Loans for cars and cards are an easy port over to the mobile environment. Mortgages, not so much.

That’s what some notably tech-savvy credit unions are finding as they build out their mobile presence into a holistic business enterprise.

BECU ($13.6B, Tukwila, WA),Coastal Federal Credit Union($2.5B, Raleigh, NC) and BCU ($2.2B, Vernon Hills, IL) are all in various stages of transforming into next-generation mobile financial service providers.

Each uses a combination of responsive websites which adjust their look, feel, and functions based on the hardware the visitor is using and forward-looking apps to maintain a seamless experience across all touchpoints. It’s a holistic approach rather than the historic notion of developing one app at a time, and it is the next step in a technology boil that began simmering with ATMs in the 1980s and started rolling with online banking a decade later.

CU QUICK FACTS

COASTAL FEDERAL CREDIT UNION

Data as of 03.31.15

- Raleigh, NC

- ASSETS: $2.5B

- MEMBERS: 201,110

- ROA: 0.83%

- 12-MO SHARE GROWTH: 5.20%

- 12-MO LOAN GROWTH: 18.88%

- NCR/mFoundry: MOBILE BANKING

- Fiserv Corillian: ONLINE BANKING

- Symitar Episys: CORE PROCESSOR

Mobile is the new online banking, says Howie Wu, veteran technologist and vice president of digital at BECU.

As in online banking, mobile is not a replacement for or the end of in-person service, especially for the more complex offerings like mortgages and wealth management. But it’s certainly where the majority of member and thus credit union interests are heading.

You can’t start something digital and then expect to finish it up with analog, says Kris Kovacs, senior vice president of operations at Coastal. You have to be prepared to digitize the entire experience. We’re building out anew infrastructure that will provide more robust services and transactions across all our channels, including mobile.

The investment in time and money required to divine and respond to a new reality is considerable and inevitably raises the question of return. But as Kovacs poignantly observes, What’s the ROI on survival?

CU QUICK FACTS

BECU

Data as of 03.31.15

- HQ: TUKWILA, WA

- ASSETS: $13.6B

- MEMBERS: 900,526

- 12-MO SHARE GROWTH: 7.24%

- 12-MO LOAN GROWTH: 13.38%

- ROA: 1.43%

- MOBILE BANKING: Monitise

- ONLINE BANKING: Fiserv Corillian

- CORE PROCESSOR: Fiserv DNA

For credit unions, the mobile proposition is simple even if its implementation is not. Here, each organization explains what’s currently working as well as where mobile is headed in the future

Mobile@BECU

A Screen For All Seasons

The focus at Washington’s $13.6 billion BECU is on creating an experience that extends all the way from app to branch.

For example, many members at BECU begin the loan process from a handheld device and finish it in another channel, says Scott Strand, the credit union’s senior vice president of member lending, business, and wealth.

Branches still represent the ideal end point for this relationship building, thanks to their natural positioning for product and sales-driven experiences. But some mobile users might prefer to jump over to a tablet or PC as well.

CU QUICK FACTS

BCU

Data as of 03.31.15

- HQ: VERNON HILLS, IL

- ASSETS: $2.2B

- MEMBERS: 197,758

- BRANCHES: 25

- 12-MO SHARE GROWTH: 9.49%

- 12-MO LOAN GROWTH: 12.86%

- ROA: 1.26%

- MOBILE BANKING: WRG (Native App), In-house (Mobile Web)

- ONLINE BANKING: In-house

- CORE PROCESSOR: Symitar Episys

In light of that reality, BECU is now using a responsive-design website that optimizes its view depending on the device the visitor is using. In addition, the credit union is redesigning its mobile apps with an eye toward launching them in late 2015.It will offer these apps across multiple platforms, including Android, iPhone, and even Amazon Fire TV.

Such platform diversity is an example of how BECU differentiates itself in the crowded mobile market.

Another example of how the credit union is responding to the voice of the member, as Strand calls it, is the addition of personal financial management software. PFM has been around for a while, but BECU only recently added it as an onlineand mobile offering.

We felt the user experience and technology had finally caught up with people’s expectations, Strand says. The time was right to use PFM to drive people to us instead of to a competitor like Mint.

As for internal development, Wu, the vice president of virtual lending, says the credit union typically buys rather than builds in mobile. By using middleware to create Web services tools that mesh more seamlessly with its core processing platform, BECUcan avoid the vicious churn of integrating something from scratch.

Mobile@Coastal

The Branch You Take With You

With a new core processing system in place, the North Carolina-based Coastal Federal Credit Union is currently in the second half of a three-year technology overhaul that is focused on providing a seamless member experience regardless of touchpoint. Don’tcall it an omnichannel approach though.

We should probably just let that word die, says Kristopher Kovacs, the credit union’s senior vice president of operations. What we’re talking about really are digital services, about building an infrastructure that enables youto have a free flow of communication with the member.

Based in the Research Triangle, Coastal isn’t afraid to innovate. It was one of the first credit unions to offer video tellers and it used Facebook as an early tool to alert members following the launch of its first mobile apps, which garnered ita quick 2,000 users.

Giving members what they want, even if they don’t know what they want, is a big part of the picture here, according to Joe Mecca, Coastal’s marketing and communications strategy manager.

Most people quickly realize the value of something when they see it in action, he says. But ultimately, it’s up to them whether to use it and how.

Build Once, Build Right

Coastal Federal Credit Union’s senior vice president of operations, Kristopher Kovacs, offers three tips to revamp a mobile presence.

- Don’t let designers get a hold of it first.

It has to work first, Kovacs says. Once it works, then you can make it pretty. - Know who you are.

You need to understand your own weaknesses and when you need assistance, Kovacs says. So we engage smart partners who can help us design these things. - Nobody can do it all.

The first vendor who tells you they can sell you everything you need should be thrown out of the building, Kovacs says.

That’s why Coastal’s Web presence now includes a responsive site that can accommodate deposits and offers consumers the ability to electronically apply and sign for loans.

The credit union also added account opening as part of its core conversion, and the loan origination software used online and on mobile devices can even handle mortgage applications, although that’s still a work in progress.

We’re working on determining how much information we really need to make a loan, Kovacs says. Finding the right answer will require some serious collaboration among Coastal’s technologists, lending specialists, and compliance and legalteam.

For now, the credit union’s legacy iPhone and Android mobile apps offer limited functionality and ride on the online banking system. But its core conversion opened the way for a new era of integration, one that includes joining BCU as one of the firsttwo credit unions live on the CUFX middleware standards for credit unions.

Today, this is a mix of acquired applications, Kovacs says. Our plan is to take more control of those as we build on that messaging layer. This will allow us to work outward, from application program interface development and employeeinteractions with the system over to member interactions.

Mobile@BCU

Think Like A Retailer

At Illinois’ BCU, addressing the volume of members who prefer to do business on a mobile device with a superior experience is paramount, says Jill Sammons, director of communications and brand strategy.

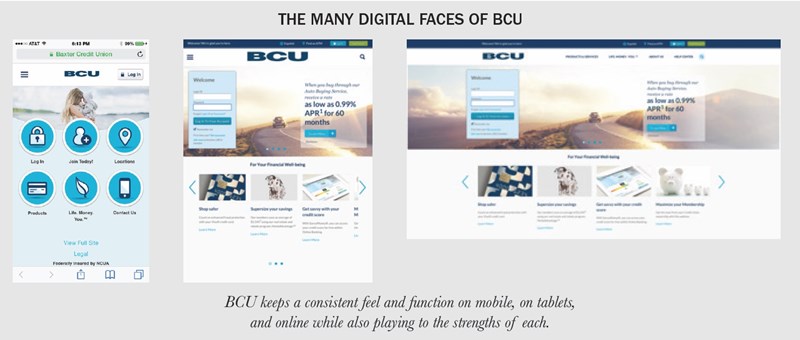

We want the experience to be as consistent as possible, whether someone is at their desk or on a handheld device, Sammons says.

That includes keeping all virtual touchpoints as consistent as possible from day to day and device to device through the use of a responsive website.

If I’m shopping the Gap website and it looks different from one day to the next, it’s a little unsettling

Similar to online vs. in-store shopping, our goal is to leverage these channels to reinforce the brand and ensure content is consistent, Sammons says. If I’m shopping the Gap website and it looks different from one day tothe next, it’s a little unsettling.

The credit union does use an app, however, to expand the functionality of members’ mobile devices. To date, its mobile app includes the ability to apply for both personal and car loans.

We definitely have a mobile-first mentality, says digital services director Scott Schmidt. And we’re working to catch up with that from the technical standpoint.

When Preference Comes At A Cost

BCU ($2.2B, Vernon Hills, IL) currently supports the two latest versions of Android, iPhone, Internet Explorer, Chrome, Firefox, and Safari. However, it costs $60,000 to $70,000 for every browser type, so BCU drops an option whenever usage among members falls below 5%.

We’d love to support every version out there, but at some point it would be cheaper to just buy the member a new device, says Scott Schmidt, the credit union’s director of digital services.

As the first credit union to use CUFX integrating technology, BCU’s preferred mix of in-house talent and outside vendors will be important as it builds interfaces that can collect data and parse it behind the scenes, helping to ensuremembers get the same experience on their smartphone as they would on a laptop. This extends to financial education as well.

At a lot of institutions, you can do online banking on mobile, but at varying levels of engagement, Sammons says. Responsive design enables an engaged experience with brand and content, limiting only graphics and photos.