Top-Level Takeaways

- Knoxville TVA Employees Credit Union and Credit Union 1 are enhancing their community impact efforts by integrating volunteerism into their company culture and performance goals.

- The two credit unions foster employee engagement by putting solid numbers around volunteerism, resulting in increased participation as well as stronger partnerships with community organizations.

In an industry rooted in service, establishing community giveback programs is an easy decision. Most credit unions do have volunteerism built into their company culture and mission, but it can be challenging to develop a method to meaningfully measure employee engagement and credit union impact.

Some industry leaders say tracking certain metrics has helped them increase program participation within the credit union’s walls and build closer strategic partnerships outside of it, enabling everyone to help more people in the process.

Talk The Talk, Walk The Walk

For Knoxville TVA Employees Credit Union ($4.5B, Knoxville, TN), volunteering goes beyond a mere mission statement or origin story. It’s a crucial part of its field of membership’s identity.

“We are the Volunteer State,” says Charlotte Havely, KTVAECU’s vice president of marketing. “It’s a part of East Tennessee. We grow up with it, so it seems like a natural fit for us to put it into our goals. We want to volunteer.”

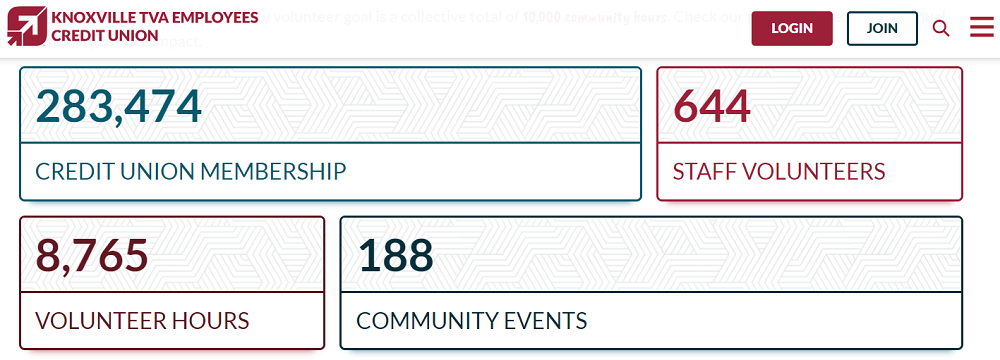

And KTVAECU staff members certainly do volunteer. They complete thousands of volunteer hours every year, attend more than 180 regional events, and give to causes such as homelessness, veterans services, childhood education, and food insecurity.

KPIs In Action

In the second quarter of 2024,Credit Union 1 distributed a culture kit to staff members that included resources and treats meant to encourage volunteerism among staff.

Thousands of miles away, the community impact efforts of Credit Union 1 ($1.6B, Anchorage, AK) combine fundraising, volunteering, and corporate sponsorship. Members of its community outreach and communications teams have three key focus areas: youth and education, health and wellbeing, and social services.

“We want to foster a strong, supportive, and inclusive environment with an emphasis on social responsibility,” says Tiarra Gustin, community outreach manager. “We want to make sure our actions not only benefit our members but also improve the lives of all Alaskans.”

An internal community service committee composed of employees from departments and branch locations across the credit union coordinate the cooperative’s philanthropic efforts. The group meets once a month and often invites nonprofit partners in-house to leverage resources and solve problems.

The most recent of these meetings took place in June.

“On the Zoom call we had staff from Nome, Ketchikan, and representatives from all of our remote branches,” says John Guintu, community outreach specialist. “It was cool as a collective to come together and brainstorm 30 minutes and pitch ideas. They walked away from that meeting with a list of things they could execute that they hadn’t thought of before.”

A New Approach

Earlier this year, Credit Union 1’s executive team rolled out a new idea to foster employee engagement — culture kits. These literal tool kits are boxes filled with resources all focused on a specific theme, with the first quarter’s focusing on performance management and second quarter’s focusing on community.

CU QUICK FACTS

CREDIT UNION 1

HQ: Anchorage, AK

ASSETS: $1.6B

MEMBERS: 92,026

BRANCHES: 12

EMPLOYEES: 385

NET WORTH: 12.4%

ROA: 0.73%

“The spirit is to educate and engage employees, get them excited about why we’re doing what we’re doing, and make sure it’s a cultural focus of our company and not just a side effort to what we do,” says Jessica Gallagher, CU1’s director of corporate communications.

According to Gallagher, the credit union designed a volunteerism-focused kit earlier this year to educate employees about the ways CU1 raises funds for communities, what their efforts support, and how they can be more involved. There are also special goodies such as stickers and a T-shirt.

“We also set little milestones once they reach their first five hours of volunteering and so on,” Gallagher says. “They get a special pin that says they’re a community champion.”

Kerry Youngren, CU1’s vice president of marketing and communications, says the credit union recorded a 25% increase in logged employee volunteering hours since the launch of the culture kit.

“We’re also looking at implementing some high level KPIs and strategic goals,” Youngren says. “Every credit union looks at ROA, membership growth, and those types of things, but what about layering in wellness goals as well — making sure our members are doing well from a financial standpoint?”

KTVAECU adopted a similar approach regarding community service goals this year.

“This was the first time we’ve ever put our community service as a KPI, and it was wildly successful,” Havely says. “We have a servant’s heart. We are here to serve. We want service really built into our culture.”

Before the end of this fiscal year, KTVAECU aims to have its employees serve at least 10,000 volunteer hours, a goal the cooperative continuously updates via a tracker located on its website. On average, this equals approximately 15 hours per employee.

Havely says she has no doubt her team will cross the finish line.

“Oh, we’ll get there,” she says. “We have so many events, and we have so many people that are participating. We will hit that number and likely exceed it.”

Lasting Impacts Inside And Out

Beyond being mindful of mission, investing heavily in the community can have significant impacts on recruitment and retainment as well as membership growth.

CU QUICK FACTS

KNOXVILLE TVA EMPLOYEES CREDIT UNION

HQ: Knoxville, TN

ASSETS: $4.5B

MEMBERS: 27,844

BRANCHES: 24

EMPLOYEES: 617

NET WORTH: 9.9%

ROA: 1.30%

“I was just at an event last week where someone came up to me and said, ‘You know, we cannot believe how much you guys are out there in the community,’” Havely says.

From a marketing perspective, fundraising and volunteering efforts boost brand awareness. Some experts have begun looking closer at the impact of community on consumer habits, with an overwhelming majority agreeing that authenticity influences decision-making.

Similar data has been collected regarding what top talent looks for when evaluating where to work.

“Our employees are really excited to participate in our volunteering and fundraising efforts,” Gallagher says. “They’re energized, and we hear time and time again that it was a deciding factor in them coming to work here.”

Both CU1 and KTVAECU are currently evaluating their plans for 2025, with hours served and people impacted continuing to grow year-after-year.

Find Your Next Big Idea At A Callahan Roundtable Join like-minded peers at a Callahan roundtable to talk about challenges, collaborate on solutions, and identify future hot topics. Callahan & Associates helps leaders share insights and best practices, build networks, and discover better ways to measure performance, like how to put hard numbers around community impact. Only a few remain. Find out how you can attend today.