In baseball, stats tell a story — the same goes for performance data when it comes credit unions. That’s why, when October rolls around, Callahan lets the numbers pitch their prediction for MLB supremacy.

This year, the 2025 World Series features a classic battle royal between the Los Angeles Dodgers and the Toronto Blue Jays. The introduction of a Canadian team presents a new challenge for determining a statistical standout, but the analysts at Callahan & Associates are eager to take a swing.

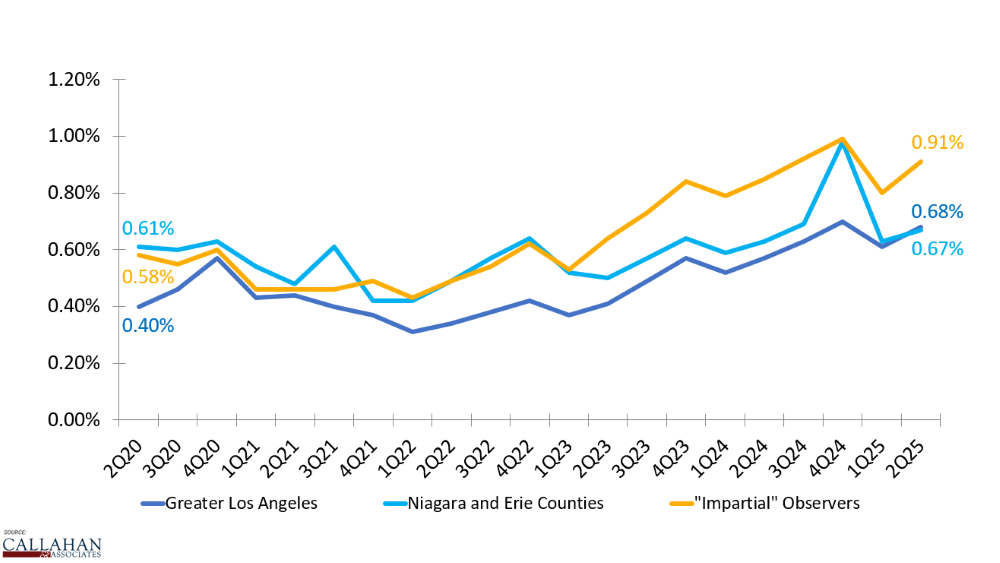

Using credit union performance data from cooperatives in the Greater Los Angeles region to represent the Dodgers and Niagara and Erie counties in New York to represent the Blue Jays, Callahan analysts have chosen a home run hero. Data from credit unions across the United States is also weighing in to represent impartial observers everywhere. “Impartial,” truly.

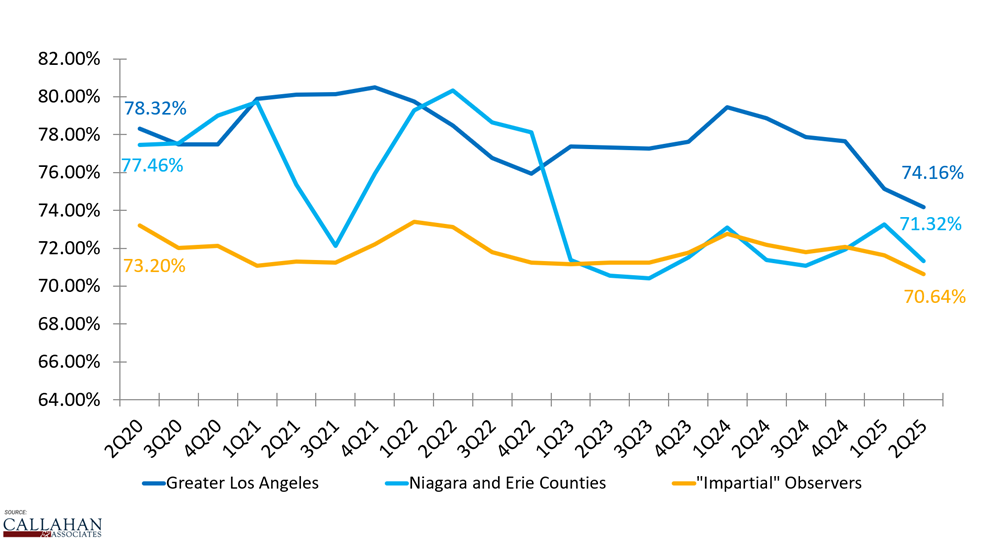

GAME 1: Efficiency Ratio

Like most sports, baseball is about finding an edge in the margins. How can a team most effectively spend its dollars? Finding a diamond in the rough who turns into a regular contributor can give a team a serious edge.

Credit unions are no different, maximizing efficiency per dollar spent is key to success. The observation peer group (and Toronto) holds the edge here, spending $0.70 per every dollar earned.

EFFICIENCY RATIO

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Although the Dodgers’ hefty payroll isn’t exactly the epitome of Moneyball, the team has found value in Japanese-born players such as closer Roki Sasaki and starting pitcher Yoshinobu Yamamoto. It also has a guy who can hit and pitch at an elite level — looking at you, Shohei Ohtani.

On the other hand, the Blue Jays has enticed production from star players like Vladimir Guerrero Jr. as well as enjoyed great postseason success from lesser names like third baseman Ernie Clement. And according to the data, the impartial observers outperform both regions in efficiency.

Go ahead and mark that against the Dodgers.

SCORE: Toronto 1, Los Angeles 0

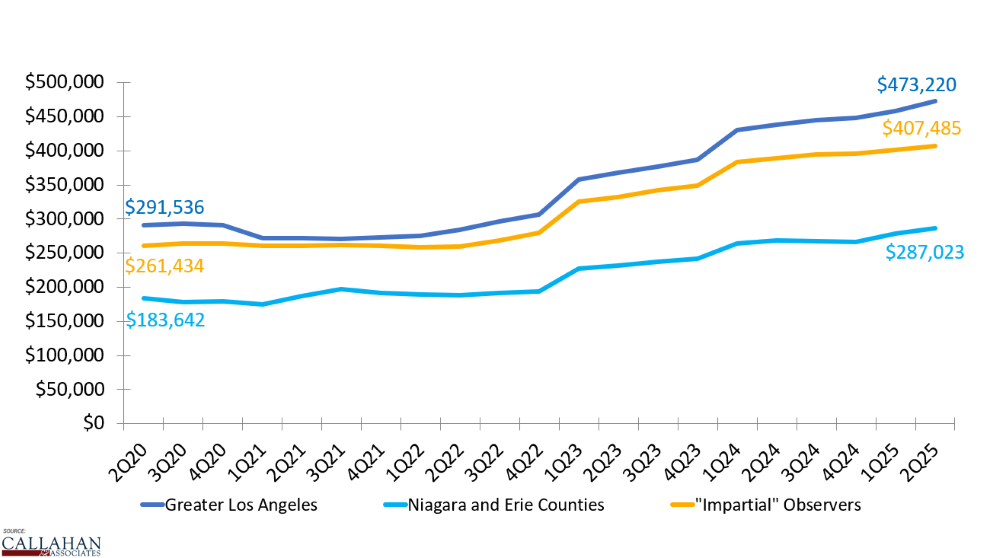

GAME 2: Revenue Per FTE

Unlike other sports, one player cannot take over a baseball game. A great starting pitcher can go a long way, but they still need their bullpen to close it out.

Similarly, a great hitter needs their teammates to get on base and drive in their run. Thus, depth is important. Credit unions are no different, it takes a well-rounded staff to achieve success.

REVENUE PER FTE

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Credit unions in the greater Los Angeles region bring in more revenue per full time employee than those in the Toronto tag team. Chalk this one up for the mighty Dodgers.

SCORE: Toronto 1, Los Angeles 1

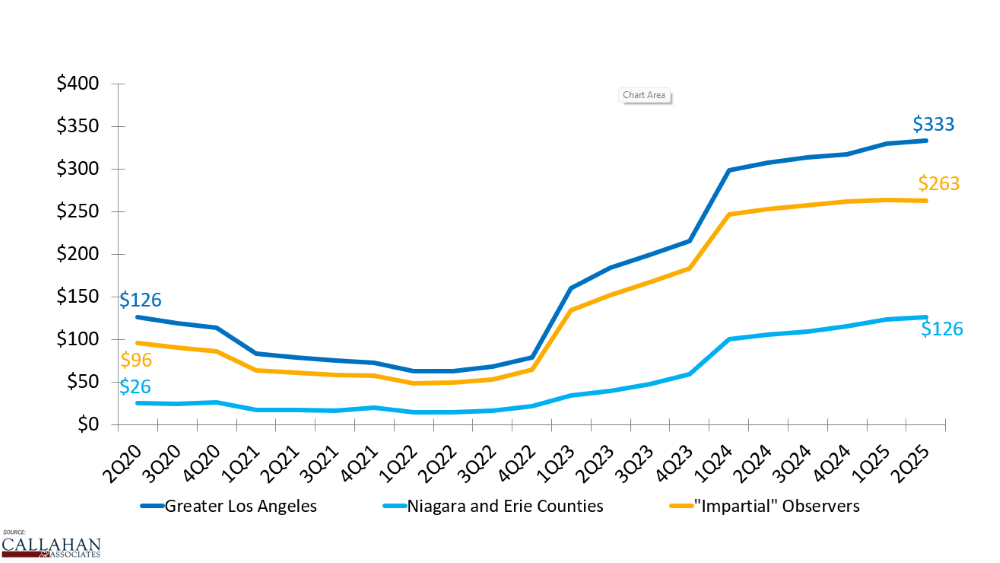

GAME 3: Average Dividend Per Member

Every die-hard fan of any team wants their organization to spend top dollar on the best players, but there are different ways to build a roster. Ultimately, what matters is the return fans get from attending games, buying merch, sharing on socials, and more.

Similarly, credit unions want to reward their members’ loyalty.

AVERAGE DIVIDEND PER MEMBER

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Much like Dodger fans, credit union members in the Greater Los Angeles region enjoy a nice return on their financial investment. Credit unions there returned $333 in annual dividends per member. That’s greater than both the Niagara and Erie region and the rest of the country.

Can the Dodgers be stopped?

SCORE: Los Angeles 2, Toronto 1

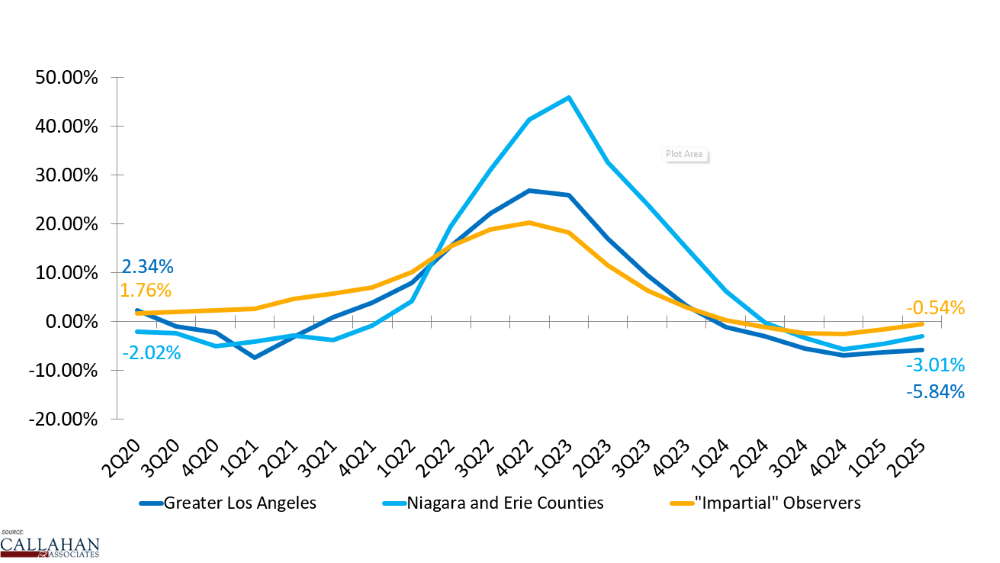

GAME 4: Total Auto Loan Growth

Although major leaguers mostly fly from city to city, baseball is still a game of miles. In the minors, being a mighty road warrior that can grind through long bus rides, packed schedules, and gritty transit days is integral to season success.

No matter the method of transportation, travel time provides players the opportunity to sharpen their minds and grow closer as a team. These intangible off-the-field benefits should not be ignored when determining a winning season.

Travel is an integral part of most members’ lives, too, particularly in the United States’ automobile-driven society. Credit unions know this. Auto lending isn’t just a number on a balance sheet; it’s an indication of how the institution is helping members move through life’s journey.

AUTO LOAN GROWTH

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Here, credit unions as a lending block demonstrate more resilience in their portfolios, with auto lending decreasing at a slower pace than in the individual regions. Credit unions in Niagara and Erie counties, too, offer a reminder that endurance, on the road or in the data, is what makes a true contender.

With that, Toronto ties the series up!

SCORE: Los Angeles 2, Toronto 2

GAME 5: Total Loan Delinquency

When a hitter steps to the plate, they need to have good timing. Swing too early or too late and they’ll miss entirely or hit a foul.

Likewise, credit unions rely on good timing in loan repayments. If a member goes too long without making a payment, they’ll fall into delinquency. Just like a mistimed swing can cost a batter the game, missed payments can cost a member their financial health. For the credit union, delinquencies can throw off their lending rhythm and strike their financials.

TOTAL LOAN DELINQUENCY

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Toronto takes the cake here, just barely edging out the Greater Los Angeles area. Credit unions in Niagara and Erie counties pull through with an impressive 0.67% total loan delinquency — the lowest of the three peer groups represented.

SCORE: Toronto 3, Los Angeles 2

And with that, Callahan predicts a great upset: The Toronto Blue Jays will edge out the Los Angeles Dodgers by the thinnest of margins.

EDITOR’S NOTE: Ignore our author’s bias and that the World Series is a best-of-seven. Fact check our math by tuning into Game 1 of the World Series on Oct. 24 and (if necessary) a Game 7 on Nov. 1.