Top-Level Takeaways

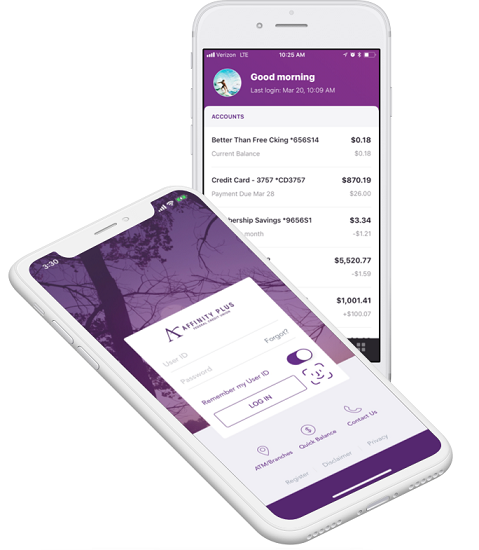

- Affinity Plus rolled out a new mobile app that has garnered better reviews and more usage.

- The credit union converted its online and mobile systems to provide a next-generation digital banking experience.

Affinity Plus Federal Credit Union ($2.3B, Saint Paul, MN) has been busy.

In the past three years, the second-largest credit union in the Gopher State has undergone seven major systems conversions, including changes to both its core and digital banking providers that allowed it to introduce an entirely new digital experience to members.

Members couldn’t fully self-serve digitally, which led them to call us or come into the branch to do their everyday banking, says Maha Brauch, director of digital services at Affinity Plus.

According to Brauch, the credit union’s previous vendor dictated its digital roadmap and strategy, and the overall experience for members wasn’t mobile-first or as all-encompassing as the institution wanted.

Members weren’t happy, either. They gave Affinity Plus’s old mobile application a rating of 1.4 stars on Apple’s App Store. The app didn’t score much better in Google’s Android Store. Users there gave it a rating of 2.5 stars. Between the two systems, the app had little more than 2,000 reviews and ratings.

That changed with the roll out of a new mobile application on April 3, 2018. The app currently earns an average rating of 4.8 stars for both Apple and Google based on 25,000 ratings in Apple and 2,500 ratings in Google.

Usage has picked up, too 23% within the first year. And in March 2019, active mobile app users surpassed online banking users for the first time ever.

A Focus On Self-Service

Affinity Plus began looking for a new online and mobile provider in the summer of 2016.

According to Brauch, the credit union’s mobile app experience at the time was a utilitarian version of the desktop one. Members could check account balances, review transaction histories, transfer between accounts, deposit checks remotely, and pay bills.

It wasn’t easy to use, it wasn’t intuitive, and it was missing key features, the director of digital services says. I can remember waiting in line at Costco trying to use the app and thinking, This can be better.’

The credit union had a long wish list for a better app design. It wanted members to be able to enroll through the app, self-serve in a lockout, and apply for products, including loans. It wanted more robust e-statement functionality and consistent account balance and transaction history presented in one location. And, it wanted a secure chat.

Members had a wish list, too. The credit union surveyed members and branch staff, culled through NPS scores, and reviewed mobile app store ratings to identify 10 things members wanted from a mobile experience. These included:

- Register for mobile banking on mobile.

- Login via touchID.

- View all accounts in one place.

- View transaction history.

- Pay others.

- Transfer funds.

- Deposit checks.

- Update profile details.

- Query a transaction.

- Call for help directly from the app.

Whatever the member wants to do in a branch or at the call center, we wanted them to be able to do digitally, Brauch says. The focus was self-service.

An open API ecosystem, the ability to partner easily with third parties, and a software development kit (SDK) convinced the credit union to choose Fiserv’s Architect system for online banking. For its mobile app, Affinity Plus partnered with BankingOn to develop a native mobile application using Fiserv’s SDKs.

Together, the two created a customized mobile app that offers the necessary base functionality including biometric logins, self-service options, better organized balance and transfer information, and secure messaging but also leaves open the potential to add more in the years ahead. Already, as Affinity Plus has learned more about the app and how members use it, the credit union has leveraged the open API infrastructure to add functionality to make a better, more encompassing member experience.

With what we heard from members and what we were trying to do from a user experience, native was the way to go, Brauch says.

Super Functionality; Superior Experiences

Affinity Plus strives to engage members emotionally, and it uses its app to make members feel like they are part of a larger community. The background for the login page shows Minnesota scenery that changes every season; most of the visual collateral features real members and employees of Affinity Plus; and users transferring money to a different member might see a picture of that member, which makes it easier to transfer money as well as builds a community within the app.

That focus on emotional engagement is apparent in the design and development of the app, too. To ensure members feel like they are interacting with the same credit union, Affinity Plus provides the same helpful, warm experience face to face, over the phone, and in the app.

Our brand promise is to provide a stronger connection for people who want a more meaningful banking relationship, Brauch says. We want that to come across in our app experience.

4 Ways To Put The People First

Affinity Plus has built an app that offers a positive emotional experience for users. One way it has done this is by humanizing copy. What does this mean? Maha Brauch, director of digital services at the credit union, explains.

- We write with care, empathy, and respect and provide information in the same helpful, human way we treat our members in person.

- We use a conversational tone. Contractions is one way to achieve that.

- We provide helpful details upfront. This helps us design effective outage messaging in our app and online banking.

- We gently nudge members back on track and provide a path forward rather than abruptly stating what they did wrong. For example, if a member tries to schedule a transfer past a cut-off time, our error message says: Because it’s past today’s cutoff, please select either immediate (which defaults to the earliest possible time) or a future date. That’s better than a robotic-like: You cannot schedule an external transfer today because it is past the cutoff time.

The credit union achieves this in a number of ways. It writes copy that sounds like a human, not a robot; it uses simple language that is easy to read and understand; and it avoids highly technical language and terminology. When it comes to color choices, it uses red only when absolutely necessary to avoid invoking a feeling of stress or panic. And, it responds to member feedback right away. For negative feedback, the credit union acknowledges member frustration, offers an alternative, and follows up to let members know how the credit union resolved the issue.

The focus on our members is not lost, Brauch says. They see it and feel it, which is why we routinely see members change their negative app ratings and reviews to a positive one after hearing back from us.

When it was designing the app, the credit union created user personas based on real members. These personas helped the development teams achieve a level of empathy and understanding about the different types of members Affinity Plus serves. And as the credit union continues to roll out features, it analyzes the entire member journey to eliminate pain points that might trigger a negative emotional response, such as frustration, stress or anger.

The app experience is simple, easy, and intuitive, Brauch says. Members don’t have to think too hard to accomplish what they are trying to do.

This includes members that might have different accessibility needs, too. A user experience team at the credit union reviews feedback from surveys, branch and call center interactions, and face-to-face meetings to identify pain points for all members. Earlier this year, the team sat down with a visually impaired member to see how he used assistive technology to navigate the app. Unfortunately, he needed assistance to accomplish simple tasks, so Affinity Plus made changes to improve the app. Now, the credit union evaluates requirements from an accessibility standpoint, too, for every feature it rolls out.

Improving member experience is a continuous and ongoing process, Brauch says. We didn’t stop with the launch of our mobile app.

Getting Ready To Go Live

The core and digital transitions that allowed the credit union to offer a better digital experience took nearly a full year of preparation.

CEO Dave Larson sent the first member communication about the conversions in May 2017. He explained to the institution’s 200,000-plus members that the technology upgrades in their immediate future were integral to the long-term viability and success of the credit union.

In September, email and print communications guided members to videos that outlined key aspects of the conversion. Marketing materials channeled the Progressive Insurance character Flo to ease misgivings about the change, and a landing page on the credit union’s website provided a one-stop shop for everything related to the upgrades. A series of print, email, and social media communications as well as in-branch, ATM, and phone messaging also spread the word.

In March 2018, Affinity Plus focused its communications on specific steps members should take to prepare for the new experience. For example, the cooperative asked members to download the new app rather than updating the previous one. Notably, the credit union didn’t require members to create a new username or password, it rolled over all custom account names, and it made sure all external funds transfers worked.

Whatever the member wants to do in a branch or at the call center, we wanted them to be able to do digitally.

We wanted to make sure they felt some familiarity with the system and could see the care we put into the design to make it frictionless, Brauch says. Change causes anxiety. When that change involves money, tolerance can be low. We made a concerted effort to ensure members could get into their online and mobile banking successfully the first time. Having it work at first try is crucial in building trust.

But it wasn’t just members who needed to prepare for change; the credit union did, too. It developed a comprehensive support plan that increased call center staffing, extended call hours, and established a conversion support center that provided a place for centralized information as well as instructions for handling inquiries or seeking assistance when necessary.

It was a central hub for gathering, tracking, and responding to app-related issues, Brauch says.

There were surprises, of course. Members commented on the security of the new app. The old app required two-factor authentication because there was no biometric component. The new app required only a thumbprint or facial scan, which some members mistook for diminished security. The number of members who used the chat functionality also surprised the credit union, which had to restructure its staff support to handle the surge of secure messaging.

It goes to show that users want to self-serve and will engage when it’s easy and convenient, Brauch says. If it’s intuitive they’ll find it and use it.

Reception And The Future

As part of the overall digital conversion, Affinity Plus created a digital team helmed by Brauch to oversee the day-to-day management of the credit union’s digital experience. Now that the credit union has control of its digital roadmap, including the ability to prioritize its own functionality rollouts, the team is especially busy.

We’re looking at the roadmap, refining the product backlog, prioritizing projects, and championing the end-to-end user experience, Brauch says.

The growing team includes user experience designers, researchers, a copywriter, digital project managers, and an overall manager who works closely with BankingOn, in-house developers, and a quality assurance team. The group is taking its initial steps toward adopting an agile methodology to project management, and it’s in large part due to the work of this team that the credit union’s digital banking experience continues to evolve.

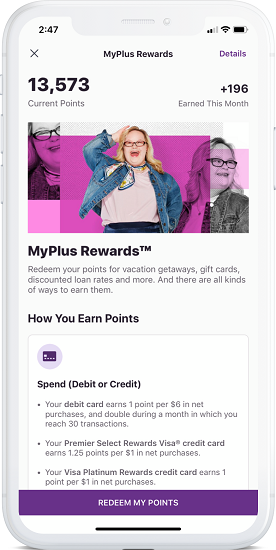

Recently, the credit union launched a rewards management feature that allows members to review and redeem rewards. The rollout was an instant hit.A month before the release, 14,000 people interacted with the rewards feature and there were approximately 28,000 clicks on the rewards button on the accounts page. After the release, the credit union recorded 35,000 interactions and 68,000 clicks on the rewards account page button. However, the credit union also identified a member behavior that helped it further improve the feature.

Members can apply rewards toward a fee refund, but even members who had no fees were asking for the refund. After running a usability study on this section of the app, the credit union discovered members thought they were asking for a free refund. The discovery helped the digital team’s copywriter re-work messaging to avoid similar associations in the future.

Affinity Plus’s digital experience has greatly evolved in just three short years, and Brauch has several tips for other credit unions that want to attempt something similar.

First, make self-service a priority. Second, test, test, test. The credit union stress tested in hundreds of business scenarios and ran several rounds of regression testing. Third, know there’s only one shot at a first impression. The last thing a credit union wants is a member’s first experience with new technology to be buggy.

Going forward, Affinity Plus plans to offer more self-service capabilities, such as the ability to find specific financial expertise, and will include its business intelligence team in the planning stages, too. Anything to build the best experience.

We need to create and offer a personalized, relevant experience that gets members where they need to go, Brauch says. They expect that from us.