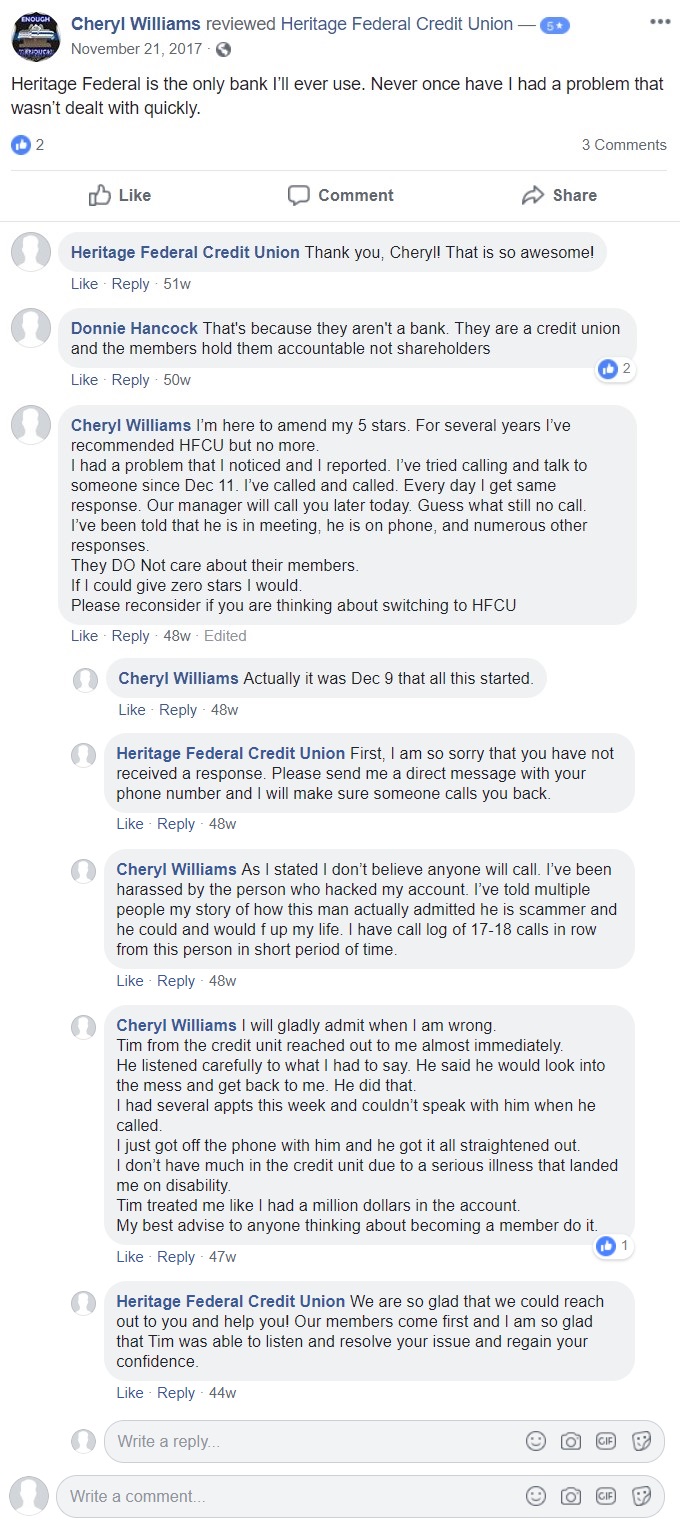

Online reviewers can be fickle. Sometimes, their only feedback in a lifetime of membership depends solely on their last interaction with the credit union. Case in point: Last year, a member gave a five-star rating on Facebook to Heritage Federal Credit Unio ($590.0M, Newburgh, IN), proclaiming Heritage Federal is the only bank I’ll ever use.

Holly Smith, VP of Marketing, Heritage Federal Credit Union

Less than two weeks later, after failing to get a timely call back from the credit union, the member changed her review to one star, noting if I could give zero stars, I would.

All was not lost, however. After a response from the credit union on Facebook, a private message, and a call from a manager, the member changed her rating back to five stars, saying,I’ll gladly admit when I am wrong Tim treated me like a had $1 million in the account.

Not all scathing online reviews have storybook endings, but according to Heritage vice president of marketing Holly Smith, there are a few things a credit union can do to push the narrative that way.

CU QUICK FACTS

Heritage FCU

Data as of 09.30. 18

HQ:Newburgh,IN

ASSETS:$590.0M

MEMBERS:59,401

BRANCHES:10

12-MO SHARE GROWTH:2.6%

12-MO LOAN GROWTH: 10.7%

ROA:0.65%

We go back by direct message and ask them to change their rating if they are satisfied and feel like we’re a five-star institution,Smith says.About 80% of the time, people will go back and change their rating.

True, online reviews account for a fraction of overall complaints that come in through email boxes and phone call, and negative reviews account for only a small percentage of all reviews; however, some can be critical or even linger online for years.And, too many bad reviews can drive away members. According to Vendasta Marketing, 90% of consumers only consider purchasing from a business with a three-star rating or higher.

Actively monitoring and interacting with both good and bad reviewers is an essential part of managing the credit union brand. Here are some tips on the best approaches for managing those interactions and turning around relationships.

1. Nurture And Reward Positive Reviewers Sometimes, They’re The Best Allies

It’s a numbers game. Credit unions need a continuous pipeline of positive reviews to offset the negative ones. Many of these come organically from members praising outstanding services in a branch or celebrating a life moment like buying a car.

Gwynn Deaver, VP of Marketing, Firstmark Credit Union

If you hear a member tell a story about their positive experience with the credit union, ask them to post a review online or on social media,says Gwynn Deaver, vice president of marketing at Firstmark Credit Union($1.0B, San Antonio, TX).

And remember that every positive online interaction is a chance to educate other viewers, including potential new members, about the credit unions brand.

We always thank them for being a member-owner, Smith says. We’re awesome because of members like you!

Of course, giveaways and member appreciation events are also tools to drive positive reviews. For the past two years, Ent Credit Union($5.5B, Colorado Springs, CO) has run a twice yearly #loveent social media campaign wherein members can qualify to win free gasoline for a year. This past year, Ent also offered free coffee and T-shirts available in person at service centers.

CU QUICK FACTS

Firstmark CU

Data as of 09.30.18

HQ:San Antonio,TX

ASSETS:$1.0B

MEMBERS: 99,050

BRANCHES:15

12-MO SHARE GROWTH:-1.3%

12-MO LOAN GROWTH:0.3%

ROA:0.64%

We wanted to give back to the members in a way that impacted their lives,says Amy Krasikov, director of marketing operations at Ent.We wanted a giveaway that would improve their finances. We thought we were signing it as you would a card,Love, Ent. The members turned it around in such a fantastic way and chose to share how they loved us.

It also helps for the credit union to respond to positive reviews and nurture brand advocates online. These loyal members might very well respond to a negative review and jump to the credit unions defense with something like,I’ve never had that experience before.

Not every post can be replied to,Krasikov says.Some posts, by the way the statement is posed, are a lose-lose for the credit union. When these posts occur, we often let members respond on our behalf.

2.Keep An Eye Out For All Reviews And Respond Immediately

Facebook has emerged as the top channel for social media engagement for credit unions, so Facebook reviews often have high visibility. As such, credit unions need to monitor all Facebook pages related to their organization. A Facebook page might havebeen created years ago and long forgotten, or Facebook might have created a rogue business page that the credit union doesnt even know about.

Amy Krasikov, Director of Marketing Operations, Ent Credit Union

Our average member age is 44, says Ent’s Krasikov.Facebook has been skewing to this age group, and we have a solid reach into our membership and potential membership leveraging this tool.

Other key review sites include Yelp and Google Places, which allow reviewers to comment on individual branch locations. However, negative reviews and posts can also appear on a variety of other sites including Twitter,LinkedIn, Zillow (related to mortgage lending experiences), and even Angies List. Still more reviews about working at the credit union can be found on employment sites such a Glassdoor and Indeed.

One of the key strategies for mitigating negative reviews is responding immediately.

CU QUICK FACTS

Ent CU

Data as of 09.30.18

HQ: Colorado Springs, CO

ASSETS:$5.5B

MEMBERS:332,077

BRANCHES:31

12-MO SHARE GROWTH:9.0%

12-MO LOAN GROWTH:13.4%

ROA:1.07%

We try to resolve it on the same day, says Heritage FCUs Smith.Having that immediate response out there is important for other members to see.

To keep track of all of the places reviews could live on the web, some credit unions rely on tools that aggregate online content. Earlier this year, Heritage FCU began using CUBrandMonitor from Callahan & Associates to keep track of these social properties.

Facebook is easy because they have push notifications, and Twitter does, too, Smith says. But if I don’t think to check Zillow, I don’t know if we have a new comment. CUBrandMonitor gives us a push notification from all of those platforms and also notifies us if there’s a photo we’ve been tagged in on our Google listings. It helps us prioritize things to keep on our to-do list and gives us peace of mind.

The transparency of Facebook reviews both good and bad helps build brand loyalty, but does it ever make sense to turn them off?

ContentMiddleAd

It did for Firstmark, when the credit union faced challenges in providing service across multiple channels, causing major pain points for members.

We made the decision to turn off reviews to allow the organization to focus on improving those processes,Deaver says.This past summer, we turned the reviews back on. The feedback, both positive and negative, that we receive from the reviews is valuable to us and helps us address areas that need improvement.

3. Take The Discussion Offline

Even if members aren’t concerned about privacy, credit unions have to be. Its not uncommon for members to share an account number or screenshot of account balances to prove their point. And because credit unions don’t have the ability to authenticate social posts as they can with online banking or a call center, it’s a good idea to never even verify someone as a member online.

Instead,use that first step toward verification to clear up potential confusion, advises Smith. Occasionally, reviewers post to Heritage FCU when they really meant to complain to another financial institution with Heritage in the name.

Click the tabs below to view images.

HERITAGE FCU REVIEW

This Heritage FCU member changed their rating from five stars to one star and back again to five after a simple call back from the right manager.

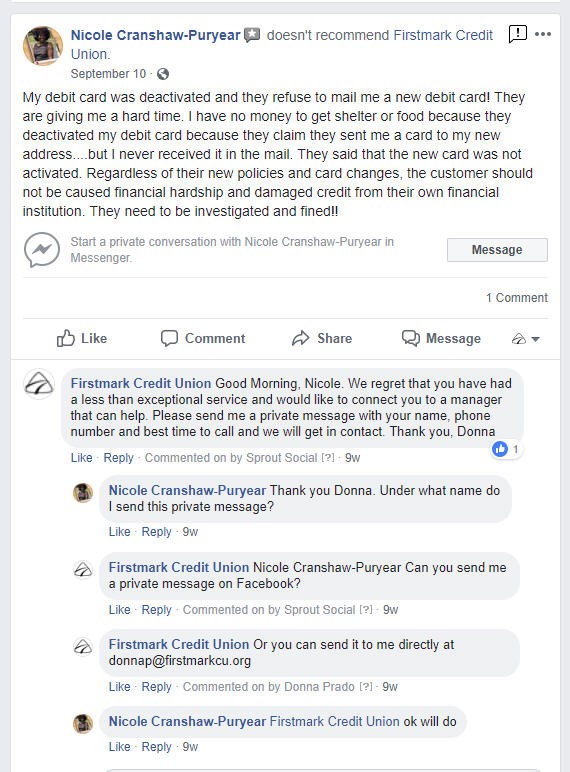

FIRSTMARK CU NEGATIVE REVIEW

When Firstmark converted its debit card portfolio from MasterCard to VISA, this member was caught unaware despite many warnings from the credit union that the old card would be deactivated.

FIRSTMARK CU NEGATIVE REVIEW UPDATE

Firstmark turned the relationship around by temporarily reactivating the card until the new one arrived.

Sometimes they’re sending information they shouldn’t be and we get to educate them that it’s not secure,Smith says.The great thing is we have messenger through our mobile app, and that’s a more secure way to talk to the credit union. We can verify identity through the mobile, so it’s much more expedient.

Again, speed to resolution is what really matters to the member. Social media managers can apologize as much as possible, but they need to take it offline and refer the complaint to the correct person in the organization who can resolve it.

When a member complains, we want to understand their situation and help them speak with a credit union leader who can either work with them or help them to understand the decision,Krasikov says.

4. Be Authentic In Responses

In recent years, consumers have learned to be on the lookout for astroturfing the practice of posing as someone else online to promote an organization or cause. That means even good reviews on social properties might not be as convincing as theywere before.

If the reviews aren’t authentic, they don’t carry weight, Krasikov says.Audiences are becoming more jaded toward five-star and one-star reviews and are leaning toward the middle ground because of astroturfing. For credit unions, I hope our reviews are authentic. I know Ents are. We believe in improving members financial quality of life, and our reviews and member posts reflect that.

That same tone of voice applies to the way the credit union responds.

Be authentic to the tone of your credit union, Krasikov advises. If you’re conversational and weird, be conversational and weird on social media. If your brand is conservative and friendly, then be conservative and friendly on social media. The key is to be the organization online that you are in person.

Deaver adds that when a member is having a problem, it’s important to show empathy toward their predicament no matter how negative the review.

Our tone is soft, understanding, and polite,Deaver says.There are times when we use a more direct tone, but the underlying message is always professional, respectful, and understanding. Our philosophy has never been to spina situation. We are transparent and honest with the reviewer and work to resolve their problem the best we can.

5. Go Above And Beyond The Call It Just Might Pay Off

Some complaints, such as one about a loan decision, can’t be reversed to the member’s satisfaction. But at the very least, the credit union can explain in person why the decision was made and that policies were followed consistently.

But credit unions can resolve other common complaints such as a check or deposit hold or a fraud alert lockout even if doing so requires the credit union to vary from a policy.

For example, Heritage FCU once had a member who failed to enable travel notifications before leaving town for a Saturday night concert. The member stopped to fill up the car and realized the card didn’t work. Card services came in on Sunday to release the hold, but by then it was too late. The concert was over. To make up for the inconvenience, the credit union refunded the cost of the concert tickets to the member’s account.

You have to look at the history of the member and if they’re a good member with a long history with you, Smith says.It’s worth it to exceed their expectations.