Top-Level Takeaways

-

CommunityAmerica’s Innovation Lab follows a rigorous process to refine ideas and develop user-driven solutions.

-

With the help of its Teen Advisory Board, the credit union developed and launched a first-of-its-kind College Cost & Compare Calculator.

-

Prioritizing the initiatives that can help the biggest groups of members with life’s key financial challenges helps keep innovation on track.

When CommunityAmerica Credit Union ($2.6B, Lenexa, KS) launched its Innovation Lab last year, its mission was clear: Use the innovation process of iterate, test, and fail to deliver peace of mind to members.

The large Kansas City credit union brought on board a new chief innovation officer to launch the independent lab and create products and services that help members navigate different stages of life. Importantly, the lab is rooted in user behavior and relies on feedback and engagement from members, staffers, and area entrepreneurs.

A College Calculator

CommunityAmerica’s Innovation Lab takes a methodical approach to research and development. The lab works on multiple ideas at once and spends a lot of time talking to members early and often to focus its efforts on addressing financial concerns shared by large groups of members.

One of the lab’s early areas of focus was solving the stress around the expense of college.

“For any member that has children, one of the main areas of worry is navigating the confusing and challenging process of finding a college their child will love and they can afford” says Anita Newton, chief innovation officer at CommunityAmerica.

To tackle the topic, the credit union first hired two college and career planners to meet with families and provide free one-hour planning sessions.

“Our members left with a customized plan” Newton says. “Our Net Promoter Score (NPS) in this area has been 100%.”

The innovation lab worked closely with the college and career planning team to gain insights about how to digitize and amplify their work. Together, they identified three deliverables:

- Streamline the process of the planners to make it more efficient via online tools.

- Launch a new video series to help families navigate college planning. Watch a video.

- Introduce a first-of-its-kind college calculator. Start calculating.

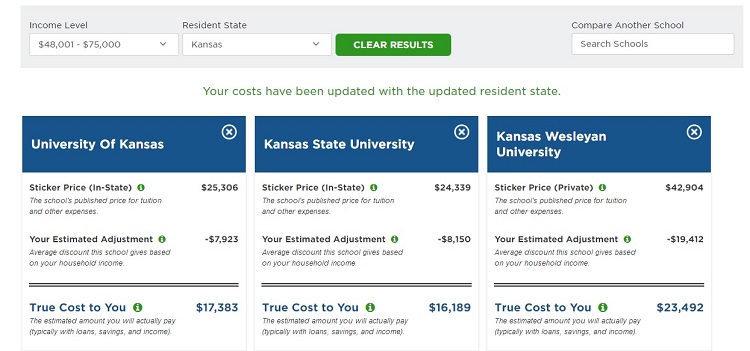

In Spring 2018, CommunityAmerica launched its College Cost & Compare Calculator, a tool that helps users determine the true cost of nearly any school in the nation. The free web-based, mobile-friendly calculator combines the user’s income and residency with public data on tuition rates and grant/scholarship capacity to estimate the true cost for different college selections. Users can then compare the results for multiple institutions.

The Idea Is Just The Beginning

Ideas like the college calculator come in to the lab from a variety of sources. Narrowing down those ideas can be difficult, but a rigorous innovation process helps CommunityAmerica keep innovation on track.

In this instance, we started with identifying big areas of focus from our career and college planners, Newton says.

From the initial five to 10 core ideas, which included things like understanding the ROI of college and student debt, the lab dug deeper in its exploration and landed on three to four problem statements. Then, CommunityAmerica pressure tested these statements with teens and their families.

‘”We wanted to create a tool that incents high school freshmen to start actively planning for college and not wait until their junior year of high school” Newton says. Part of the innovation process involves looking at whether anyone is doing this already and filtering the ideas by whether or not we can deliver.

And according to Newton, a major part of the innovation process involves research and development conducted directly with members.

“We start with ideas, then interview members to learn more about their needs” the CIO says. “From there, we put together wire frames. Then, we do more research, revise wire frames, and create clickable prototypes.”

Although the process involves a lot of back and forth along with various edits and deletions along the way, the final product is much more likely to resonate with the target audience. Because the target of the college calculator was teenagers, CommunityAmerica’s Teen Advisory Board played a critical role in the development process by providing brutally honest feedback and poking holes in the tool all along the way.

How Did Credit Unions Perform In 1Q18?

Listen to Callahan & Associates and guest speaker Anita Newton, chief innovation officer at CommunityAmerica Credit Union, discuss industry performance trends, successes, opportunities, and more.

Out Of The Mouth Of Babes Or Teens

As the credit union conducted its more than two dozen parent interviews, it quickly learned that what’s inside the mind of a teenager is a complete black box. So, the credit union went direct to the source and enlisted feedback from the teens themselves. That took the college and career planning initiative into new directions.

We didn’t land on the calculator as step one, Newton says. We knew that college and career planning required a commitment from teens and wanted to create something to help them and their families.

In November 2017, CommunityAmerica hired a group of 16 high schoolers to form an advisory board that vetted ideas, interviewed others to gather qualitative feedback, and reported their findings back to the credit union. The group has been meeting for 90 minutes once or twice a month since January and will wrap up meetings in May. The board has used online tools to provide quick feedback on time-sensitive development questions, identify issues, and submit research notes.

“The teens were highly motivated and interested in starting their own businesses” Newton says. “We intentionally created a light schedule so the teens had no more than an hour of work to do in between meetings. It wasn’t a lot of time for them, but it was very helpful as we prioritized must-haves for the development of our final calculator product.”

Growing Up Google

Newton says CommunityAmerica’s experience with the teen advisory board has been eye-opening.

“We’ve learned a lot about how teens think and what they do and don’t need” Newton says. “These kids have grown up in a Google/Instagram world, and they look for tools that are simple and beautiful. Anything extraneous they delete.”

3 Tips To Innovate

For credit unions considering an innovation lab or just looking for new ways to approach R&D, Anita Newton, chief innovation officer at CommunityAmerica Credit Union, offers these three key pieces of advice:

- Start Small Don’t rush out and spend a fortune on an army of people, tools, and consultants. Money doesn’t necessarily drive activity. Start small, listen to members, and have a clear process.

- Understand Why Tie innovation into strategy. There is no use in innovation for the sake of innovation. The overriding business value must be present. What is the credit union trying to do for its members?

- Give it Time CommunityAmerica has an amazing management team that understands it takes time to innovate. For example, we worked on one of our big ideas for four months before writing a single line of code. This helped us ensure we had a firm grasp of what the members wanted first.

For example, the credit union initially included an average salary estimate as part of the calculator. But users with no frame of reference for what a good salary was deemed this extra piece of data unnecessary. Another early idea that didn’t make the cut was a recommendation feature for a major or career.

For this generation that is so accustomed to having Spotify or Pandora perfectly recommend music with almost spooky accuracy, having a tool that recommended something that was even slightly out of sync would have resulted in the entire calculator being dismissed outright, Newton says. Recommendations that are wrong are like a big joke to them because their expectations are so high.

Insights like this are part of the real benefit of working with real users.

“It’s not always about knowing what we are going to do” Newton says. “It’s also about deciding what we are not going to do.”

User-Driven Versus Management-Driven

At every stage of the Innovation Lab’s process, CommunityAmerica seeks the voice of the member.

“Our chance of success is much better when we make it a user-driven process versus a management-driven one” Newton says. “Our whole goal is to level the financial playing field and deliver peace of mind for our members through tools that will scale.”

The calculator is one way the credit union is reaching more families and providing transparency into an opaque process, changing lives in the process.

“Low-income and minority families often opt out of potential schools because they think they are too expensive, but household income is the biggest driver of financial aid” Newton says. “What’s super exciting is I’m getting emails from people saying they would never have considered a school but are now focusing on getting in versus whether they can afford it.”

Now, CommunityAmerica is talking with other credit unions about customizing both the calculators and educational videos for their own use.

“It’s a great way to showcase the credit union difference” Newton says.