CECL: A Half-Baked Cake

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

Our Risk page is the top spot to learn about business continuity, compliance, enterprise risk management, fraud, and vendor management.

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

For the past decade, the credit union’s head risk leader has been evangelizing the idea that everyone must be a risk manager to ensure the

The crisis is still unfolding, but the latest high-profile bank failure has plenty of takeaways for credit unions around asset management, net worth, communication, and

Experiences in high-tech manufacturing, small business services, and the rodeo have prepared Kim Alexander, executive vice president and chief financial officer of Warren Federal Credit Union, for her role at a high-growth credit union.

As the business model of credit unions evolves, leaders must decide how to allocate resources and where to invest time, money, and people.

Credit union involvement seen as limited but experts say keep an eye on the bouncing ball nonetheless.

What do mountains, frisbees, and barbecue competitions all have to do with credit unions?

Communication with real estate partners and with members will make disclosure changes less of a barrier to getting a home purchase closed.

Not all dark waters as TRID changes take effect and HMDA changes announced, but much work remains.

How will the agency’s ruling ultimately affect credit unions?

A panel at BAI Retail Delivery focused on “turning lemons into lemonade” with a culture shift that makes compliance a customer service imperative.

Small or large, ensuring the right business lending specialist has experience and talent is key to successful partnership.

Credit union card processors say conversion process is well underway, and don’t call it a deadline.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

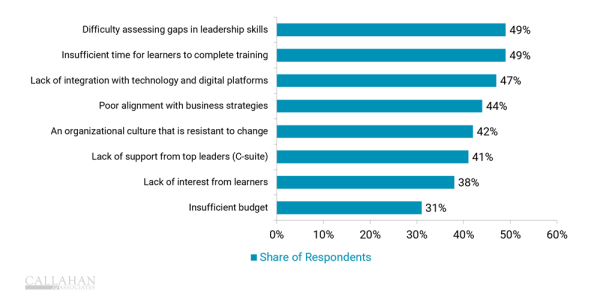

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

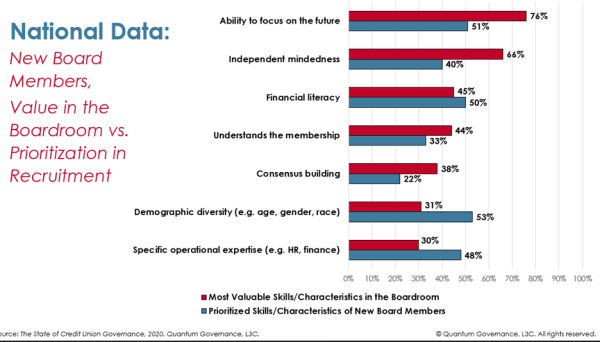

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.

The California cooperative moves beyond the 9-box to identify skills, gaps, and opportunities to prepare leaders for what’s next.

The right tools and consistent approach make succession planning simpler for credit union leaders and board members.

CreditUnions.com revisits three credit unions to learn how their strategies have evolved since their original spotlight and see what’s in store for the future.

A national leader in urban agriculture shows how front-line insights drive real local impact — and why credit union branches are perfectly positioned to do the same.