FEDERAL FUND RATE VS. LOAN TO SHARE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

© Callahan & Associates | CreditUnions.com

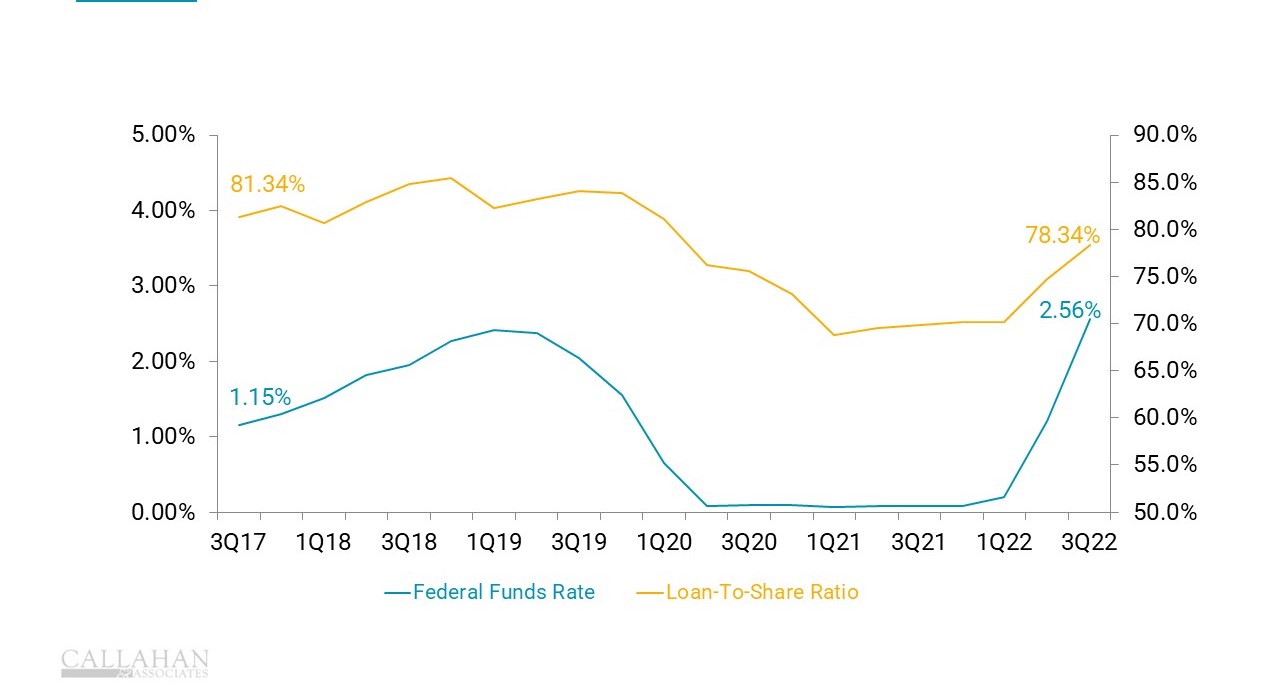

- Increases in the federal funds rate have historically had a negative effect on credit unions’ loan-to-share ratio, but recent interest rate hikes and broader macroeconomic conditions have resulted in rare instances of both figures rising simultaneously.

- The federal funds rate plays a key role in the interest rate credit unions charge members for loans as well as what they pay members for deposits.

- The Federal Reserve lowered rates to nearly 0.0% in March 2020 with the intention of bolstering consumer spending at the onset of the pandemic. Economists expected loan-to-share ratios at financial institutions to go up, but government stimulus payments and other factors resulted in credit union members depositing excess funds rather than taking out new loans at lower rates. Credit unions also sold off larger portions of their mortgage originations to the secondary market, removing more than one-third of those loans from their portfolios.

- In March of this year, the Fed began raising rates to combat inflation — the first interest rate hikes since late 2018. More increases are expected in 2023, which will increase the cost of borrowing for financial institutions, consequently raising loan rates and, likely, lowering demand for loans.

- Despite a decrease in the number of loan originations compared to last year, increased asset prices kept loan growth at record levels in the third quarter of 2022, and the loan-to-share ratio was up 8.5% from one year ago.