Pairing a fresh start checking account with a short-term loan has helped First Imperial Credit Union ($77.4M, El Centro, CA) post strong deposit growth in an areawhere a lot of people don’t have a lot of money to spare.

The credit union’s three-branch operation in Southern California’s Imperial Valley serves an agricultural area where seasonal work results in unemployment that regularly exceeds 20%.

Imperial County is more than 80% Hispanic, and many of its residents use check cashers and payday lenders, as well as reloadable prepaid cards from their employers, to turn their paychecks into usable cash.

CU QUICK FACTS

FIRST IMPERIAL Credit Union

data as of 09.30.14

- HQ: El Centro, CA

- ASSETS: $77.4M

- MEMBERS: 15,276

- BRANCHES: 3

- 12-MO SHARE GROWTH: 9.39%

- 12-MO LOAN GROWTH: 4.25%

- ROA: 1.09%

That’s expensive, and that’s where First Imperial comes in. To encourage direct deposit and help members build a relationship with a traditional financial institution many for the first time

the credit union offers a starter account called Opportunity Checking.

We created Opportunity Checking to help those that were using check-cashing establishments because no one else would open an account for them, says Fidel Gonzalez, who moved from Los Angeles to take the helm at First Imperial in 2009.

Gonzalez says he and his staff typically find that members with a negative ChexSystems record have a history of overdrawn accounts with unpaid fees. Most tell the credit union they were willing to pay for the transaction but couldn’t afford thefees that came along with it, so the bank closed their accounts.

For $10 a month, Opportunity Checking provides direct deposit and a debit card but no overdraft privileges. Those and lower fees come later, once members prove they can handle the new financial relationship.

And if $10 sounds pricey, add up those fees they’re paying elsewhere, and we charge a hell of a lot less, Gonzalez says, adding he’s heard little pushback over it.

Deposit Growth

|

| Fidel Gonzalez has been CEO at First Imperial Credit Union since 2009. |

Under Gonzalez’s tenure, total checking accounts have grown from 3,500 to 5,200, about one third of its membership. That includes approximately 350 of the Opportunity Checking accounts.

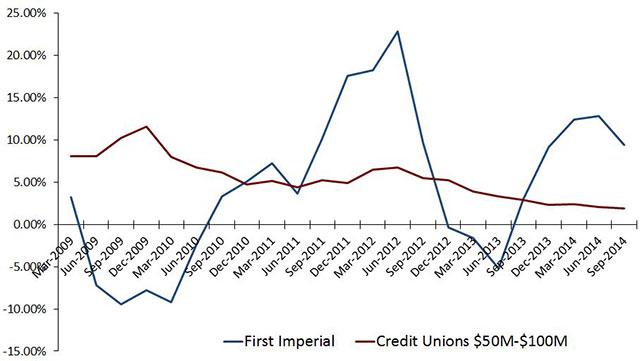

Share growth, meanwhile, was 9.39% in the quarter ending Sept. 30, 2014, compared with 1.9% for its peer group: the 764 credit unions of $50 million to $100 million in assets nationwide.

Our deposit growth has mainly been because of membership growth and making a big push for checking accounts with direct deposit, Gonzalez says, adding that direct deposit is not required to open an Opportunity Checking account.

Member growth during the third quarter was 6.76% at First Imperial, compared with 0.59% for its peer group, continuing a five-year trend wherein the credit union has averaged1,000 new net members each year.

It’s easy to help those that have perfect credit scores and stable jobs, Gonzalez says. When you position your credit union as one that is willing to work with those that truly need it, the word gets around.

Share Growth

Data as of Sept. 30, 2014

Callahan & Associates | www.creditunions.com

First Imperial’s share growth has been strong relative to its peer group.

Source: Peer-to-Peer Analytics by Callahan & Associates

Lending Matters

First Imperial’s loan growth in the third quarter was 4.25%, a shade below the 4.85% average for credit unions with $50 million to $100 million in assets, according to Callahan & Associates.

That number includes a fair population of loans that many financial institutions might not have made, and some they already did. The former are people who fall into the payday lending cycle. The latter are auto loans.

First Imperial offers an alternative loan of up to $500, with no credit check and payable in four installments, for anyone who direct deposits paychecks into a credit union account.

Members can take out up to four of these loans per year, and the credit union reports them to the credit bureaus. This helps members increase their credit scores and ease their reliance on payday lenders, Gonzalez says. But that’s not the only loanfor marginalized members.

We’re a big auto lender in our community, and we have positioned the credit union as a refinancing hub, Gonzalez says.

According to Gonzalez, First Imperial’s refinancing of loans at two percentage points below the existing loan with a floor of 4% started as a successful promotion that the credit union never ended. Otherwise, the credit union doesno indirect auto lending and very little mortgage lending.

Lending Philosophy

First Imperial uses work record instead of credit score to determine whether to lend, and it uses credit score to price the loan. According to Gonzalez, the ability to repay a loan at the time of funding is more important than what has happened in thepast.

We look at the whole credit relationship to be able to understand if we are helping or hurting the member by granting the loan, the credit union CEO says, adding that the institution focuses on real trade lines rather than collection accounts.

First Imperial’s third quarter 2014 loan delinquency rate of 1.96% is higher than the 1.11% for its peer group. The credit union offsets some of its credit risk with higher average loan yields 7.29% at First Imperial compared with 5.5% forits peers but it is prepared for a rough fourth quarter that is typically the worst for delinquencies and charge-offs.

Many of our members fall behind because they spend their monies elsewhere and we end up picking up more vehicles than normal, Gonzalez says.

Write-offs also jump in December when the credit union charges off its repos on hand .

We overfund our allowance account on the fourth quarter so when December charge-offs hit we don’t take such a big hit to the bottom line, Gonzalez says.

Capital And Community

Solid deposit growth has allowed First Imperial to maintain a loan-to-share ratio of approximately 78%. Gonzalez says a current capital ratio of more than 10% means the credit union is not concerned right now about its own guidelines that call for additionaldeposits if the loan-to-share ratio reaches 90%.

What the CEO and his staff instead can focus on is building its member rolls and the deposits that come with it through serving the community holistically.

For Gonzalez, that began with creating the credit union’s first real Hispanic outreach, including Spanish language marketing and disclosures, along with offering the online services and checking and savings options that all credit union membersexpect .

We’ve done a good job of getting involved in community events and promoting the benefits of membership versus using alternative financial options, he says.