Two years ago, Wright-Patt Credit Union ($9.3B, Beavercreek, OH) began reimagining its role in housing—not just as a lender, but as a catalyst for community change. That shift from products to purpose sparked a bold new initiative: helping first-time, income-qualified buyers in Northwest Dayton achieve their dream of homeownership.

“Affordable homeownership is one of the keys to financial success,” says Tim Mislansky, president and CEO of Wright-Patt Credit Union. “When we can help members become homeowners, we can help them build wealth, strengthen families, and create lasting communities.”

That commitment to community impact is backed by market leadership. According to Mislansky, WPCU is one of the two largest purchase-money lenders in the Dayton area.

“More than half the mortgages we make are to first-time buyers,” Mislansky says. “That’s possible because of our willingness to teach people about homeownership, our unique products, and our people.”

That mission-first mindset sparked the creation of WPCU’s Housing Collective, a cross-departmental effort that unites lending, financial education, and philanthropy under the banner of expanding the credit union’s reach and relevance in the housing space. As the team explored new ways to serve, its focus turned outward — toward collaboration. That’s when the WPCU Sunshine Community Fund, Wright-Patt’s 501(c)(3) charitable arm, connected with the Pathways to Homeownership program, a local initiative already working to increase access to affordable housing in Dayton.

A Ripple That Became A Wave

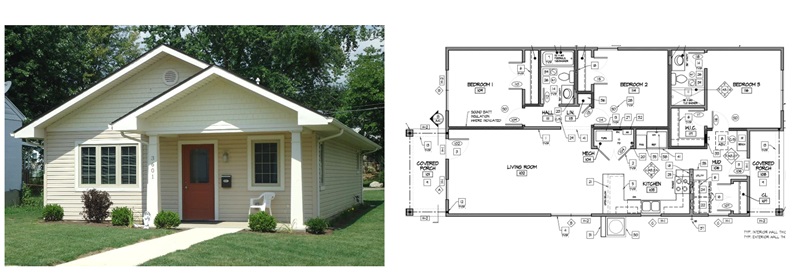

The Pathways to Homeownership initiative began as a response to the devastating 2019 Memorial Day tornadoes that struck the Dayton area. Spearheaded by County Corp, the program primarily sought to address the housing challenges faced by residents in the aftermath. Phases I and II included the construction of 19 homes built and sold by mid-2024, but more funding was needed for the initiative to continue.

Serendipitously, that’s when the WPCU Sunshine Community Fund got involved.

“It all began over lunch with the president of OMEGA CDC,” Mislansky says. “As we talked about our shared goals, we realized we had the ability to create a better future in Northwest Dayton, where more than 30,000 WPCU members live.”

Former Sunshine Community Fund executive director Tracy Szarzi-Fors championed the foundation’s involvement, which included making a crucial investment of $1.3 million to launch Phase III. Mislansky credits partner credibility for WPCU’s confidence in making such a significant early investment.

“We seek organizations that share our values, are well-respected, and have a proven record of success,” he says. “The model we built stands on the foundation of past work, incorporating key lessons to create sustainable housing opportunities in Northwest Dayton.”

Working in partnership with Learn to Earn Dayton, Omega’s Hope Center for Families, and the HomeOwnership Center, WPCU aims to build an additional 30 new homes in the next three years.

For Ivy Glover, Wrigth-Patt Credit Union’s director of community and social impact, the joint effort to revitalize Northwest Dayton is as much a personal journey as a professional project.

“I grew up in that neighborhood,” she say. “My teacher lived down the street; my doctor was two blocks over. One of the goals is to restore that sense of community and accountability where people know their neighbors and look out for one another. That’s what Pathways is trying to bring back.”

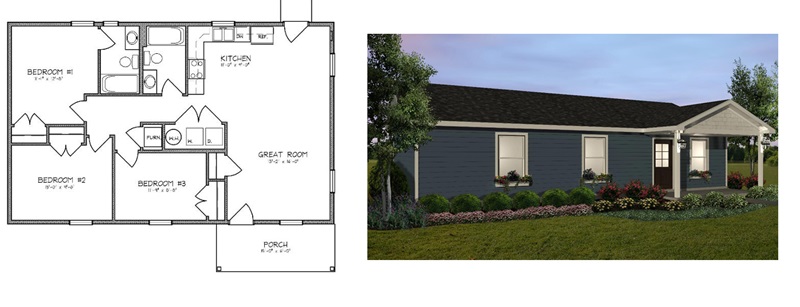

Construction of the first five homes began this summer, and the homes are expected to be move-in ready by November. The three-bedroom, two-bathroom modular homes will be sold at market price, but eligible buyers will receive down payment and closing cost assistance in addition to other resources.

“I tell my team all the time: Every drop makes a ripple, but some make a much bigger one,” Glover says. “This is a big ripple moment.”

Far From Just A Financial Contribution

Wright-Patt’s role didn’t stop at writing a check. The credit union embedded itself in the process, committing time, talent, and resources to make homeownership a reality.

“We didn’t just cut a check,” Glover says. “We committed to making homeowners. That meant building education programs, seeking more resources, and wrapping additional community support around the effort.”

The credit union developed a five-week homeownership readiness program complete with one-on-one coaching, financial education, and sessions through the HomeOwnership Center, with a dedicated program coordinator facilitating both group and individual engagement.

WPCU piloted the program this summer and launched the first full cohort in October. By the end of next year, WPCU aims to graduate at least 120 participants. Because the program is in the early stages, Glover doesn’t have lessons learned or hindsight to share yet; however, she does have one meaningful takeaway.

“I wish we’d started the education piece sooner,” she says.

Meanwhile, the credit union’s Housing Collective also has worked to develop affordable mortgage options and is exploring a deposit solution dedicated to home saving.

“Together, this collective effort really shows our commitment to housing access and equity for all,” Glover says.

Building Momentum And Sustainability

To complete Phase III, Wright-Patt Credit Union and its partners must raise an additional $2.75 million, which is no small number even with multiple organizations working together.

“Our partners, who are very experienced from phases one and two, know the cadence by which funding needs to arrive to keep construction moving,” Glover says. “The key is aligning the timing of building homes, finishing them, and having buyers ready to purchase because those sales fund the next phase.”

Glover, who today also serves as the WPCU Sunshine Community Fund’s interim executive director, says the foundation raises money through credit union employee contributions, member donations, fundraising, and development team grants.

“We’re also exploring, although nothing is finalized, some turn-based grant models that tie funding directly to residents, which could add a layer of accountability and sustainability,” she says.

Mislansky adds that although WPCU provided the initial funding, sustaining the project will require a communitywide effort.

“Our investment helps fund the first five homes as a proof of concept,” he says. “We believe this, along with continued fundraising and collective storytelling from all the partners, will lead to the additional funding needed to complete the next phases.”

For Mislansky, the initiative has underscored the importance of shared values and consistent communication.

“Every organization involved has a lot going on, and this project is just one of many ways we’re all trying to make a difference,” he says. “Staying aligned on the mission and regularly checking back to the original plan has been crucial.”

For Glover, it’s been powerful to watch the contributions of WPCU members and employees make such a direct impact on the community.

“It’s surreal to be part of something that is literally rebuilding the community I grew up in,” the Dayton native says.

Mislansky agrees, adding that the long-term impact extends far beyond the physical homes.

“The neighborhoods we’re focused on have been hit hard by redlining, job loss, and predatory lending for decades,” he says. “Over 70% of residents rent and more than 40% are housing-cost burdened. We believe this program can change lives, revitalize communities, and demonstrate what’s possible when mission-driven organizations work together.”