Top-Level Takeaways

-

Through the IRS’s VITA program, credit unions across the country help underserved community members prepare and file taxes at no cost.

-

Although VITA is a single program, how credit unions participate takes many forms, from partnering with community organizations to training in-house tax preppers.

Credit unions’ long history of community service extends beyond lending and savings. This time of year, especially, cooperatives participating in the federal government’s Volunteer Income Tax Assistance (VITA) program help community members maximize tax returns at a minimal expense: Free.

The VITA program offers hands-on tax preparation by IRS-certified volunteers to assist people who make $54,000 or less a year, have disabilities, are elderly, or who speak limited English.

Along with saving the participants the filing fees charged by private services, the VITA program helps ensure households receive their maximum refunds plus all the benefits to which they’re entitled through the federal Earned Income Tax Credit and other federal and state tax credit programs.

VITA sites pop up each spring at such locations as libraries, schools, shopping malls, community and neighborhood centers, and, of course, credit unions. This year, participating cooperatives include Georgia United Credit Union, UVA Community Credit Union, Border Federal Credit Union, and First Credit Union.

Take a look at how each of these institutions approaches this high-impact community service work every year.

Georgia United Credit Union

Kim Wall has been at Georgia United Credit Union ($1.9B, Duluth, GA) for 39 years, the past five as director of business and community development for the 171,200-member cooperative. Georgia United has been offering VITA services in collaboration with the University of Georgia for the past 17 years and with Dalton State College for the past nine years at branches near the college campuses.

The Georgia United Foundation works with Professor Lance Palmer from UGA’s College of Family and Consumer Sciences to coordinate the VITA program and the 130 student preparers. The foundation helps pay for graduate assistants to supervise the students as well as for the appointment scheduling software; the credit union provides office space after hours and on Saturdays. For its part, the university trains students who are enrolled in financial planning, accounting, or finance service-learning courses on how to provide tax prep and filing services.

The opportunity to engage with clients in a supervised setting and provide valuable services and financial education builds the students’ technical and people skills while also providing a valuable service in the community, Palmer says.

Last year, the volunteers processed 1,882 federal returns for nearly $2.8 million in refunds and 1,854 state returns for another $471,277 in refunds. In the past 17 years, they’ve processed 28,969 federal and state returns for nearly $25.9 million in returns.

Saving on those few hundred dollars in tax filing fees and getting those tax refunds translates into groceries for the month, a car payment, paying the utility bill, or being able to pre-pay rent for a few months, Wall says. Helping working families with these things helps build a stronger community.

She says Georgia United markets the VITA service through press releases in the two local markets and that both schools also promote the partnership. The credit union also has a seasonal announcement and makes online reservations available on the gucufoundation.org website.

In its VITA marketing, Georgia United highlights its partnership with the University of Georgia for VITA services offered online and or at a credit union branch in Athens.

Before COVID, we processed more returns because we allowed walk-in appointments, Wall says. Now, we only honor appointments that have been scheduled through our online system. This has reduced wait times and provided a more efficient experience for VITA clients and volunteers.

Luckily, the requirement to have an appointment has not diminished the program’s popularity.

In recent years, we have actually decreased our marketing efforts because we have so much positive word of mouth, referrals, and repeat clients, Wall says.

Saving on those few hundred dollars in tax filing fees and getting those tax refunds translates into groceries for the month, a car payment, paying the utility bill, or being able to pre-pay rent for a few months.

UVA Community Credit Union

Alison DeTuncq has been president and CEO of UVA Community Credit Union ($1.4B, Charlottesville, VA) for 23 years and is retiring from the 73,624-member institution in May. UVA Community began offering the VITA service not long after it joined the newly formed Thomas Jefferson Earned Income Tax Credit (EITC) Coalition, which is now known as Cville Tax Aid.

That collaboration provides VITA services in the Charlottesville urban area. The credit union itself offers services in six branches located primarily in the rural areas it serves, DeTuncq says. Each year, UVA Community trains and certifies approximately 35 team members from the branch and back-office staff.

This is our credit union’s largest and most significant community outreach program, the UVA Community chief executive says. It helps lift people out of poverty and creates an economic stimulus to strengthen the community in which we operate. It helps taxpayers avoid high-cost tax preparation services and in some cases predatory lending activities. It reflects our core values and creates an emotional bond with individual taxpayers that last a lifetime.

During tax time, many of UVA Community’s departments chip in to help out, including:

- Member Service Center Screening and scheduling appointments.

- Training Department Training volunteers, disseminating tax site materials, and collecting required certification documents.

- Marketing and Community Relations Developing and executing campaign marketing material and ongoing social media content. General program oversight.

- Senior Management Supporting the dedication of credit union resources to the effort.

Although the tax filing season typically begins in January and ends in April, our efforts to carry out this vital service are almost year-round and require a significant commitment of credit union resources and staff time, DeTuncq says.

According to DeTuncq, UVA Community averages approximately 600 federal and state returns a year, saving each filer about $225 in tax preparation fees and returning them an average of $1,700 in refunds. This translates to a yearly economic impact on the local economy of between $1.3 million and $1.9 million.

The pandemic closed many of our coalition’s partner sites and the credit union stepped up, Detuncq adds. In 2021, we prepared about 887 returns. This year, we’ve already prepared about 600 returns, and we still have 15 days left in the filing season.

Border Federal Credit Union

Maria Martinez has been president and CEO of the 25,326-member Border Federal Credit Union ($218.7M, Del Rio, TX) for nearly 25 years. Her institution has been participating in VITA for 17 years.

Border does all its work in person via a drop-off service that replaced face-to-face work once the pandemic arrived.

Taxpayers are seen in the order in which they arrive, all documents are collected at this time, and an interview is conducted, Martinez says. Once the interview is concluded, the taxpayers are given a date to return to review and sign their tax return.

Border certifies its branch staff VITA volunteers through the IRS and will continue its drop-off system because of the growing volume of taxpayers using the service. The credit union was preparing approximately 2,000 returns a year. That grew to 2,224 last year, representing slightly more than $5 million in refunds and saving filers who average $21,000 in family income approximately $330,000 a year in preparation fees.

The credit union does very little VITA marketing, yet Martinez says more than 70% of its clients return year after year.

While working with VITA program participants, Border also takes the opportunity to offer low- and no-cost products, including the government’s ITIN Program, and financial counseling to unbanked and underbanked community members.

The financial impact to our community with the free service is tremendous, Martinez says.

First Credit Union

Heidi Kim has been with First Credit Union($666.3M, Chandler, AZ) in suburban Phoenix for 32 years and currently serves as chief experience offer for the 41,644-member cooperative.

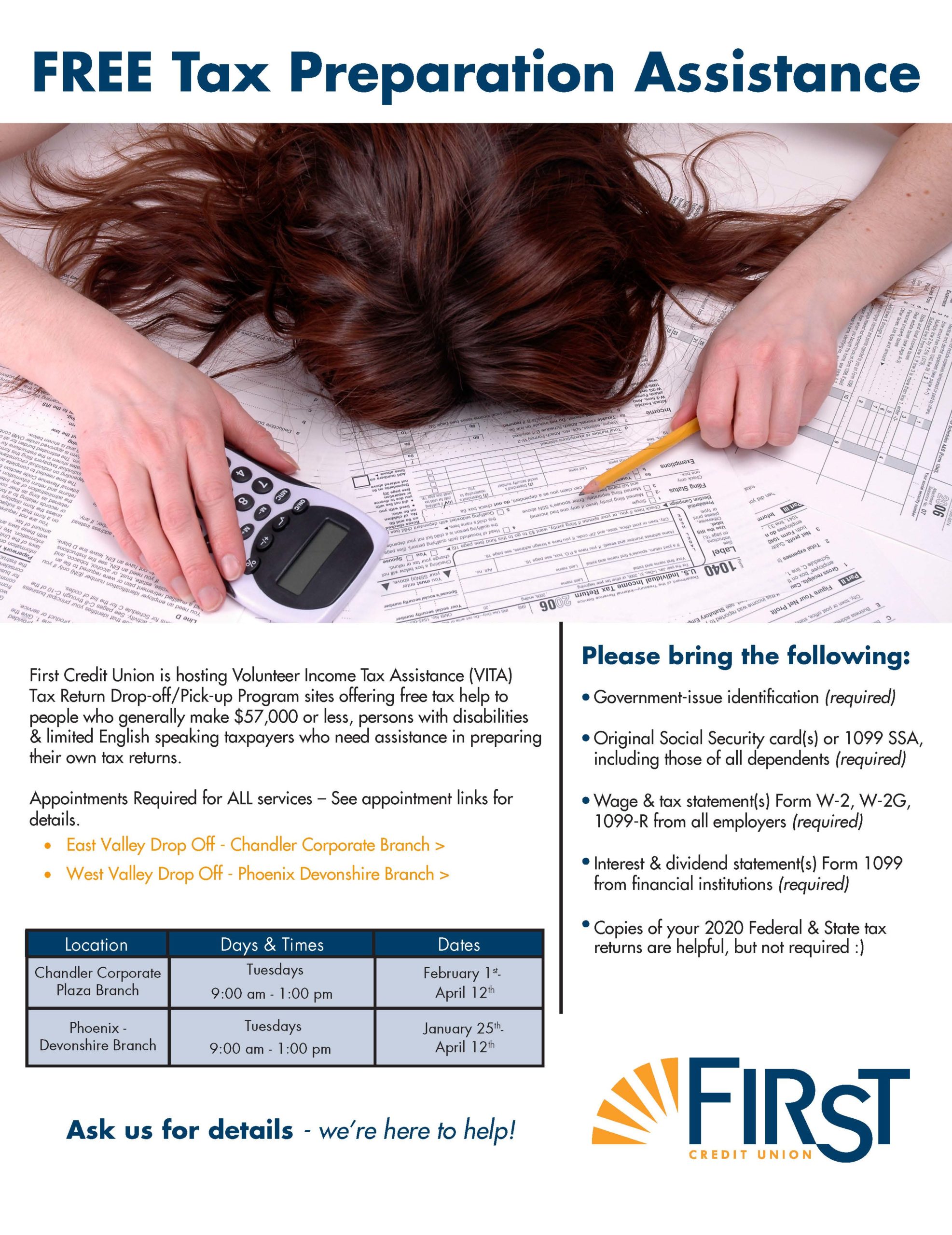

First Credit Union has been offering the VITA program for more than 15 years, partnering with local municipalities and community organizations that sponsor and train the VITA volunteers.

Kim says the cooperative prepared 309 returns last year that totaled more than $431,000 in refunds; 82% of the clients reported incomes below 80% of the area’s median family income.

First Credit Union uses a variety of communications, including flyers, to promote its participation in the VITA program.

Community partners do much of the outreach for the VITA program, but First Credit Union also pitches in with marketing on its website, in-branch messaging, and placements on community partner websites. After 15 years of VITA participation, community members that have used the credit union’s services also help spread the word by mouth and many are repeat participants, Kim says.

When we began, we were one of the first locations in our immediate community involved; now many others also participate, the chief experience officer says. VITA helps us give back and connect to our community. We are here as people helping people, and we’re fortunate to have many loyal, dedicated volunteers who are passionate about helping those who need VITA services.