It’s hard to say what makes a thing cool because coolness is both subjective and variable. To steal from former Supreme Court Justice Potter Stewart: coolness is something you know when you see. And for many brands, being uncool is a fact of existence.

Money is cool. People like to have it; they like to find new ways to get it, like companies that will help manage it. Even if it’s not the most popular, the financial services industry is cool in its own way.

For the fourth consecutive year, Bank Innovation ranked the 10 coolest brands in banking. The list, in order from coolest to lamest:

So what’s cool this year? Here we look at what seven of these coolest companies are doing right:

Person-to-Person Finance

Venmo

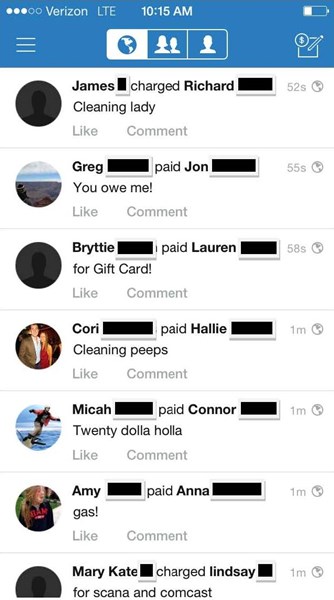

Quickly becoming ubiquitous in the peer-to-peer payments space, Venmo is growing fast thanks to its ease of use and social capabilities the app features a newsfeed that allows users to see a display of friends’ payments. In the third quarter of 2014, Venmo processed $700 million in payments, according to Bloomberg, up from $141 million in the same period in 2013.

Although the company doesn’t share its user numbers, Venmo, according to eBay chief executive John Donahoe, is on fire. In the big picture, the company’s ultimate vision is to build a user base so large that Venmo becomes a default mobile checkout option, earning money by charging merchants for processing the transaction. A 2013 Forrester Research study estimated the amount of money spent by Americans via mobile payments will reach $90 million in 2017 and merchants are likely to work with whatever intermediary customers prefer. For Venmo, things aren’t all roses. It’s weathering serious security concerns and facing stiff competition, most notably and recently from Facebook.

Lending Club

Lending Club is a peer-to-peer lending service that connects borrowers to investors for personal or small business loans. These loans have caps of $35,000 and $300,000 respectively, and rates can vary from 5.93% to 26.06% depending on credit risk and market conditions.

According it its site, to date Lending Club has issued 595,128 loans, corresponding to approximately $7.6 billion. In fourth quarter 2014, the company issued 117,806 loans worth $1.4 billion.

With Lending Club, peer-to-peer may be a bit of a misnomer Lending Club’s founder has suggested calling it marketplace lending. The company’s investors are, according to Bank Innovation, increasingly institutions such as hedge funds or mutual funds, and Lending Club has even set up a department solely focused on working with financial institutions interested in buying loans through its platform.

Lending Club is growing. In addition to growing loan issuances and amounts more than 500% since fourth quarter 2012, in August of 2014 the company filed for an IPO with the SEC. By December, it raised$1 billion.

Payments

Starbucks

While Apple is searching for a way to get people to ditch their physical wallets for mobile phones, Starbucks already has. According to CEO Howard Schultz in a late 2014 conference call, mobile payments made at Starbucks locations were growing nearly 50% annually. Furthermore, though he didn’t cite a source for the data, 90% of all mobile payments in 2013 were made at Starbucks.

The app is an extension of the Starbucks plastic card, a proprietary payment option. The app allows customers to pay for purchases, view balances and manage cards, and earn and track rewards all by scanning a 2-D barcode at the register at checkout.

The program has been successful in large part due to the robust rewards offered. The more one pays with the app, the greater the rewards one can earn, whether it be free in-store refills, custom offers via email, or even a free food or drink item.

Stripe

Stripe provides a way for individuals and businesses to accept payments over the Internet. An alternative to a merchant account, it’s used by more than 17,000 websites and supports payments in nearly 20 countries and in more than 100 currencies. Stripe charges 2.9% plus $0.30 per successful charge, potentially less based on volume. It counts Kickstarter, Salesforce, Lyft, Shopify, Foursquare, Twitter, Rackspace, and Reddit as clients, processes bitcoin transactions, and has received more than $190 million in venture capital.

Just 2% of global purchases take place online, according to Stripe, but that figure will only increase. And Stripe plans to figure prominently in that growth.

We want to increase the GDP of the Internet, says Andy Young, head of Stripe UK, in a December 2014 Wired talk.

Apple

Apple released Apple Pay in 2014, the highest profile launch of a digital wallet service. You’ve probably heard about it. We’ve written about it a ew times on this very site.

InfoScout and PYMNTS.com released Apple Pay By The Numbers: Adoption And Behavior. The survey, based on more than 1,000 individuals who had iPhone6’s and therefore could have used Apple Pay, found a marginal uptick in Apple Pay usage in March 2015 compared to figures from a similar survey conducted in November 2014. 6% of those surveyed use the service and 9% had tried it but weren’t using it up from 5% and 4% respectively from November leaving 85% who had never tried it. Major hurdles Apple faces are awareness and merchant acceptance.

As we’ve previously reported, the launch of Apple Pay is the first shot in a large scale digital wallet war; a war with effects that haven’t yet been seen. Still, Apple succeeded in creating a wide-spread discussion about mobile payments and digital wallets, and that’s pretty cool.

The Anti-Banks

Fidor

The German bank Fidor considers itself the pirate of banking, a creative description for what Bank Innovation calls an anti-bank.

Fidor operates a branchless model and added 51,000 users in 2014 to reach approximately 264,000, increasing loans outstanding 41% year-over-year to $233 million. In May 2014, Fidor became the first bank to integrate Ripple’s (another top-10 coolest) payment protocol as part of its transaction infrastructure. The move will allow Fidor’s customers to send money in any currency (read: bitcoin) in any amount at a lower cost. In February, Fidor announced its intentions to open a banking platform in the U.S. pending regulations that could increase domestic adoption of cryptocurrency.

U.S. Bank

Don’t think of us as a bank, said Dominic Venturo, the bank’s chief innovation officer in an American Banker article from 2014. Think of us as commerce. We are experts in payments and enable commerce.

In early 2014, U.S. Bank released plans for mobile shopping software called Peri. The product is designed to make advertisements on marketing channels such as print, television, or radio searchable to make shopping seamless.

To communicate between phone and advertisement, one of the necessary technologies is digital watermarking. It’s a technology that embeds digital information in audio, images, and printed materials and is detectable by a smartphone. With this technology, brands can determine which advertisements are responsible for each sale. According to Payments Source, U.S. Bank will test Peri in the first quarter of 2015 through partnerships with a magazine and several large retailers.