Deposit growth has been plaguing credit unions for the better part of 2023. The personal savings rate is now the lowest it’s been in more than 30 years and credit card debt just hit a record high of over $1 trillion. Unfortunately, while credit unions are best positioned to help consumers solve this problem, awareness of their offerings remains low, which has led to a deposits slump many CUs feel today. That’s where Debbie comes in.

Deposit growth has been plaguing credit unions for the better part of 2023. The personal savings rate is now the lowest it’s been in more than 30 years and credit card debt just hit a record high of over $1 trillion. Unfortunately, while credit unions are best positioned to help consumers solve this problem, awareness of their offerings remains low, which has led to a deposits slump many CUs feel today. That’s where Debbie comes in.

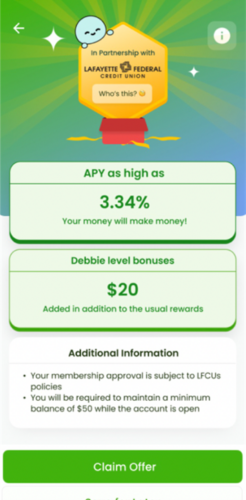

Debbie is a marketplace that helps credit unions reach and convert Millennials and Gen-Z in their community. How does Debbie find these prospective members? Our app offers cash rewards to your community for positive financial behavior, including increasing savings and paying off debt. Financial institutions can leverage Debbie to incentivize behaviors above and beyond credit card spending and provide just-in-time personalized savings and loan offers to both members and prospective members.

Case Study: Michigan State University Credit Union

Michigan State University Federal Credit Union ($7.7B, East Lansing, MI) is the world’s largest university-based credit union. When working with Debbie, MSUFCU’s goals were to:

-

- Expand new membership.

- Help existing members improve their financial health by reducing debt.

- Increase member deposits.

MSUFCU utilized Debbie as both a stand-alone affiliate traffic source, as well as an existing member engagement tool. During the first six months of MSUFCU’s pilot, users who were on Debbie:

-

- Increased savings by an average of $60 per month.

- Reduced spending by 20%.

- More than doubled their deposit growth.

- Reduced debt by 5% per month on average.

- 6% opened an additional savings account or consolidated their debt with MSUFU.

In the first two weeks of targeting non-members in MSUFCU’s counties, Debbie acquired over 400 membership-eligible users into the app.

How Does It Integrate?

Debbie launched MSUFCU’s debt consolidation and high yield savings offers inside the app to users in select Michigan counties who did not currently have a relationship with the credit union. The users received a simple link-out to their offer, and Debbie was able to track the conversion by prompting users to reconnect the newly formed accounts inside the Debbie app.

In addition, to get started on a test pilot and prove ROI quickly, Debbie offered a co-branded app to MSUFCU members. The credit union encouraged members to download the Debbie app at various points of contact, including email, within the decline funnel for a loan, in the branch, and through push notifications.

MSUFCU members received a unique invitation code that allowed them to skip the Debbie waitlist, receiving a coveted spot. Once inside the app, members were able to:

-

- Connect their debt and savings accounts via Plaid to track their progress.

- Set up debt payoff and savings goals.

- Complete a free curriculum that focused on the behavioral psychology of money and spending rather than traditional financial literacy.

- Earn rewards for engaging inside the app and meeting their goals.

MSUFCU members completed an average of 15 behavioral psychology modules over the time frame, with 84% of users completing at least one module. They also connected more than 5,000 individual accounts with almost 40% of the dollar value of debts coming from institutions besides MSUFCU.

This data provides the credit union insights into where else its members are banking as well as opportunities to serve relevant products to those members.

What’s Up Next?

Debbie’s goal is to create the next generation marketplace to help elevate the credit union mission to the younger generation, and give them the tools to become better members.

Interested in learning how to partner with Debbie? Head over to www.joindebbie.com/partners.