INTERNSHIP HURDLES: WHAT’S STOPPING STUDENTS FROM GAINING EXPERIENCE?

FOR 2,430 COLLEGE STUDENTS

SOURCE: Gallup

Internships are a valuable component of higher education experience, with research confirming the value they offer interns as well as employers. But a March 2023 Gallup survey of university students found roughly six in 10 respondents reported they did not have internship experience, despite its importance in securing a job post-graduation.

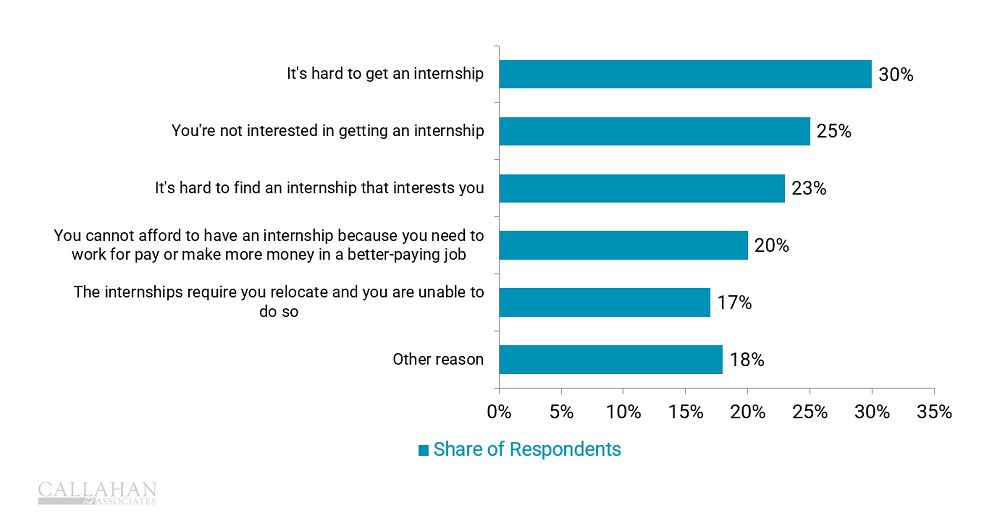

The reasons underlying the lack of internship experience varied. The highest percentage of respondents — 30% — noted the difficulty in getting an internship at all, whereas 23% reported it was difficult to find an internship that interested them. Notably, 20% said they could not afford to work at an unpaid or lower paid internship.

Strategic Insights

- First generation college students reported the lowest rate of internships, at just 27%. Meanwhile, students at private, not-for-profit colleges reported the highest rate, at 52%. These disparities highlight how difficult it can be for students in some demographics to secure or sustain an internship.

- For credit unions that employ interns, understanding these pain points and adjusting outreach strategies accordingly can help create a more diverse team. Internships at Nusenda Credit Union($4.7B, Albuquerque, NM) help students identify potential professions for themselves while developing future permanent hires for the credit union.

- Targeting demographics that might find it more difficult to obtain or accept an internship — either because of exposure or the need to earn a certain wage — can pay dividends. California Credit Union($5.0B, Glendale, CA) started small with a program of six interns four years ago. Today, 13 interns work for nine weeks in full-time, paid positions. The internship is aimed at students currently pursuing a bachelor’s degree in finance, accounting, economics, or a related field.

- It can also be beneficial to look beyond college campuses. Gesa Credit Union($5.9B, Richland, WA) gives high school students the opportunity to work as paid interns at high school branches, while an internship program at AmeriCU ($2.8B, Rome, NY) helps military members transition into the civilian workforce.

Don’t Stop Here. With the academic year over, students across the country are moving into internships — some of those young workers will be the future of the industry. Read more in “From Internship To Credit Union Career.”