Do-it-yourselfers nowadays easily navigate the technology needed to design their own kitchens and backyards. But it doesn’t stop there.Why not build an application where credit unions can build and design their own digital branch?

Being able to quickly and easily build out features that credit unions need to compete has never been more important.

The pandemic greatly accelerated mobile and online banking use, and non-bank disruptors have joined the credit union movement’s traditional competition banks bringing with them agility that today’s member-owned financial cooperativeneeds to match to keep up or risk falling behind and even fading away.

Fortunately,the solutions are in the market to take advantage of the opportunities credit unions have to quickly add new services, modify their existing products, enhance their interactivity,and now to do all that regardless of size or internal IT capacity.

The Challenge And Opportunity Is Here And Now

Right after COVID-19 sent America home, VisiFI saw a 59% jump in mobile banking alone through our digital platform. That was in March 2020. Now, just more than a year later, those numbers continue to climb, even as the pandemic subsides.

The challenge now is that members and prospective members seem to be increasingly aware of the digital gap between what they can do at a credit union versus a bank, at least in their perception. And in this case, perception is reality.

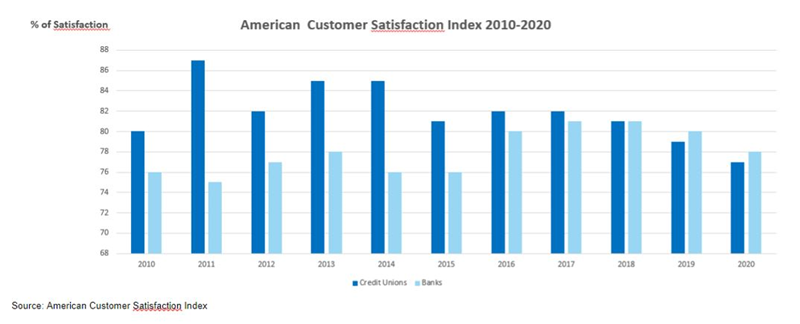

A recent American Customer Satisfaction Indexshows credit unions continuing to fall behind banks. Digital banking no doubt is a major reason. Banks, especially the big ones, offer more digital capabilities than a typical credit union. And they can quickly add more.

It doesn’t have to be that way. For many credit unions, their long-term survival may well depend on their ability to quickly get new capabilities to market, and a digital storefront approach can provide that ability effectively and efficiently.

Credit Union Satisfaction Slips Behind Banks

We Are Building A More Personal Style And Approach To Design

The tools are there for savvy credit unions to build their own digital branch. VisiFI, for example, offers an intuitive, interactive application that allows credit unions to simply drag and drop, choose layouts, colors, and more as they design a digital storefront that is personal and custom branded to align with their style and reputation.

And you’re not going it alone. Our design options, widgets, and workflows ensure you won’t build an ugly or complicated digital branch. Characteristic of the best new technologies in this realm, the VisiFI solution uses sophisticated principles such as behavioral science to empower end users to easily create products and services that members will find uncomplicated, appealing, and as personal and accessible as the staff inside a branch.

Going Digital While Staying Personal: A Simple Roadmap

Today’s innovative credit union can meet competitive challenges and leverage the opportunities to display the credit union difference by using the right tools to go digital while staying personal.

Incremental steps can get you there and the best systems like VisFI’s include these characteristics:

- A modular design and connectivity with any core processing platform along with multiple APIs and third-party solutions and services

- Innovative drag-and-drop applications that can create digital storefronts easily with just a few clicks

- The ability to grow by easily adding and modifying features

- Embedded security that meets the industry’s highest standards

- Simplify the onboarding process by implementing digital account opening

The ideal solution is to work with a technology partner who can empower you with the tools you need to easily cut through the complications and rapidly go to market with updates and advances to your digital presence and services.

Our company includes experts with long experience at credit unions themselves and with leading credit union suppliers. We bring the expertise and the passion for the credit union difference to help your cooperative separate itself from the competitionand grow with the opportunities as they present themselves.

In the words of one of our clients on this journey with us:We have a three-year digital roadmap: we want to continue to be on the edge with new technologies, to deliver more security and safety for our members. We stand and build on members’needs.VisiFI has the knowledge to accompany us as we move forward says Greg Mills, CEO of $250 million Aventa Credit Union in Colorado Springs,CO.

With the right technology, credit unions can quickly design and go to market with the digital presence they need to retain members. VisiFI provides that with a Design Your Branch application, which is part of VisiFI’s digital banking platform. Along with the company vision: To help credit unions attract, engage, and grow membership through innovation, this solution’s goal is to simplify the digital transformation process of the Credit Unions with its all-in-one standalone platform.

Robin Kolvek, CEO, VisiFI

Be sure that partner has a solution that’s built to meet these goals that are critical to both member service and your institution’s ability to stay viable in an ever-growing, intensely competitive financial services market:

- Compete with banks by using technology to expand services

- Enhance customer care by innovating members’needs

- Transform brick and mortar by creating your own digital storefront

- Be recognizable by elevating your image and preserving your brand

Robin Kolvek is CEO of VisiFI. For more information,visitwww.visifi.com.