Credit unions are different from banks. Most credit union members understand this.

Credit unions don’t have stockholders to distract management and skim off the profits. Instead of fixating on profits for stockholders, credit unions can direct all their attention to providing the best deal in retail financial services to their members. They are mission-driven institutions with a legal obligation to deliver value to members.

That’s one heck of a value proposition that seems to be resonating with consumers. According to first quarter data reported by Callahan & Associates during its quarterly Trendwatch webcast:

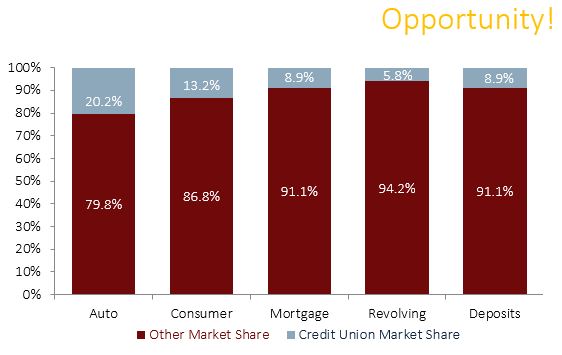

- Credit union market share of auto finance was 20.2% an all-time high.

- Credit union market share of non-revolving consumer loans was 13.2% an all-time high.

- Credit union market share of first mortgage originations was 8.9% an all-time high.

- Credit union market share of revolving consumer loans was 5.8% an all-time high.

- Credit union market share of consumer deposits was 8.9% an all-time high.

ContentMiddleAd

Credit union leaders should be proud of this performance. But, is the movement being ambitious enough?

Aside from auto finance, credit unions’ total market share for core products and services is only 9%-10%. That leaves a lot of opportunity on the table.

CREDIT UNION MARKET SHARE BY LOAN SEGMENT

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.18

Source: Callahan & Associates.

Credit unions should be the right choice for the majority of American consumers, so why isn’t the movement doing better?

CUNA research validates what many leaders have observed anecdotally:

- Too many Americans don’t know what a credit union is.

- Too many don’t understand the cooperative model.

- Too many think credit unions are too small, too inconvenient, and not able to deliver the same level of service as big banks.

- Too many don’t think they can join or think they have to belong to a labor union to join.

These are real challenges, no doubt. But there are other issues than run deeper than misunderstandings about what a credit union is and whether or how one can join.

When I talk with credit union leaders across the country, I often ask them about their primary competitors. More often than not, they cite other credit unions. If my math is right, that means credit unions are fighting over 10% of the population that already are getting good value from a credit union rather than focusing on the 90% using banks.

This makes no sense.

Credit unions might be underdogs, but they have a distinct advantage that goes beyond ownership and tax exemptions: Credit unions can collaborate. They can work together to deliver value to the communities and consumers they serve.

Yes, every credit union has its own distinct set of challenges and opportunities. But as individual institutions that together comprise a larger movement, credit unions also have an awful lot in common. Instead of leveraging those commonalties to compete more effectively against banks, many credit unions maybe even most focus on what makes them different.

Why do credit unions obsess over their differences rather than make the most of their commonalities? That’s not how movements succeed.

For a movement to succeed, its players must work together, not bicker among themselves.

For a movement to succeed, its players must work together, not bicker among themselves.

It’s not competition or consumer awareness that stands in our movement’s way. If credit unions want to serve members 100 years from now heck, 10 years from now they must start aiming higher, being more ambitious.

To do that, the movement needs more than words. It needs action. It needs collaboration.

It’s Time For Tough Questions

Asking tough questions helps the credit union movement flourish. Make Callahan’s Tough Questions commentary on CreditUnions.com a regular stop for insight on thinking differently about the movement and framing strategies for success.

Read More Commentary

Is The Credit Union Movement Ambitious Enough?

Credit unions are different from banks. Most credit union members understand this.

Credit unions don’t have stockholders to distract management and skim off the profits. Instead of fixating on profits for stockholders, credit unions can direct all their attention to providing the best deal in retail financial services to their members. They are mission-driven institutions with a legal obligation to deliver value to members.

That’s one heck of a value proposition that seems to be resonating with consumers. According to first quarter data reported by Callahan & Associates during its quarterly Trendwatch webcast:

ContentMiddleAd

Credit union leaders should be proud of this performance. But, is the movement being ambitious enough?

Aside from auto finance, credit unions’ total market share for core products and services is only 9%-10%. That leaves a lot of opportunity on the table.

CREDIT UNION MARKET SHARE BY LOAN SEGMENT

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.18

Source: Callahan & Associates.

Credit unions should be the right choice for the majority of American consumers, so why isn’t the movement doing better?

CUNA research validates what many leaders have observed anecdotally:

These are real challenges, no doubt. But there are other issues than run deeper than misunderstandings about what a credit union is and whether or how one can join.

When I talk with credit union leaders across the country, I often ask them about their primary competitors. More often than not, they cite other credit unions. If my math is right, that means credit unions are fighting over 10% of the population that already are getting good value from a credit union rather than focusing on the 90% using banks.

This makes no sense.

Credit unions might be underdogs, but they have a distinct advantage that goes beyond ownership and tax exemptions: Credit unions can collaborate. They can work together to deliver value to the communities and consumers they serve.

Yes, every credit union has its own distinct set of challenges and opportunities. But as individual institutions that together comprise a larger movement, credit unions also have an awful lot in common. Instead of leveraging those commonalties to compete more effectively against banks, many credit unions maybe even most focus on what makes them different.

Why do credit unions obsess over their differences rather than make the most of their commonalities? That’s not how movements succeed.

For a movement to succeed, its players must work together, not bicker among themselves.

It’s not competition or consumer awareness that stands in our movement’s way. If credit unions want to serve members 100 years from now heck, 10 years from now they must start aiming higher, being more ambitious.

To do that, the movement needs more than words. It needs action. It needs collaboration.

It’s Time For Tough Questions

Asking tough questions helps the credit union movement flourish. Make Callahan’s Tough Questions commentary on CreditUnions.com a regular stop for insight on thinking differently about the movement and framing strategies for success.

Read More Commentary

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Credit Union Data Predicts Who Will Win Super Bowl 2026

140 Million Reasons To Lend

Rethinking Auto Lending And The Choices Facing Credit Union Leaders

Keep Reading

Related Posts

Financial Nihilism Is Real, But How Can Credit Unions Respond?

2026 Begins With Market Sentiment Similar To 2025

Preparing For 2026: Why The NCUA’s New Succession Planning Rule Elevates The Strategic Role Of Credit Union Boards

5 Tucson Credit Unions Join Forces For Affordable Housing

Savana MorieHow APL FCU Builds A Board Succession Pipeline

Aaron PassmanHow 2 Credit Unions Reduce Recidivism 1 Class At A Time

Savana MorieView all posts in:

More on: