Generations Federal Credit Union ($624.8M, San Antonio, TX) doesn’t have the largest investment portfolio its total of $145.2 million is approximately $50 million less than that of credit union peers with assets from $500 million to $1 billion in the first quarter of 2016. But the investment portfolio doesn’t have to be large for the credit union to find value. Not when the average yield on investments is 2.37%, higher than the 1.27% average of Generations’ peers, according to Callahan’s Peer-to-Peer data.

In this Q&A, Marcel Theriot, senior vice president of finance for Generations, discusses the credit union’s approach to investing and why the investment portfolio warrants as much management as the loan portfolio.

What is Generations Federal Credit Union’s investment strategy?

|

| Marcel Theriot, SVP of Finance, Generations FCU |

MT: We have a disciplined approach to investing, which means we have a plan in place and we execute that plan when the market is up and when the market is down. Our investment philosophy does not change.

We have a risk-adjusted basis for our philosophy. We manage risk first and yield second. The three parameters of our philosophy are safety, liquidity, and yield in that order. We’ve outperformed the rest of our peers because of that disciplined approach.

What investments are included in Generations’ portfolio?

MT: We manage our portfolio in a couple of different ways. We have the traditional portfolio composed of securities permitted under Part 703. We have purchased mortgage-backed securities (MBS), and in the past private-labeled MBS, to increase our yield in that area. In addition, we have allocated approximately $10 million for employee benefits. Under rule 701.19, credit unions may use alternative investments for this portion of the portfolio, which is for employee benefits such as health insurance, tuition reimbursement, retirement, etc. Some credit unions use insurance, but we use an allocation of mutual funds and exchange traded funds.

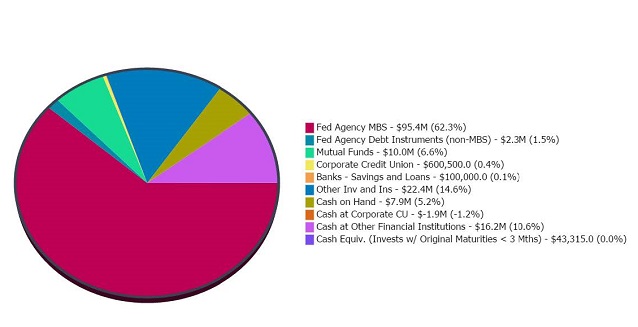

INVESTMENT COMPOSITION

For Generations Credit Union | Data as of 03.31.16

Callahan & Associates | www.creditunions.com

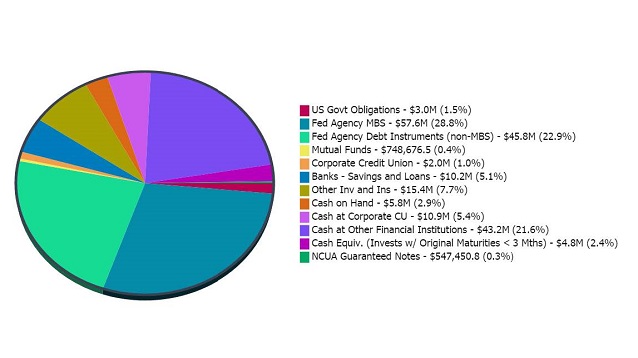

INVESTMENT COMPOSITION

For credit unions $500M-$1B | Data as of 03.31.16

Callahan & Associates |www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

How does this portion of your portfolio differ?

MT: Since the portion allocated for employee benefits is not subject to the limitations in Section 703, we manage the portfolio in a 60% bond and 40% stock mix using mutual funds and exchange traded funds to provide greater yields. We’ve had greater than expected returns in this part of our portfolio while focusing on a risk-weighted adjustment using standard deviation. Thus, our portfolio has outperformed without significant risk.

Do you use external resources or perform analysis in-house?

MT: We maintain all research and decision making in-house. I am the lead portfolio manager of our investment strategy. We have an investment committee that meets regularly to review and execute strategies.

Follow The Leader

Explore dozens of leader tables and hundreds of pages of credit union performance data in Callahan’s Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

Explore dozens of leader tables and hundreds of pages of credit union performance data in Callahan’s Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

What tools do you use to manage the portfolio?

MT: We use Bloomberg for both the Part 703 portfolio and our alternative investments. That is probably the most vital tool we have in terms of reviewing securities we can buy in the market, tracking how our current investments are being priced, and looking at yield curves.

CU QUICK FACTS

generations FCU

Data as of 03.31.16

- HQ: San Antonio, TX

- ASSETS: $624.8M

- MEMBERS: 53,871

- BRANCHES: 14

- 12-MO SHARE GROWTH: 10.45%

- 12-MO LOAN GROWTH: 44.11%

- ROA: 0.64%

If a credit union has an investment portfolio of greater than $50 million, I believe a tool like Bloomberg, which allows you to diversify your securities and enhance your portfolio, is worth the investment. Having the investment expertise and background to use the tool is also critical.

Have you done any special training or education, especially with your board of directors?

MT: We have done some education, but we’ve also found ongoing, open communication about what is going on in the market and our philosophy is effective. I shouldn’t be the only one who knows what’s going on with our investment and loan portfolios; we all need to be aware of what’s going on. If we find that a portion of the loan portfolio is underperforming, we might decide to move that to investments for the benefit of the entire organization. We discuss both monthly at our ALCO meetings and continually communicate with the senior management team and board.

The investment portfolio is not just a cash repository for future lending; it’s a vehicle that can also produce income for you in a risk-adjusted manner.

What advice do you have for credit unions looking for new investment strategies or alternative options?

MT: Know what you are getting into. Don’t let anyone sell you something you are not 100% familiar with. Managing your investment portfolio is just as important as managing your loan portfolio. As a credit union investment manager, you need to make sure you are up to speed and educated about what’s going on in the overall market and within your portfolio so you can improve it. The investment portfolio is not just a cash repository for future lending; it’s a vehicle that can also produce income for you in a risk-adjusted manner.

You Might Also Enjoy

- How Firefighters First Credit Union Plans To Hit $1 Million In Net Income

- 21 Ratios All Credit Unions Must Know

- How Rogue Builds Relationships, Deposits With Loyalty Programs

- Investments By The Numbers