Since the beginning of time, lenders have sought a way to accurately measure and predict risk in their loan portfolios. Understanding risk allows lenders to make sound credit decisions and properly price loans. Ideally, lenders need to make, at the very least, a high enough return on loans to cover the principle and any costs, including losses, associated with the loan.

Unfortunately, the inability to properly measure, manage, and predict risk appropriately has been the ruin of many a lender. Putting one’s finger on the cause and effect of the multitude of factors that can influence a borrower’s desire to originate a loan and ability to repay can be a time-consuming endeavor. Most lenders, like myself, were trained to read a credit report and consider each loan request independently. We never really looked beyond that individual credit application or borrower. Considering aggregate trends in a portfolio, and even market performance, can be helpful to gaining a greater insight into future performance.

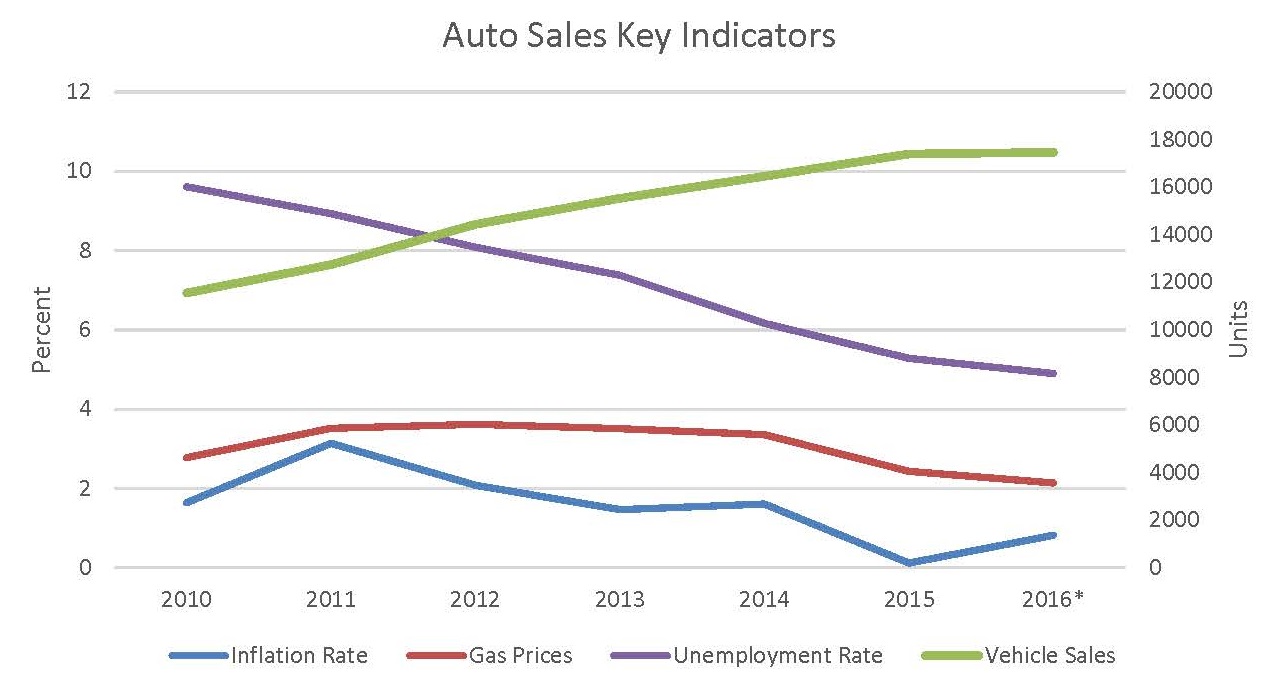

Let’s take a close look at how external factors influenced consumers’ behavior during the most recent recession cycle. One might assume that inflation and fuel costs would have had a role to play in consumer demand for new vehicles. Yet, more than any other factor, since 2010, the unemployment rate had a direct, inverse correlation to auto sales. Auto sales decreased as the unemployment rate rose, and increased as the unemployment fell. Therefore, it would be reasonable, based on recent trends, to predict auto loan growth based on unemployment forecasts.

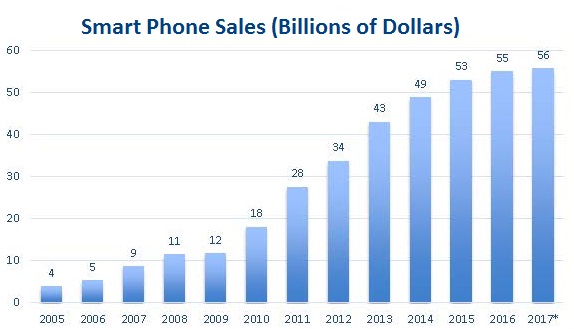

While one may find a strong correlation between unemployment and sales in the data above, it would be a fallacy to assume that unemployment rates would influence all consumer purchase decisions. For example, smartphone sales have consistently risen over the past 11 years, despite the impact of unemployment on consumers’ buying power.

According to Ipsos, a leading market research firm, many American families can spend as much or more on monthly mobile communications as they do on automobiles. So, with the same level of expense relative to income, why would consumers’ attitudes be different between one choice and another?

There is a hidden factor that we may not have considered; that is technology. Until recently, technology in automobiles has not changed at as rapid a pace as with smartphones. Therefore, consumers are willing to hold onto a current vehicle longer if they do not perceive a significant improvement in technology available in a new vehicle.

But, they may be willing to trade up if new technology provides a better user experience, even in an economic downturn, as with smartphones. This may be of particular interest to auto lenders in the future as many new vehicles are loaded with new technology. With driver experiences increasingly more dependent on the latest in technology, will vehicle owners begin to trade more often, and like old mobile phones, will used vehicles become obsolete?

Granted, most auto lenders today would simply like to get a better handle on loan pricing and losses. However, the same principles of analysis are true. One must be able to look beyond the obvious; we all know that that delinquency rates will change when there are major shifts in the health of the economy. We don’t need a crystal ball for that.

I’d argue that the hidden risks are probably the most problematic for credit unions. Delinquencies and losses in small segments of the portfolio that point to lax collection practices or loopholes in underwriting practices, if unchecked, could grow to be real issues.

This is just one example of how analytics can help lenders go beyond the typical ratios used today to manage and improve portfolio performance. Credit unions need to incorporate the kind of analytics that can dig deep beyond the surface to discover important facts about their loan portfolios, predict future performance and allow credit unions to make better, faster decisions.

CU Direct’s new fourth generation Lending Insights Loan Portfolio Management System helps credit unions maximize their ability to translate lending data into predictive analysis to effectively uncover risk and new opportunities.

Understanding the value of the data credit unions are collecting is vital, notes my colleague, Courtney Collier, product manager of the Lending Insights program. There are three essential steps when working with a credit union ― helping them collect data from disparate sources; cleansing the data to ensure that it is accurate; and constructing data models to make it easy to extract and formulate insights.

We’ve tied extensive data from our Lending 360 Loan Origination System directly into the new Lending Insights, helping lenders better manage indirect dealer relationships, connecting application performance data to portfolio data. As a result, business development representatives can share individual dealer reports with their dealer network.

Lending Insights’ predictive analytics includes support for the new CECL regulations, which change the way credit unions account for future losses. This next generation of analytics helps credit unions develop and leverage a Big Data strategy that will help increase profitability and efficiency, drive business decisions, and maintain a competitive marketplace edge.

Michael Cochrum is vice president of analytics and advisory services at CU Direct in Rancho Cordova, CA.