Top-Level Takeaways

CU QUICK FACTS

University FCU

Data as of 12.30.19

HQ: 12.30.19

ASSETS: $2.7B

MEMBERS: 314,649

BRANCHES: 24

12-MO SHARE GROWTH: 11.6%

12-MO LOAN GROWTH: 6.2%

ROA: 1.08%

A long-term focus on boosting community prosperity combined with visits to cooperatives around the world has inspired University Federal Credit Union ($2.7B, Austin, TX) to redefine and expand how it can improve the quality of life for members and more.

In April 2018, UFCU’s board of directors approved a carefully crafted motion that formally pivoted the credit union’s focus and codified the cooperative as a social purpose credit union. UFCU is not only committed to staying true to its roots and mission but also is doubling down on the seventh cooperative principle concern for community as a part of its commitment to community financial health.

All credit unions serve a social purpose. At UFCU, we’re reaching well beyond financial services to influence secondary education, middle skills employment, and housing affordability, says UFCU CEO Tony Budet, who spearheaded this new vision that puts community impact at the forefront of everything the credit union does. Under the umbrella of community financial health’ are challenging and meaningful objectives that have ignited the imaginations of our board, executive team, and staff.

UFCU’s board and executive team includes many local leaders who actively work to improve the Austin community. The credit union’s new focus resonated with these stakeholders, who were eager to leverage UFCU’s brand and scale to accomplish more than they could individually.

Being a social purpose credit union means Budet has focused as much as 70% of his time on community issues while the executive team at UFCU handled most day-to-day matters. Currently, the CEO spends approximately 30% of his time outside of the credit union. The credit union is shifting strategy so, over time, everything it does will be in service to three high-impact areas: education, employment, housing affordability.

High-Impact Areas

UFCU has been the No. 1 mortgage lender in the Austin area for the past three years. Not bad for a credit union that opened with 30 members and $855 in deposits.

UFCU was founded in 1936 to serve the University of Texas. Today, it serves more than 200 universities, associations, and employers in Central Texas and Galveston County. Many of its select employee groups are connected to institutions of higher education, and the credit union recognizes that mid-skill employment industries such as plumbing and HVAC that require training that falls between a high school diploma and four-year degree is vital to the Texas economy.

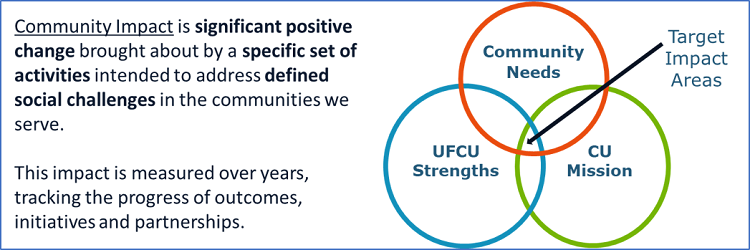

With the end goal of creating a financially healthy community, UFCU identified the top social and developmental issues in its service area. It then compared these issues against the strengths and mission of the cooperative to select three areas in which it could make the biggest impact.

A community truly prospers when its people are financially healthy and have ample opportunities for quality education, employment, and housing, says Heather McKissick, senior vice president, community impact for UFCU.

To sharpen its focus for community impact efforts, UFCU identified the areas in which the community’s most pressing needs, the credit union’s own strengths, and the credit union’s cooperative mission overlapped.

Programs For Education

To improve area education, UFCU worked with the president of each university it serves to learn about the strategic goals of the institutions. This enabled the credit union to identify common priorities, which include:

- Increase first generation college student graduation rates.

- Increase two-year certification completion rates.

- Reduce time to first employment.

- Improve socioeconomic mobility.

Armed with this information, the credit union has started creating programs to support the goals of the universities. UFCU Scholars, for example, provides college scholarships and paid internships along with financial health training, savings incentives, and mentoring and networking opportunities. It benefits the students who participate, but it also benefits the credit union. Through their firsthand experiences, scholars naturally become ambassadors for UFCU and share the credit union difference with their classmates.

data-ride=”carousel” id=”myCarousel”>

UFCU Scholars

The UFCU Scholars Program has provided college scholarships, paid internships, financial health training, savings incentives, and mentoring and networking opportunities to more than 150 students.

UFCU Plan U

Plan U helps skilled employees at UFCU’s SEG partners reduce debt, build better credit, and increase savings.

To date, the credit union has given $300,000 to more than 150 scholars, provided 18 internships, and funded 78 high school equivalency fee waivers through the program.

Programs For Employment

Because of the link between education and employment, some of UFCU’s programs benefit more than one high-impact area. For example, the UFCU Scholars Program promotes both education and employment. However, the credit union also is tailoring specific assistance for mid-skill employment.

Plan U offers online and in-person financial health counseling, education, and special product offerings for the mid-skill employees of UFCU’s partner groups. Although still in the pilot stage, the program has helped more than 50 participants reduce debt, build better credit, and increase savings.

Sample Plan U materials show how UFCU incorporates online tools, in-person financial counseling, and special product offerings to support mid-skill employment in its service areas.

Programs For Affordable Housing

In the area of affordable housing, UFCU is partnering with Foundation Communities on a facility called the Prosper Center. Foundation Communities is a local nonprofit that offers attractive, affordable apartments with on-site support services for education, financial stability and health. Credit union volunteers, sponsorships, and programs, ensure the community has access to such essential services as:

- Tax preparation.

- Financial health counseling and education.

- Down payment savings programs.

- Mentoring, tutoring, and after-school care.

This partnership currently provides support services and affordable housing to more than 2,800 families.

Lessons Learned And Looking Ahead

UFCU has learned that measuring the real impact of its efforts is a long-term proposition.

How to measure the big-picture impact is not an easy or quick thing, McKissick says. It’s not just a credit union challenge, all social purpose businesses are grappling with the same thing.

At this stage, the credit union is measuring participation, process, and outcomes. And, it’s learning a lot along the way.

Partnering with organizations that already have a good handle on those long-term measurements is key, McKissick says. We don’t have to reinvent a way to measure impact just expand the thinking to include how we’re working on these areas together.

She encourages other cooperatives to take their time throughout the process from identifying the areas where they can make the most impact to measuring the end results.

Don’t be in a hurry, she advises. This is not just another marketing angle.

Purpose=Impact

Purpose-driven organizations outperform the market, have an easier time attracting and retaining employees, and are changing the way businesses think about their roles and responsibilities to society.

Sustainable Business Strategy with Rebecca Henderson teaches credit union leaders that being purpose-driven is more than being a community-forward organization and helps them re-examine their part in ensuring the long-term prosperity of members, employees, communities, and the environment.

Credit unions need to deeply and clearly understand the needs of their communities to ensure they design the right programs to make a lasting difference. Involving the entire organization, from the board level to front-line staff, is key in doing this. For its part, UFCU embeds its employees in its social purpose mission.

It’s not just something you can slap a logo on and expect people to get behind, McKissick says. This is about who we are as an organization. The staff has to make it come to life.

That means a credit union must dedicate a great deal of time to educating staff members about community needs and connecting the dots so it is clear how their day-to-day jobs and volunteer support have a significant lasting impact.

For UFCU, taking the time to fully onboard employees resulted in 53% of employees volunteering more than 3,000 hours in 2019. That’s a total contribution of $76,200 worth of volunteer time plus more than $160,000 in monetary donations through the employee matching program alone.

And, this is just the beginning.

-

America’s Christian has four strategic pillars that clearly define its mission.

-

In the past three years, the credit union has used the focus these pillars provide to clearly communicate its purpose and organize its operational directives.

CU QUICK FACTS

America’s Christian Credit Union

Data as of 12.31.19

HQ: Glendora, CA

ASSETS: $434.4M

MEMBERS: 115,177

BRANCHES: 2

12-MO SHARE GROWTH: 10.9%

12-MO LOAN GROWTH: 9.5%

ROA: 0.70%

At a board retreat three years ago,America’s Christian Credit Union($434.4M, Glendora, CA) set a clear direction for the cooperative it wanted to become.

The credit union was emerging from a period of up and down loan and share growth, although both assets and members were increasing fast. Rather than brainstorm new products and services, however, the retreat focused on how the credit union could live up to and communicate how it was fulfilling its mission to reach, serve, and teach.

America’s Christian was founded in 1958 as Nazarene Federal Credit Union to serve the ministers and parishioners of the church as well as students and faculty of local Nazarene universities and colleges. In 1993, it expanded from a federal to a state charter, and in 2003, it added Wesleyan-based denominations to its field of membership and rebranded to its current name. Today, its religious affiliation allows the credit union to serve a nationwide membership, but most of its members reside in California.

At that retreat in 2017, it developed four strategic pillars Stronger Ministries, Stronger Futures, Stronger Communities, Stronger Families that serve as de facto statements of purpose. The pillars establish a clear connection to the mission of the cooperative and tie back to the credit union’s products, services, and programs.

These pillars have focused our internal efforts, says Nicki Harris, America’s Christian’s chief financial officer. We still offer all the products and services members expect from a credit union. The pillars just highlight the why’ behind what we do.

America’s Christian Growth Rates

data-ride=”carousel” id=”myCarousel”>

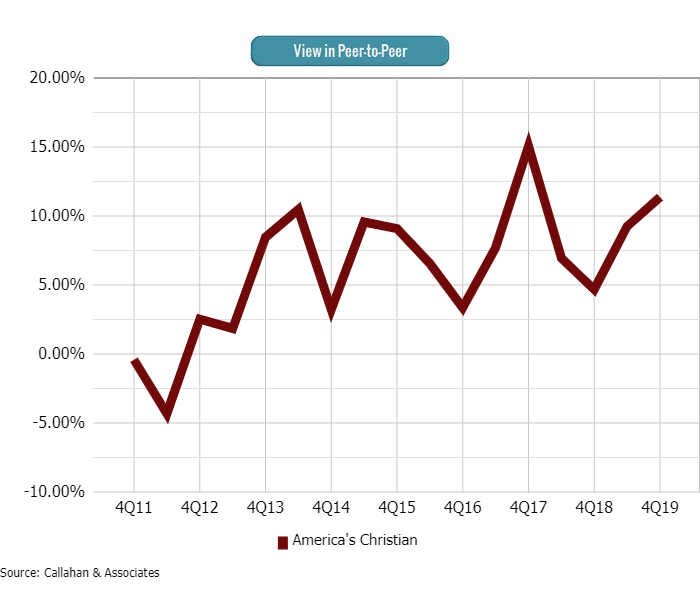

ASSET GROWTH

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Since 2011, America’s Christian has added nearly $200 million in assets with

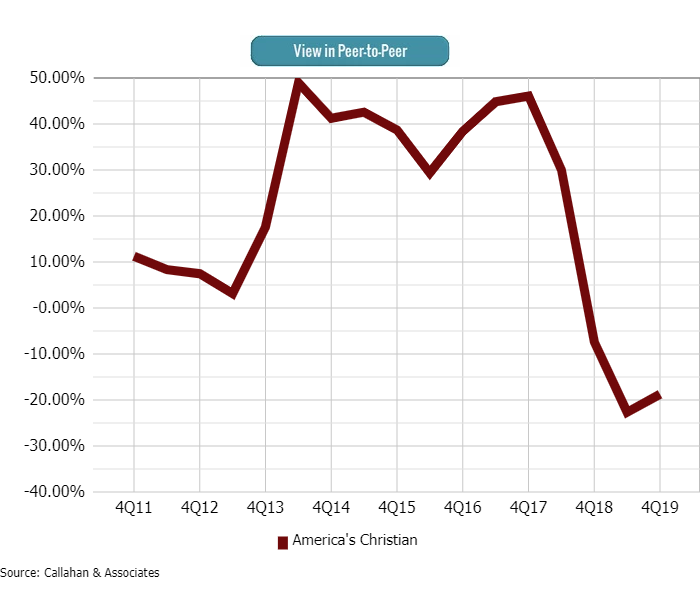

MEMBER GROWTH

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

America’s Christian attributes the spike in membership starting in 2015 to an influx of Health Care Sharing accounts originated at Medi-Share, a Christian care ministry that America’s Christian serves as a financial partner. The steady decline in members represents Medi-Share’s efforts to curb concentration risk by opening accounts at other financial institutions, says Nicki Harris, America’s Christian’s chief financial officer.

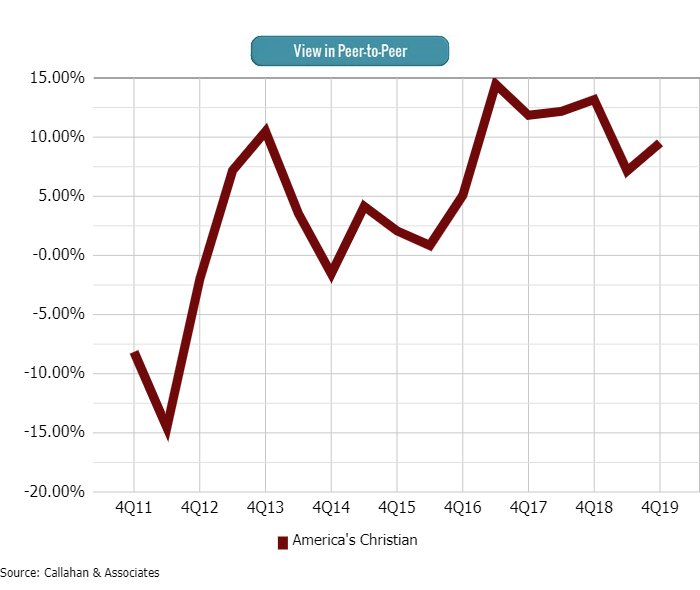

LOAN GROWTH

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates| CreditUnions.com

Although the credit union makes approximately one-fourth of its loans to church building projects, its recent double-digit loan growth coincides with a newfound auto loan engine. In the fourth quarter of 2016, the credit union held $18 million in new and used auto. As of the fourth quarter of 2019, that portfolio totaled more than $50 million.

Stronger Ministries

According to Harris, the credit union has prioritized financing for church buildings and parsonages since 1993. According to data from Callahan & Associates, member business loans have comprised at least 39% of America’s Christian’s total loan portfolio since 1998, when Callahan’s Peer-to-Peer data set begins. The vast majority of those loans are construction loans for churches.

We understand churches and the challenges they face, Harris says. We believe in what they do for their communities. This is one way we support that.

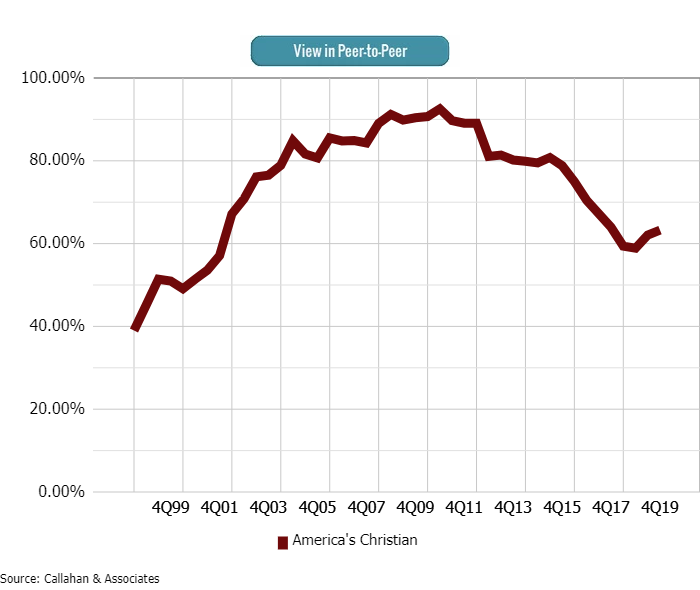

MBL LOANS / TOTAL LOANS

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

For the past two decades, member business loans have comprised a large percentage of American’s Christian’s loan portfolio. During the recession, member business loans often accounted for 90% of its loan activity.

In addition to construction loans, the credit union offers business accounts and related services to ministry members. But, lending is its primary way of meeting their needs. Loans vary in size, from $100,000 to several million dollars , although Harris estimates its average church construction loan is $700,000.

The fact that churches are non-profit entities makes church lending different from other forms of commercial lending. A church’s funds are typically donated from its parishioners, which can create irregularities in cashflow and complicate underwriting. America’s Christian has set requirements for debt coverage and debt-to-net worth ratios for the latter, it won’t finance projects that puts the church more than three times above its current net worth ratio.

A church’s main expense is in its property and staff, Harris says. Those are difficult to reduce quickly, which doesn’t give them much flexibility should cash flow fluctuate.

That said, the credit union gets to know church leaders to form a better sense of the organizational and governance structure before making a final decision.

We do spend the time to get to know them, Harris says.

Stronger Futures

America’s Christian works to provide tools for every stage of life. This includes credit repair services and auto loans which tend to appeal to younger members as well as mortgages and retirement accounts which tend to appeal to more established ones. The credit union also works to build stronger futures through its support of education, especially Christian higher learning.

The credit union is a long-time partner of Azusa Pacific University, in Azusa, CA, and Point Loma Nazarene University, in San Diego. Additionally, it funds six annual scholarships for members attending Christian or non-religious colleges and universities.

In 2016, it funded the Economic Impact Study for the Council for Christian Colleges and Universities. According to Harris, Christian colleges and universities are experiencing challenges in federal funding. By funding the survey, the credit union hoped to enumerate the impact these higher learning institutions have in their communities.

Ultimately, the study revealed the work of Christ-centered institutions has an economic impact worth $60 billion annually.

Stronger Communities

To create stronger communities, America’s Christian donates time, money, and resources to numerous causes, charities, and foundations that hew closely to its religious ties.

For example, the credit union works closely with foster care and adoption agencies by providing thousands of dollars in charitable donations to organizations such as Harvest Family Life Ministries and offering financial education classes to current and former foster youth. In July 2019, the credit union held three literacy workshops at Pasadena City College, where it taught budgeting, credit score building, and goal setting to dozens of college-aged former foster youth.

When kids age out of the foster care system, often they still need support and education to guide them through personal finance, Harris says.

Stronger Families

Adopting a child can be an expensive endeavor. Harris estimates the costs range between $20,000-$40,000 depending on whether the adoption is domestic or international.

There are a number of steps in the adoption process, from qualification to preparation, Harris says. Legal costs, agency fees, travel costs. It can be a financial burden.

If a family has the desire to adopt, it might not have the financial means to do so. To meet this need, America’s Christian has offered adoption loans since 2009 that cover up to $50,000. Recently, the credit union funded its 2,000th adoption loan.

The credit union also recently provided financial support to the Care Portal, a website that connects families in need of financial support or resources with churches, charities, or other families who can provide it. The credit union itself, along with several employees, are listed as a resource.

It might be a foster family in need of a bed or clothing, Harris says regarding the assistance the website facilitates.

Purpose=Impact

Purpose-driven organizations outperform the market, have an easier time attracting and retaining employees, and are changing the way businesses think about their roles and responsibilities to society.

Sustainable Business Strategy with Rebecca Henderson teaches credit union leaders that being purpose-driven is more than being a community-forward organization and helps them re-examine their part in ensuring the long-term prosperity of members, employees, communities, and the environment.

The Future

America’s Christian is not just a church lender. In the past three years the credit union has grown its auto loan portfolio by more than $30 million with more than 95% of that being direct loans and it hopes to continue this success.

To ensure it has an adequate operational foundation for future growth, the credit union will begin a core system conversion in 2020 and continue to evaluate its digital offerings to better support a national membership.

We are committed to our mission and our history, supporting ministries, churches, and communities, Harris says. But we don’t forsake the consumer side. We’re investing in the technology that helps us continue that on a national scale.

Top-Level Takeaways

-

Loan participations spread risk and returns, allowing credit unions to diversify their portfolios through collaboration.

-

Connecting and servicing loan participants has become a cottage industry for some credit unions and CUSOs.

Credit unions have a long history of working together, and the rise in loan participation activity in the past decade shows that willingness to collaborate writ large.

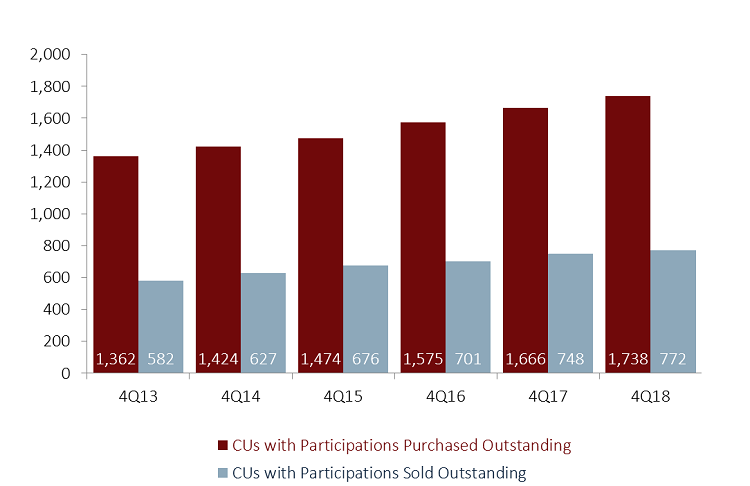

The movement’s portfolio of purchased participations at year-end 2018 stood at $31.6 billion, nearly triple of that at the end of 2009. At that point, as the financial crisis was at its deepest, there were 507 credit unions that had sold participation loans on their books and 1,206 that had purchased participation loans. Today, that’s 772 and 1,738, respectively.

The appeal is simple: participation loans allow lenders to partner with other lenders to reduce risk exposure and increase profits. They help free up capacity, increase liquidity, and reduce concentrations.

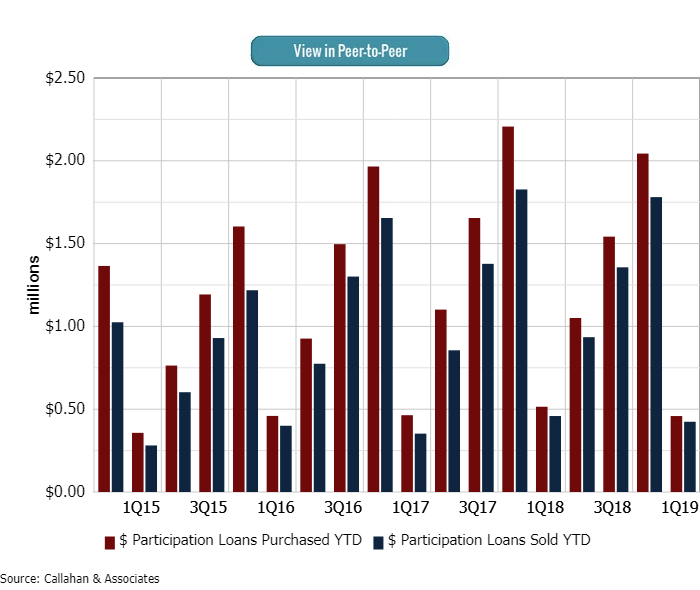

PARTICIPATION LOANS SOLD

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Loan participation activity has risen sharply in the past five years, and tends to peak in the fourth quarter each year.

Buyers also can use the loans to test the waters in areas they’re not experienced with, such as commercial lending or niche products like solar. They can also extend the geographic range of the local economies in which they can participate.

Because of that, a mini-industry of sorts has sprung up. Credit unions, CUSOs, corporates, and others who provide the broker, advisory, and servicing functions, can help credit unions, large and small, take advantage of the opportunity to share the risk and rewards of loan participations.

That activity reflects a dynamic that has seen the industry’s loan-to-share ratio hit a first quarter record high of 82.3% in 2019, up 13.2 percentage points in the past five years alone. Within that aggregate are credit unions with low ratios that can benefit from buying participations that yield more than investments, and conversely, credit unions with high loan-to-share ratios who can sell parts of their portfolio to gain the liquidity they need to keep lending.

CREDIT UNIONS IN LOAN PARTICIPATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

There are 190 more credit unions with sold participations outstanding at year-end 2018 than five years ago, a jump of 32.6%.

Time To Buy?

CU QUICK FACTS

Alliant Credit Union

Data as of 03.31.19

HQ: Chicago, IL

ASSETS: $11.6B

MEMBERS: 452,560

BRANCHES: 2

12-MO SHARE GROWTH: 7.5%

12-MO LOAN GROWTH: 10.7%

ROA: 0.39%

The first thing participations specialists can help a credit union do is decide if the time is right to buy or sell, or both.

A sweet spot for participation activity is the intersection of credit unions with too many deposits and those with too many loans.

A lower than desired loan-to-share ratio is a common motivator for buying loan participations, says Charles Krawitz, vice president of commercial lending at Alliant Credit Union ($11.6B, Chicago, IL).

The costs in personnel, office space, and technology for producing loans also makes buying participations attractive, says Krawitz, whose credit union currently has 15 other cooperatives buying their participations.

Charles Krawitz, Vice President of Commercial Lending, Alliant Credit Union

Alliant began selling consumer and residential loan participations in 2014 and added commercial loans in 2017. Krawitz says his operation averages 33 basis points of servicing income on its participated loans, plus generates varying gains on the sales themselves.

The income is nice, of course, but income and risk management are not the only benefits of selling and servicing participation loans.

Being in the market helps us enter into constructive dialogue with other credit unions, Krawitz says.

Such discussions often provide insights on risk tolerance, loan structure, pricing and market positioning, the veteran commercial lender says. We’re able to learn from others while sharing what we feel constitute best practices.

PARTICIPATION LOANS SOLD

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates |CreditUnions.com

| Rank | Credit Union | State | Participations Sold YTD |

|---|---|---|---|

| 1 | Digital | MA | $191,669,521 |

| 2 | Bethpage | NY | $145,082,755 |

| 3 | Alliant | IL | $92,998,156 |

| 4 | American Heritage | PA | $88,352,491 |

| 5 | Hershey | PA | $78,333,334 |

| 6 | Logix | CA | $78,007,885 |

| 7 | Coastal | NC | $76,001,418 |

| 8 | First Tech | CA | $69,523,802 |

| 9 | Bellco | CO | $58,446,813 |

| 10 | Verve | WI | $53,875,482 |

Alliant sold the third most participation loans among U.S. credit unions in 2018, according to Callahan & Associates analysis of NCUA call reports, while Digital Federal Credit Union finished atop the list.

When To Sell

CU QUICK FACTS

Digital FCU

Data as of 03.31.19

HQ: Marlborough, MA

ASSETS: $8.9B

MEMBERS: 820,869

BRANCHES: 22

12-MO SHARE GROWTH: 5.6%

12-MO LOAN GROWTH: 7.6%

ROA: 0.55%

But when is it a good time to sell loans? The answer varies from cooperative to cooperative, according to the chief lender at a current leader in participating out credit union paper.

Every credit union has different needs based on their balance sheet position, says Craig Roy, senior vice president for retail lending at Digital Federal Credit Union ($8.9B, Marlborough, MA).

According to Callahan data, DCU sold $191.7 million in participation loans in 2018, the most in the industry. Since 2015, the big Bay State cooperative has sold $2.8 billion in commercial, mortgage, and consumer loans, Roy says, and is currently expanding into home equity and solar loans.

Craig Roy, Senior Vice President for Retail Lending, Digital FCU

That activity has helped maintain order in a burgeoning lending portfolio. DCU has been fortunate to experience steady loan growth over the years. We view loan participations as an important tool to manage balance sheet risks, and it allows us to continue to serve our members in the best way possible, Roy says.

Serving those members in the best way possible also can include loan participations as an economic development tool. That’s the case for credit unions who have the opportunity to make commercial or agricultural loans that are sound from an underwriting perspective but larger than what the originating credit union would want to hold on its books.

For them, participations may be a good option and should be considered, says Phil Love, president and CEO of Pactola, a commercial and ag lending CUSO based in Rapid City, SD.

He adds, Credit unions that want to challenge banks for larger deals can make a large impact in their community by helping to create jobs and fulfill the dreams and financial goals of workers at these companies.

PARTICIPATION LOANS OUTSTANDING

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates |CreditUnions.com

| Rank | Credit Union | State | Participations Sold Outstanding |

|---|---|---|---|

| 1 | Bethpage | NY | $383,629,492 |

| 2 | Digital | MA | $355,045,427 |

| 3 | Verve | WI | $209,910,901 |

| 4 | Evangelical Christian | CA | $188,756,651 |

| 5 | First Tech | CA | $186,339,868 |

| 6 | Coastal | NC | $172,467,099 |

| 7 | Bellco | CO | $167,491,296 |

| 8 | Pentagon | VA | $135,853,944 |

| 9 | Logix | CA | $127,634,861</td |