Top-Level Takeaways

-

Franklin Mint FCU is in its fifth year of a strategy to rapidly add SEGs that then adopt the credit union as its primary financial institution.

-

The credit union has leaned on treasury, ACH, and other business essentials as well as financial education and personal outreach to add approximately 500 select employee groups a year.

Franklin Mint Federal Credit Union ($1.4B, Chadds Ford, PA) is coining new business relationships to the tune of 500 new select employee groups (SEGs) a year.

Typically, a SEG is a source for consumer member relationships. That’s the case at Franklin Mint, too, but the Philadelphia-area cooperative also has a fast-growing business serving the banking needs of the SEGs themselves.

The credit union deployed that strategy in 2016, but veteran business lender and relationship builder Marc Ernest took the strategy to the next level in 2017 when he assumed the role of chief relationship officer. Typically, that’s a natural person member emphasis, but FMFCU has a chief retail officer with those responsibilities.

Marc Ernest, Chief Relationship Officer, Franklin Mint FCU

The credit union kicked off its SEG strategy by dividing the business into three groups: small (1-25 employees), middle market (25-225 employees), and major (225 employees or more). The credit union already had the ability to serve the small and middle groups but not the major employers.

FMFCU beefed up its business suite by adding treasury management solutions, remote deposit checking, ACH, sweep accounts, accounts receivable, SBA loans, secured and unsecured real estate loans, construction loans, andvery competitive business checking accounts.

Except for point-of-sale merchant services, the credit union runs all functions in-house, Ernest says, which allows FMFCU to optimize the credit union differentiator.

Chief relationship officer usually refers to retail member banking work, but not at Franklin Mint FCU. The credit union has a chief retail officer for that. Find out more about Marc Ernest’s role as chief relationship officer here:What’s In A Name: Chief Relationship Officer.

That’s our opportunity, the relationship officer says.We can control pricing and the member experience. When there’s a problem or issue, we take care of it instead of pushing it off to the vendor. Right now, we feel like we can bank any member.

That includes the stand-alone entrepreneurs all the way to the 1,500-employee healthcare operations and local universities.

Expanded Staff Nurtures Business

Although building the infrastructure in-house takes time and effort as does keeping the business development and branch staff up to date on the ins-and-outs of their cooperative’s capabilities the results have been striking.

Ernest was the only commercial lender when he joined the credit union in 2008, and the role was part of his duties as a district manager. The credit union’s clientele were multifamily real estate and owner-occupied commercial businesses that required only basic banking services and small lines of credit.

Then, the credit union deployed its new strategy and SEGs served grew from 2,700 SEGs to more than 5,100 in five years.

We don’t even use the term SEG’ much anymore, Ernest says.We call them commercial and business clients.

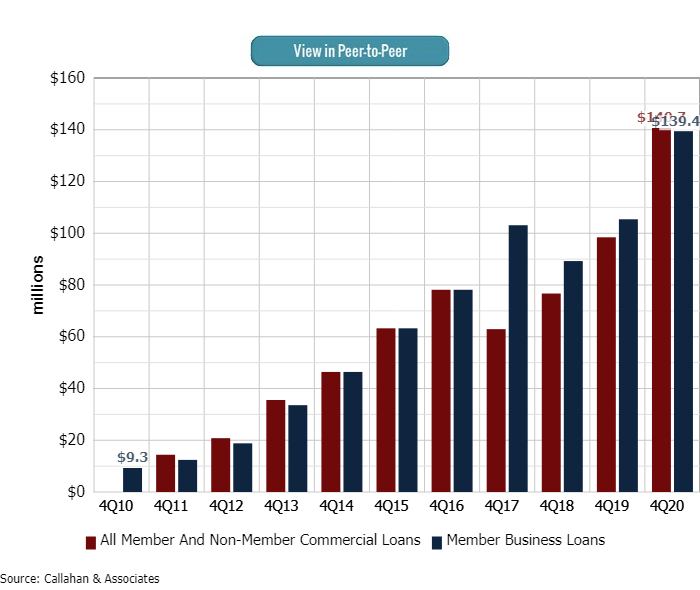

At the end of 2016, the cooperative held 596 member business loans worth approximately $73.7 million. At the end of 2020, there were 461 with $140.7 million in outstanding balances.

That growth doesn’t even include the 200 notes worth $35 million the credit union transferred from its commercial loan balance sheet when the NCUA changed how it categorized housing loans for one to four units. That portfolio of loans and 5,000 or so business accounts is nurtured by a staff that includes a sales team dedicated to seeking out commercial loans.

Currently there are seven of them, Ernest says, including three senior relationship managers who together oversee an area that includes Delaware County where FMFCU is the largest home-based financial institution Chester and Montgomery counties in Pennsylvania and Newcastle County in Delaware.

Focus On Relationships And Engagement

Relationship managers at FMFCU concentrate on just that relationships. And in 2016, the credit union moved the loan application process into the hands of a commercial lending analyst.

They can spend more time developing relationships and less time on the process, Ernest says.

As a result, relationship managers can concentrate on engagement and, to date, the credit union considers approximately 80% of those accounts active. But what doesactive mean at FMFCU?

COMMERCIAL LOANS AND MBLs

FOR FRANKLIN MINT FCU | DATA AS OF 12.31.20

Callahan & Associates | CreditUnions.com

Franklin Mint FCU has turned out dramatic growth in business lending during the past several years.

They meet one of three metrics, Ernest says.Any sort of loan from us, a checking transaction within the past 30 days, or $1,000 or more in a checking account.

The FMCU chief relationship officer says the credit union would like to see that percentage move closer to 85% and sees expanded treasury management and ACH service as key drivers to continue engaging businesses.

In fact, there’s a relationship management support specialist whose job is to work with branch staff and relationship managers specifically on treasury management solutions, using training sessions and other awareness efforts.

Currently, Ernest says, the relationship managers have a goal of 83% active for all new business accounts opened in 2021.

That drives them to pull lists, introduce themselves to new business clients, look for loans, and call on existing clients, Ernest says.

FMFCU also expects its relationship managers to drive natural person members from SEGs into the credit union fold.

CU QUICK FACTS

Franklin Mint FCU

Data as of 12.31.20

HQ: Chadds Ford, PA

ASSETS: $1.4B

MEMBERS: 116,337

BRANCHES: 34

12-MO SHARE GROWTH: 20.3%

12-MO LOAN GROWTH: 7.6%

ROA: 0.67%

According to Ernest, his emphasis on hiringbranch people for business relationship roles helps the credit union achieve its goals. The kind of experience and immersion in the credit union philosophy these employees hold means they are familiar with the availability and value of consumer products, and they take pride in encouraging SEG employees to take advantage of those opportunities, too.

They take a lot of pride in that, Ernest says.The goals can almost seem irrelevant at times.

Personal Outreach And Financial Education

Creating awareness around what credit unions especially FMCU can do is especially challenging when it comes to businesses.

So many just don’t know or pay attention to what we can do for them, Ernest says.Their perception is we’re the place their parents go for auto loans. That’s why it’s important to get them to sit down with us for a conversation.

Along with the power of personal outreach and traditional advertising and local business outreach through chambers of commerce and other networking opportunities FMCU has found financial education is one of its most powerful engagement tools.

The community education manager is part of Ernest’s team and works closely with the relationship manager as part of the business development process. FMFCU was conducting close to 100 seminars a year in person, but the pandemic has introduced a new way to reach more people with fewer sessions.

We still do a lot of the financial literacy and education webinars, but doing them virtually has grown attendance, Ernest says.We started with about 18 attendees each time and now average 45 or so. And it’s increasing.

It’s an intentional strategy, the result of combining SEGs for a single presentation when possible.

We call it less is more’ and focus on bringing more professional speakers to more people at a time, Ernest says.The turnout has been amazing. We now get 200-plus registrants to our seminars. And for those 75% who don’t make it, we have their info and can reach out later.

Along with presenting valuable information about college planning and other hot topics in real time, the webinars yield data that provides further value to the engagement effort overall.

We get post-survey data about what’s on employees’ minds and can share that with the employers, Ernest says.

And that creates even more opportunities for what FMFCU has to offer those companies and the people who depend on them for their livelihood.