Delinquency has worsened across the credit union industry during the past few quarters. Although it is still within historic norms, it has notably ticked up from the all-time low levels recorded during the pandemic.

In the context of an intentionally cooling economy that has been struck by high inflation, the rapid increase in delinquencies is somewhat expected. However, credit unions still must closely monitor the metric to ensure the health of members as well as institution.

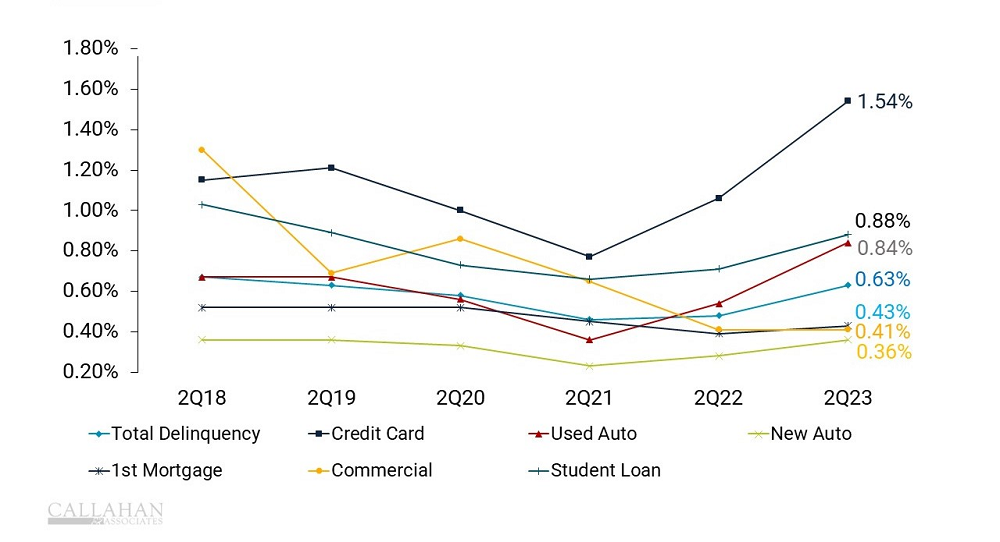

National employment remains near record highs, so members have money to pay some of their bills, but budgetary deterioration is starting to show on the consumer loan side. First mortgages and commercial delinquency rates remain healthy; however, strains on asset quality are evident in credit cards and auto loans.

Although synchronized delinquency across products is a warning sign for a recession, the stark contrast in delinquency patterns between these categories suggests a somewhat unique scenario: When faced with a difficult budgetary decision, members are disproportionately choosing to pay their mortgage over other loans.

DELINQUENCY BY LOAN TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

Asset Quality For Credit Unions

During the pandemic, U.S. consumers faced pandemic-induced restrictions even as lawmakers made unprecedented fiscal and monetary policy decisions. Now, the economy is rapidly correcting itself as it seeks a new equilibrium. In a system reliant on stability, quick changes bring some pain, and things have certainly changed.

Early on in the pandemic, trillions of dollars in government aid and ample consumer liquidity helped lessen asset quality risk. By some estimates, consumers used approximately one-third of federal aid to pay down personal debt. This monetary relief combined with generous repayment forgiveness programs together drove down credit union delinquency to the lowest levels on record.

However, the “free” cash in conjunction with low interest rates drove up asset prices and inflation hit levels not recorded since the 1980s. Higher prices and higher interest rates have consumed Americans’ budgets and savings. Consequently, delinquency rates have quickly returned to pre-pandemic levels.

Total credit union loan delinquency was up 11-basis points from one year ago, reaching 0.63% at midyear. Although this rate still hovers around historic norms, the rapid increase should raise eyebrows. Credit cards and used auto loans — the primary drivers of total delinquency — both reported substantial growth in delinquency the past few quarters, with the metric reaching 1.54% and 0.84% respectively. In contrast, delinquencies in new auto loans, first mortgages, and commercial loans have all remained relatively low — 0.36%, 0.43%, and 0.41%, respectively.

In periods of economic turmoil — like the 2007-2008 recession — delinquency rates often move in near-parallel across product types. Today, however, first mortgage and commercial loan repayment rates are heavily influenced by the historically low pandemic-era interest rates. Millions of borrowers who locked in loans at near-zero rates are making sure to cover their mortgage payment, even as inflation eats away at budgets and forces them to make difficult financial choices.

On the consumer side, consumers tend to miss credit card and vehicle payments when money is tight. Thus, credit cards and used auto loans are facing the brunt of financial strain. Notably, new auto delinquency remains strong, possibly a byproduct of less credit-worthy borrowers being priced out of the price-inflated market.

Student Loans And Asset Quality

In March 2020, the Federal government temporarily suspended payments on Federal loans, providing relief to nearly 44 million borrowers. Particularly for younger Americans, the freeze helped borrowers absorb the impacts of inflation. However, payments resumed in October, and there is concern about a potential domino effect. When savings rates are already near zero, will borrowers be able to make another monthly payment? If not, will the asset quality of other loan products deteriorate even further?

Some cracks are already showing. Student loan delinquency among credit union borrowers was 0.88% at midyear, higher than every loan segment but credit cards. Although credit union-held student loans are a small portion of portfolios, they reflect the younger demographic. Additionally, given the population of members most impacted by student loans and the population of members who own a home has a relatively small overlap, will deteriorating student loan quality exacerbate the already strong divergence between real estate and consumer repayment patterns?

DISTRIBUTION OF STUDENT LOAN PAYMENT AMOUNTS

FOR U.S. CONSUMERS RESUMING PAYMENT | DATA AS OF July 2023

© Callahan & Associates | CreditUnions.com

The Bottom Line

Delinquency rates are on the rise nationally, but they are not yet cause for panic and have simply returned to normal, pre-pandemic levels. The critical question is how overall asset quality will respond to an unstable economic outlook.

As long as employment remains strong, the economy is unlikely to slip into a full-on recession, but that does not mean members won’t struggle. Credit unions are tasked with helping their members through difficult times. Helping members budget, offering savings promotions, and setting aside provisions for loan losses are all ways credit unions can be bastions of stability, both institutionally and for their members. And given that younger members are disproportionally struggling in the current environment, the industry has a clear opportunity to demonstrate the value of the cooperative movement to a new generation.

Benchmark Asset Quality With Ease

How does your institution’s delinquency and charge-off performance stack up against peers and the industry? Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.