Judy Walz became the senior vice president of marketing and planning of VyStar Credit Union ($6.8B, Jacksonville, FL) in 2004. Although Walz had served in a similar role before she joined VyStar in 2001, it was the first time the credit union had married the two responsibilities.

At VyStar, Walz’s main areas of responsibility include marketing research, market research, member information and analysis, advertising, public relations, branch merchandising, member communications, and strategic planning. Here, Walz discusses why the credit union created the role, how her department influences VyStar’s operations, and what data sources she uses to make decisions.

Why did VyStar tie together marketing and planning?

Judy Walz: Marketing is more comprehensive if planning is with it. There’s more consistency for the organization. You need the same basic information: You need to be able to research your communities, understand the market, and know what the economic base is. All of that goes hand-in-hand with what a marketer does and what you need to do to plan for the organization.

When I joined VyStar, I did it with the idea that planning would be with marketing. That was made official after I had been here a few years.

Where was planning before?

JW: Planning was primarily CFO and CEO work. Senior team members would write their portion of the strategic plan, and then the CEO would put it together into the final plan. I was involved in that process. I helped with the research and helped write my portion. Now that I have planning, things have switched over to me. I facilitate the plan.

Judy Walz, Senior Vice President Marketing Planning, VyStar Credit Union

What were you hoping to accomplish by adding planning to your role?

JW: Marketers are more effective when they understand overall strategy, and we wanted to have a more strategic outlook on where we are going.

Marketers need to understand the markets. They need to help other departments figure out what they want to do and make it so. Good marketing involves strategizing, but a lot of marketers get caught up in implementation and never look at strategy. Putting marketing and planning together gives us a more holistic view of the market and helps things work together more effectively.

What are the challenges with this set up?

JW: There’s some risk with the workload. You can’t be a one-man-band. When you’re analyzing data, sometimes it’s good to have other people take a look and see what they’re thinking.

CU QUICK FACTS

VyStar Credit Union

Data as of 03.31.17

HQ: Jacksonville, FL

ASSETS: $6.8B

MEMBERS: 553,884

BRANCHES: 56

12-MO SHARE GROWTH: 8.7%

12-MO LOAN GROWTH: 14.7%

ROA: 0.84%

One interesting thing in this position is as people have gotten used to the analysis, how we look at data, and what kind of information we have, we’ve gotten more requests. It’s getting interesting to see how people think about what’s out there in the marketplace, how we can target members, and what we can do with the data other than just running a promotion.

Which employees do you generally ask for input?

JW: First, senior team members. The chief lending officer helps substantiate lending-related observations, and the senior vice president of member services gives additional information about a market characteristic we think is important.

Second, employees in the demographic we are researching. We’ve also had focus groups where we brought in employees’ children who were in the age bracket we were researching.

This helps establish an environment of learning and information seeking and puts us on the same page.

Where do you fall in the organization?

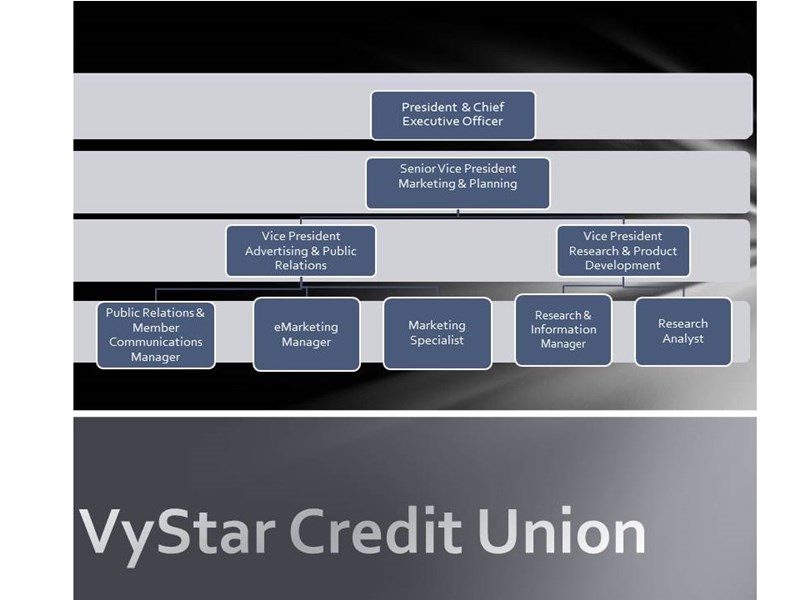

JW: I am a member of the senior team. I report to the CEO. The marketing department reports to me. Marketing includes the vice president of advertising and public relations, the vice president of research and product development, managers of emarketing, public relations and member communications, research and information, and a research analyst and marketing specalist.

VyStar’s Marketing Department. Photo courtesty of Judy Walz.

What resources do you use when planning?

JW: We use data from the Stanford Research Institute. We use census information. The source I like best is Claritas, and that information is through Nielsen. We subscribe to a lot of the Nielsen site reports. That gives us a lot of demographic data and we compare that to what we’re seeing off our MCIF data. And then we also look at what the local economists are saying.

We have a strong research system. We know the kinds of data we have and what we can use. The whole senior team works with me on different portions of the strategic plan, so most of the management team puts together concepts and does things for planning.

What’s an example of how planning has effected a marketing project?

JW: Planning helps us analyze where we are going to put our branches and how we’re going to market to them. Our field of membership is the 17 counties of Northeast Florida. Right now we’ve got branches in 10 of them and we’re looking to go into the eleventh, Volusia County, next year. This year we’re opening three new branches and putting one in a high school. Next year we’ll be opening another three branches.

As we plan to go into a new market, we look at market share, demographics, ethnicities, and age groups to see if we are going into a market or area where our products and services are needed. We look extensively at the market data to see that the area could support a credit union. And when it’s time to open a branch, we already have that data and we know exactly whom to target.

We also thoroughly analyze the competition and the community so that our entry into a new market is based on the commumity, its needs, and how we can relate based on the analysis.

What does marrying planning and marketing say about the organization’s operations and structure?

JW: I think it says it’s probably more of a strategic organization that understand its market and knows where it’s going. If I didn’t have the research, I wouldn’t be able to do effective marketing. And when other people see you’re doing the research, it’s suddenly the basis of the overall planning and it makes the organization click.

Are You Ready For Strategic Planning?

The most effective planning sessions require prep work, sharp focus, and a true understanding of your credit union’s place in the market.

Use this set of essential performance ratios for strategic planning to make the most of your team’s time together.

READ NOW

.png)