BluCurrent Credit Union ($265.5M, Springfield, MO) has been on the same core processing platform since the turn of the century, but little else has remained the same thanks to Diann Hollen-Stansbury. The director of core services has help guide technology at the Show Me State cooperative since she joined the team in 2010.

It’s not typical for a credit union of that size, or any size, to have someone specifically in that role given this age of plug-and-play commoditization, but Hollen-Stansbury’s work speaks to the critical role the core plays as the operational hub in today’s credit union. Her work also underscores how someone dedicated to making the most of the core can make a difference in the entire operation.

Hollen-Stansbury joined the former Postal Federal Community Credit Union in February 2010 and became director of core services in July 2011, a month before the cooperative became BluCurrent Credit Union with a charter to serve 10 counties in southwest Missouri.

Here, she describes how she works with the core platform and her colleagues.

What core is BluCurrent on? Do you operate the core in-house or through a service bureau?

Diann Hollen-Stansbury: We’ve been on the Symitar Episys system since 1998. We operate through an independent CUSO, Managed Financial Networks. Our servers for our core processing are in the Springfield Underground.

Why did BluCurrent create a title and role of director of core services?

DH: Our IT team was growing quickly. In-house projects created new needs that required a new role. In my current role, I function as somewhat of a liaison between the banking-focused staff and our IT team.

I talk to the staff to understand, from a banking perspective, what their needs are and translate that into actionable items on the IT side. I’ve been in the banking industry for 24 years, so I’m able to translate banking terminology into actionable IT items.

Once I moved into the director of core services role, I was able to pull in new functionalities that benefit the credit union. BluCurrent was able to grow alongside its core system.

The credit union also didn’t have a team member who continually reviewed core system releases. Once I moved into the director of core services role, I was able to pull in new functionalities that benefit the credit union. BluCurrent was able to grow alongside its core system.

Broadly, what do you do at BluCurrent?

DH: I work with anything that touches the core. This includes how data flows into the core, how the core is functioning, and protecting the data from system to system. I focus on what data goes where and how it gets there.

I also talk to third-party vendors when the credit union is considering adding a new product or service and assess how it will impact the IT area.

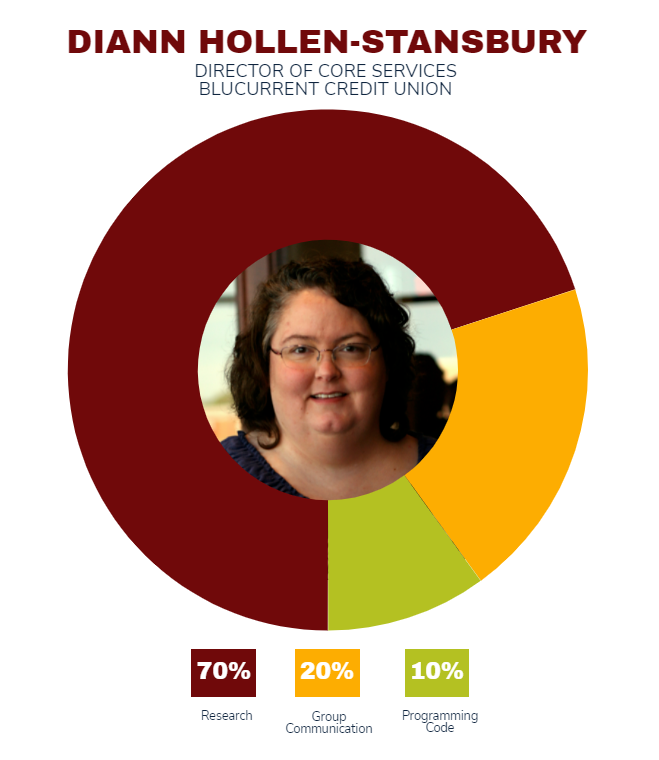

I spend much of my time researching, including regulations, how to do things differently in the core, and why certain things are happening.

More specifically, what do you do and how does your role bring value to the credit union?

DH: I assess how things work and why they are functioning a certain way. I also review the documentation the credit union has access to. If it goes beyond the documentation the credit union has readily available, I work with the vendor to get additional information. Overall, I dig in to see what the program is doing.

I have attended user conferences and participated in core alpha testing for several years, which means testing what goes on before it goes to the beta testers.

I use the core processor’s robust website, resources, releases, and documents. There’s also a user-created library of programs that have different functions. It’s especially helpful to see how other credit unions have completed projects and done things. This stops you from having to totally re-create something or start from scratch.

How has improved integration and other advances helped BluCurrent offer new products and services?

DH: We previously handled project management from start to finish internally. Now the vendors assist with project management. They communicate with one other directly and work together to figure out what the credit union wants and where it should be done in the system. Does it make more sense for the core to house something or a different program?

For example, our online and mobile banking vendor recently worked directly with our card provider to set up card controls for our members. We’ve seen advances in cards, like contactless payments and mobile wallet. All of the pieces are working together at the same time to make this possible.

How have these improvements helped improve your own internal processes?

DH: It has helped fill in the gap between what the staff needs and what the programmers can accomplish and provide. It has helped translate from front-line staff needs to code.

Who do you report to? Who reports to you?

DH: I report to our senior vice president of information systems. I don’t have any direct reports at this time, but we hope to continue to grow our team.

CU QUICK FACTS

BLUCURRENT CREDIT UNION

DATA AS OF 09.30.21

HQ: Springfield, MO

ASSETS: $265.5M

MEMBERS: 23,237

BRANCHES: 4

12-MO SHARE GROWTH: 13.8%

12-MO LOAN GROWTH: 18.0%

ROA: 1.47%

What makes you a great fit for this job?

DH: I have a computer information systems degree, which is significant because computer science degrees have more emphasis on the technology behind things, like operating systems. My degree was more focused on the business side. I have 24 years of banking experience and previously worked for a large core processor.

What challenges and opportunities for the credit union does your role address and how do you address them?

DH: As for opportunities, we’re staying up to date with core system advantages and producing more in-house programming work, which allows us to develop and customize programs to meet our specific needs.

We had to challenge the team to shift their mentality to a more proactive way of approaching things like pending updates, regulatory changes, and data validation and cleanliness. All this will help us avoid problems that could lead to potential fines or other penalties.

What’s your daily routine at BluCurrent?

DH: I do research on how to make things work and coordinate systems with one another. I also figure out how to do what the credit union wants to do, like process changes, program changes, or a combination of the two. I continually seek solutions to provide new opportunities such as new software or functionalities that we should evaluate. I facilitate communication among different departments and staffing groups and do it in a way that’s understandable for all.

How has the COVID-19 pandemic affected what you do at BluCurrent?

DH: We went from working in the office to many working remotely. Our responsibilities have stayed the same. As a team, we decided to fast-track digital banking services.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How does your role improve member service?

DH: I find out the needs and requirements of different roles in the credit union and work to find a solution or a better way to do things.

How do you track success in your job?

DH: When we smoothly implement something new while making sure we address needs without impacting any other moving parts. During an implementation, it’s always disappointing when there’s an unforeseen negative impact to a different area of the credit union.

I also see success when I get assurance that things are functioning perfectly or at least as efficient and effective as possible. Our management team is great at complimenting a job well done.

I find the fact that I get to work on a team of intelligent, skillful IT professionals a success. When one of the team members wins or is successful, it’s a win for me.

How do you stay current with topics that fall under your role?

DH: I attend user conferences for our core system and sometimes for other vendor products we use. I never miss an opportunity to ask a lot of questions to the vendor directly. I review documentation, newsletters, and other publications, some of which are specific to regulations. I also participate in industry user groups one example is the Verafin community to learn what we can do to improve.

This interview has been edited and condensed.