. Consumers know that the identity information in account applications can be verified online after all, they can even file digital tax returns. Meanwhile, many institutions with a digital option still require follow-up via email (interruptive), print-to-mail (momentum-blocking) or even personal visits (show-stopping). If convenience is the name of the consumer game, this obstacle must be eliminated.

- Accumulating case studies showing successful digital account opening are too many to ignore. Celent cites four of these studies, including the award-winning efforts of Santander US, which cut account opening time by more than half. Santander processed more than 2,500 new accounts within the first week after deploying its digital solution, and, notably, upped customer satisfaction by 10% at the same time. Closer to home, USAlliance Financial Federal Credit Union ($1.2B, Rye, NY) posted significant growth in shares, credit card loans, net income, and gross revenue. They discuss their experience in this CreditUnions.com article and an associated webcast recording.

More prospective members are finding and applying for credit union accounts through digital channels every year. To the extent that their experiences are insufficient or unacceptable, success rates will continue to be impeded, and branches will play the lead role in account growth.

The pressure toward the digital channel is only going to increase, and it will only benefit institutions that do it well. This means, first, capturing the consumers who are ready to make decisions online, and second, moving them quickly, efficiently and entirely digitally, all the way through completion. The rewards for pursuing digital excellence are a compelling reason to keep the focus on digital solutions.

Bluepoint Solutions invites you to attend an upcoming one-hour webinar featuring Celent Senior Analyst Bob Meara, High-Uptake Digital Account Opening: How To Get There Now. Register now and get full details here.