When Caroline Santangelo joined Workers Federal Credit Union ($2.5B, Littleton, MA) three years ago, she brought with her more than 20 years of experience in improving marketing through targeting and segmentation, primarily with large insurance companies.

Two years later, the Bay State cooperative promoted her from vice president of marketing to senior vice president of marketing and product performance, reflecting a commitment to using advanced data analytics to provide actionable insight into members’ basic financial needs.

Here, Santangelo talks about her role.

Why did Workers create this role? Is it specific to you?

Caroline Santangelo: The title was created to reflect that, in addition to my prior duties as head of marketing, I’ll also be driving the performance of products by furthering the credit union’s understanding of member wants and needs and deepening member relationships and engagement.

What challenges and opportunities does your role address?

CS: It’s a challenge to change the way people think about their financial institution as being only transactional instead of relationship-based.

It’s a great opportunity to share the innovative work Workers does in providing products and services that truly improve the daily lives of our members, and in doing so, build stronger communities across the region. The more people learn about us, the more our engaged membership grows.

What initiatives drive product performance by furthering Workers’ understanding of members’ wants and needs?

CS: It’s as simple as listening and taking action, whether that’s through one-on-one interaction or via our member feedback platform. Data analytics also plays a critical role in understanding. Numbers aren’t just numbers, they’re the aggregation of member thoughts, feelings, and behavior.

What Can You Learn From Like-Minded Leaders? Credit unions are responding to the evolving needs of members with a variety of products and services. Callahan Roundtables put leaders in the same room to share solutions, solicit feedback, pose questions, and more. Inspiration is a Roundtable away. Learn more today.

What are your goals for strengthening member relationships and engagement? Describe the program in, say, five years.

CU QUICK FACTS

Workers FCU

DATA AS OF 06.30.22

HQ: Littleton, MA

ASSETS: $2.5B

MEMBERS: 122,928

BRANCHES: 17

EMPLOYEES: 371

NET WORTH: 14.8%

ROA: 0.53%

CS: We want to meet members where they are, at any life stage. Our go-to-market model reflects that. Five years from now, Workers will continue to innovate products and programs for a growing number of engaged members. But based on Workers’ unique mission, the ultimate measure of success is whether we’re improving the financial wellness and daily lives of our members.

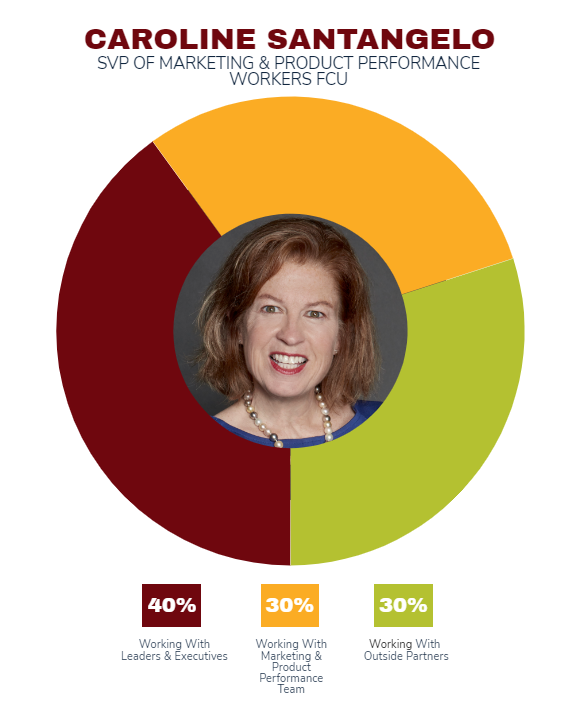

How do you work across the enterprise to create and execute on your goals?

CS: I believe in building a strong team based on trust and the willingness to do what it takes for our members and for one another. I want to be a valued mentor or partner to everyone I work with. At Workers, we have a leadership team we call the Stakeholder Team, and everyone brings their A game.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What’s your daily routine at the credit union?

CS: It’s such a fast-paced environment, which I think would be very surprising to people who don’t understand credit unions. No two days are alike.

What makes you a great fit for the job?

CS: I index high on creativity and storytelling, both of which are central to driving innovation and getting others on board. I also have a strong background in strategy and analytics. This enables me to think big picture while keeping the individual member at the center. I think people would say I’m a strong leader as well as a team player — and I always keep it fun!

This interview has been edited and condensed. This article originally appeared on CreditUnions.com on April 3, 2023.