New auto prices continued to rise amid global trade tensions, which stifled supply, and easier access to consumer financing following two rate cuts by the Federal Reserve in the third quarter. According to data from Kelley Blue Book, the average new vehicletransaction price hit $38,300 in October. That’s up from $37,195 one year ago. Much of this increase came from a shift in demand toward the more expensive categories of trucks and SUVs, which has dampened purchase levels for new cars. Seasonallyadjusted total vehicle sales fell 766,000 units versus one year ago to 17.1 million units in December, according to FRED Economic Data. Despite slowing unit sales, automakers sold more than 17 million cars in a calendar year for the fifth consecutiveyear.

Key Points

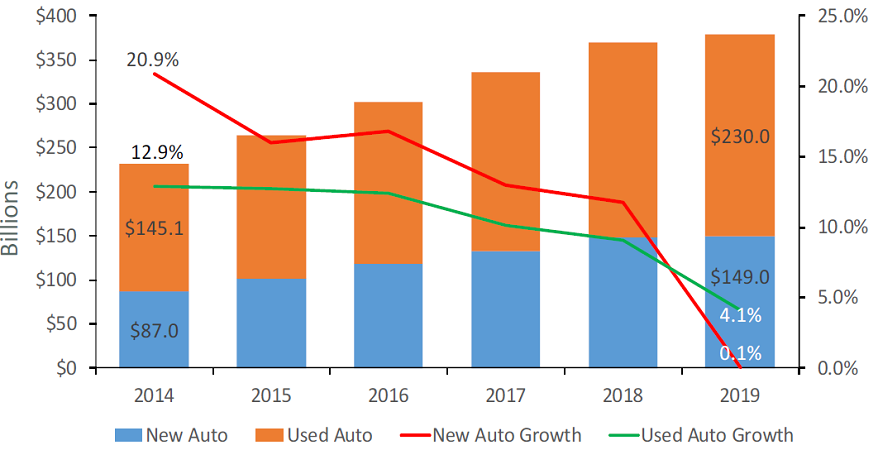

- Credit union auto loan balances expanded 2.5% in 2019. This is the lowest year-end growth rate since 2011, when it was 0.3%. Used auto loan balances grew 4.1% during the year while new auto balances increased 0.1%.

- Despite slowing growth, total auto loan balances hit a record high of $378.9 billion. Auto loans comprised 33.8% of the industry’s loan portfolio, down from 35.0% in 2018.

- Indirect lending grew 2.7% in 2019, a substantial decline from last year’s 14.3% rate. As indirect loans make up 60.6% of total auto balances, this slowdown has had a significant effect on cooperative auto performance.

- Auto loan penetration increased 8 basis points year-over-year to 21.3%. The number of auto loans outstanding grew 4.0% during the past 12 months, outpacing 3.6% annual member growth.

INDIRECT LENDING

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

After six straight years of double-digit growth, growth in outstanding indirect loan balances was 2.7% as of Dec. 31, 2019. This is the lowest rate since year-end 2011.

NEW VS. USED AUTO BALANCES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

New auto balances grew at a slower rate than used auto balances in 2019. The last time this occurred was in 2011.

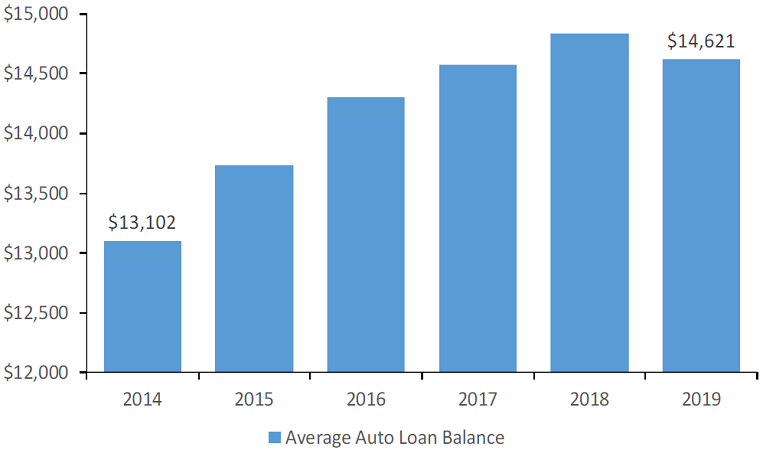

AVERAGE AUTO LOAN BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

As consumer demand shifted toward used and off-lease vehicles, the average auto loan balance declined 1.4% in 2019. This is the first calendar year decline since 2010.

The Bottom Line

After nearly a decade as the dominant strategy for increasing auto loan balances and attracting new members, indirect lending has started to slow as many credit unions pivot toward other avenues of loan generation. Despite slowdowns in indirect lendingand auto loan demand, auto penetration (21.3%) and market share (18.5%) remain strong at year-end.

This article appeared originally in Credit Union Strategy & Performance. .