Another standoff; another shutdown.

With Congress at an impasse, the federal government entered another shutdown at midnight on Oct. 1. But this time around, the impact could potentially be more severe. Here’s why:

- A Sept. 25 White House Office of Management & Budget memo to the heads of government agencies directed those organizations to identify programs and activities that can be eliminated in the event of a shutdown.

- The memo also advises agencies to prepare for further reductions in force.

- Since entering office in January, President Trump — along with the Department of Government Efficiency — has attempted to dramatically reduce the size of the federal workforce. Although many of those dismissals face legal challenges, data from the Bureau of Labor Statistics shows approximately 97,000 fewer people work for the federal government now than did at the start of 2025, according to government data.

- Further reductions would likely also face challenges in court, but firings on top of a shutdown would make things harder for employees already living paycheck to paycheck and struggling with finances.

The federal government has closed down three times since 2013 and nearly closed numerous other times — including two years ago when, as often happens, a last-minute deal averted a larger crisis.

Bigger Than The Beltway

Think this is just a DC problem? Think again.

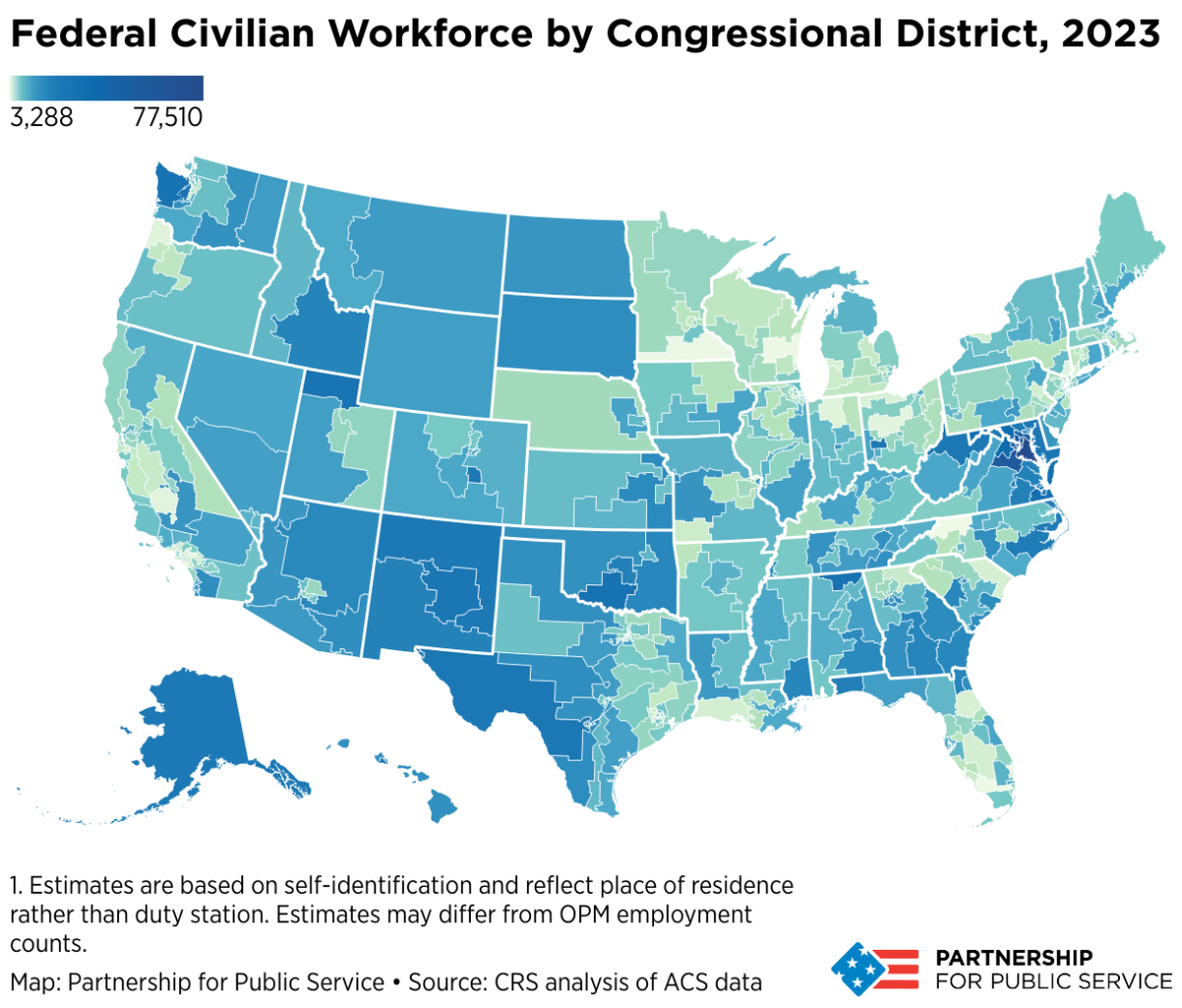

A 2023 report from the Partnership For Public Service shows just how geographically spread out the civilian federal workforce is. Not surprisingly, the concentration of federal workers is high along the southern border, but it’s also high in less likely places such as the Dakotas, Eastern Idaho, the Pacific Northwest, and beyond.

The federal civilian workforce — not including postal carriers and military — comprises approximately 2.29 million people, according to a March 2025 report from the U.S. Office of Personnel Management. There are no public details on how many people could be impacted by a shutdown, but previous shutdowns — both those that happened and those that nearly happened — impacted about one-third of the federal civilian workforce, or more than 700,000 people, according to one news site.

A New York Times analysis published Tuesday before the shutdown deadline estimated more than 492,000 federal workers could be subject to furloughs, with civilian workers at the Department of Defense representing more than two-thirds of those affected. Three quarters or more of employees at the Departments of Commerce, Labor, Education, and the Environmental Protection Agency would also be impacted, along with a variety of other agencies. The National Credit Union Administration remains open.

A shutdown will also have an economic impact that extends beyond federal workers, including into the many national parks and other federal facilities that will close temporarily, which could lead to reductions in travel, spending, and more.

In other words, credit unions across the country — not just those in and around the nation’s capital — should brace for impact.

Operational Best Practices

Unfortunately, there’s no way to know whether any last-minute deals will emerge to stop a shutdown or just kick the can down the road a few weeks or months. That’s where credit unions come in. Many across the industry have adopted a handful of best practices to help members weather the (potential) storm.

Low- Or No-Rate Loans

One of the industry’s standard offers in these scenarios is to offer loans at 0% APR or another low interest rate to help members manage their funds during work stoppages. Loan amounts are generally limited to an amount equal to the member’s most recently direct-deposited paycheck. These loans generally present extremely low levels of risk to credit unions because government employees receive back pay once the government reopens and can repay the loans that way.

Canyon View Credit Union ($2.1B, West Jordan, UT) offers various shutdown assistance in the form of skip-a-pay programs and a shutdown loan. The loans — which correlate to the amount of a member’s most recent paycheck on direct deposit at the credit union — are capped at $6,000, with 0% interest for 60 days and no processing fees. The credit union also requires members with loans not paid back within 60 days to establish a payment plan.

Be Patient With Payments

Many credit unions provide up to 60 days or more to repay shutdown loans, but in the event that more time is needed, many credit unions offer low-rate repayment plans, such as the 4.00% APR for 36 months available at Congressional Federal Credit Union ($1.3B, Oakton, VA).

VyStar Credit Union ($14.0B, Jacksonville, FL) doesn’t begin repayments until after 90 days and offers shutdown loans of up to $15,000, with loan amounts calculated based on twice the member’s monthly salary. Skip-a-pays and hardship deferments are also available for consumer loans or credit cards that meet specific stipulations. VyStar maintains a page on its website specifically outlining these options.

Be Prepared — But Don’t Jump The Gun

Since government shutdowns never come early and are often thwarted at the last minute, there’s little need for credit unions to disburse funds before the congressional deadline.

With that in mind, U.S. Senate Federal Credit Union ($1.5B, Alexandria, VA) offers a 90-day loan at 0% APR for up to $5,000 for all government employees who can show loss of income. Government contractors are excluded, and the credit union won’t accept applications for a loan until the first business day after the government shuts down. That said, it won’t release funds “unless [or] until the government shutdown results in a missed payroll,” according to the credit union’s website.

Communication Strategies

Of course, relief programs only matter if members know about them. That’s why proactive, consistent communication is a cornerstone of effective shutdown response.

Go Early And Be Consistent

Key Actions For Credit Unions

- Communicate proactively to members with potential exposure to shutdowns.

- Review and update emergency loan and skip-a-pay programs.

- Repurpose content for financial literacy hubs to guide members during income disruptions.

- Use lessons learned to improve long-term resilience and operational readiness.

These crises occur often enough that many credit unions keep their shutdown messaging online and promote it as needed.

State Department Federal Credit Union ($2.9B, Alexandria, VA) sends proactive communications that direct members to various financial relief products, including loan payment deferments, complimentary financial counseling, penalty-free certificate withdrawals, interest-free credit cards, and more. The credit union also routinely updates articles in its online “learning hub” such as “How To Make The Most Of A Reduced Income” to help members weather the storm.

“We always have this handy for things like natural disasters or government shutdowns, so we don’t re-create this every time,” says CEO Jim Hayes.

The credit union designed its programs for those scenarios, but Hayes adds it also came in handy earlier this year when many members were subject to the government’s reductions in force.

Navy Federal Credit Union ($191.8B, Vienna, VA), the world’s largest credit union, also keeps a standing page with information on shutdown-related offers. One key difference is that it updates the date on the page when it adds information. As of March 10, 2025, it offered loans up to $6,000 dependent upon the amount of a member’s direct deposit relationship with the credit union.

Know Members — And When To Reach Out

SEG ties and direct deposit data allow many credit unions to know exactly which members are federal employees. That makes proactive communication easier and faster so members can be prepared and rest easy knowing the credit union has their back.

That’s important in moments like these, but there are benefits beyond a government shutdown. Americans are anxious about the economy and the state of the world, and cooperatives can solidify their standing by reminding members that they’re standing by with real solutions.

Member-Focused Strategies That Look Forward

Short-term solutions are critical, but shutdowns also spotlight the importance of long-term financial planning. Once the immediate crisis passes, the real work begins: helping members build resilience so they’re better prepared when the next shutdown inevitably arrives.

Help Plan For Next Time

Rising interest rates have spurred dramatic spikes in share certificate usage at credit unions. With better returns than consumers have seen in a long time, credit unions can help members by continuing to promote certificates, high-yield savings accounts, and more.

At Michigan State University Federal Credit Union ($8.2B, East Lansing, MI), for example, the Savings Builder account offers tiered returns based on account balances. Tools like that and others can help members be financially prepared for the next time this crisis arises.

Change Members’ Long-Term Habits

Although shutdown loans, payment deferrals, and other methods can help ease the short-term pinch of a shutdown, Sunmark Credit Union ($1.2B, Latham, NY) is attempting to take a longer view. The Upstate New York-based cooperative hosts a page on its website on how to survive these increasingly common situations.

The content, repurposed from a NerdWallet article, includes information on dealing with various types of creditors, including auto and home loans, credit cards, and more. The page also provides advice on how to manage the financial worries these situations generate, such as the importance of a side hustle and the potential to catch up on missed payments or lost savings with next year’s tax refund.

Hoping For ‘Cooler Heads’

Resource Guide

Industry groups help credit unions assist members and manage shutdowns.

- Defense Credit Union Council

- America’s Credit Unions

- NCUA

- Consumer resource guide from Sen. Martin Heinrich (D-NM)

More than one-third — 36% — of the membership at True Sky Federal Credit Union ($822.4M, Oklahoma City, OK) ] has ties to the Federal Aviation Administration, despite being headquartered more than 1,000 miles from Washington.

“I saw an article [several days before the deadline] where there is a 65% chance that the government will shut down,” CEO Sean Cahill said via email. “While we pray that cooler heads will prevail, [there are] some things we are prepared to offer if there is indeed a furlough.”

That includes multiple loan options — either 60 days at 0% APR or six months at 1.99%, both based on the amount of the member’s most recent direct deposited paycheck — along with penalty-free CD withdrawals, overdraft forgiveness up to $100, free credit counseling, and more.

Cahill added the credit union may also offer mortgage abatement offers, but those offers will be dependent upon how long any shutdown drags on.

What’s Next?

Government shutdowns might be unpredictable, but credit union action is not.

Whether this standoff ends with compromise or closure, credit unions are already moving to support members through the turbulence. They are refining emergency relief programs, focusing on long-term stability, financial education, and relying on built-in trust to provide assistance that not only bridges immediate gaps but also builds lasting financial resilience. With tools to address the here-and-now and strategies to strengthen members’ financial futures, the industry ensures that whenever the next shutdown looms, members won’t face it alone.