The national economy felt the effects of nationwide quarantines in the second quarter. The Federal Reserve cut interest rates to record lows in an effort to stimulate spending, but with restaurants and leisure activities shut down, consumer expenditureslowed. Homebuyers took full advantage of the low rates, however, and mortgage lenders reported a record first half of the year, led by a surge in refinances. Still, total U.S. household debt fell $30 billion dollars from last quarter to $14.3 trillionthe first quarterly decline since 2014 as real estate loan growth was not enough to offset the savings habits spurred by COVID-19 and related government aid programs.

Key Points

- Through the first half of 2020, loan originations at credit unions nationwide totaled $314.4 billion. Credit unions granted $175.4 billion between April and June, the most in any quarter on record.

- Record low interest rates and increased savings helped spur a 94.0% annual increase in first mortgage originations, which totaled $130.0 billion through June.

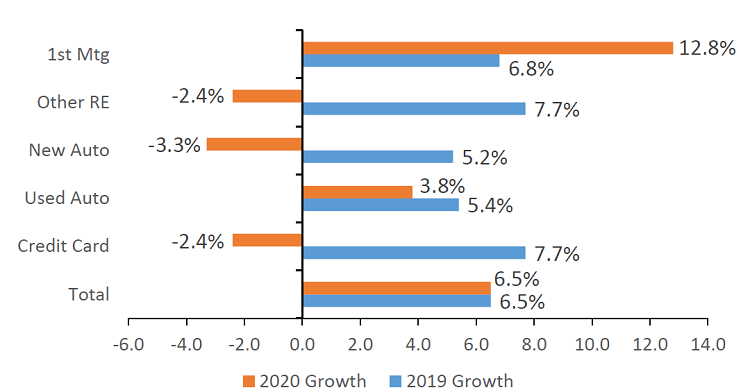

- Outstanding loan growth at credit unions accelerated 8 basis points annually to 6.5%, as of June 30. Credit unions historically perform well in a refinance market, a story that bore out with a 12.8% increase in mortgage balances.

- Commercial loan balances grew 17.0% year-over-year due largely to government-sponsored PPP loan programs. 833 credit unions engaged in the program and provided support to more than 170,000 small businesses.

YEAR-TO-DATE LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Historically low interest rates catalyzed a record year for mortgage originations. Refinances made up 62.5% of year-to-date first mortgage originations, according to data from the Mortgage Bankers Association.

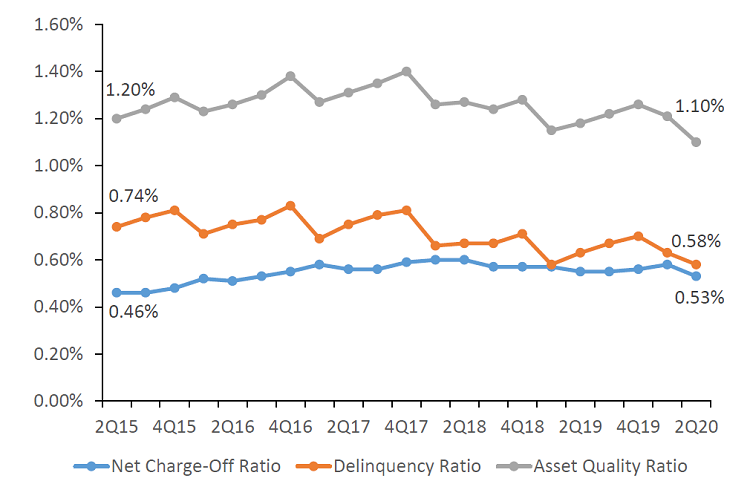

ASSET QUALITY

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

The asset quality ratio (the delinquency ratio + the net charge-off ratio) has improved since the onset of COVID-19, although much of this can be attributed to lenient payment deferral policies.

LOAN BALANCE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

COVID-19 lockdowns slowed consumer spending across the board, but strong mortgage growth resulted in accelerating overall loan growth.

The Bottom Line

Although the pandemic hindered day-to-day spending, the credit union loan portfolio still reported strong gains in the second quarter. Mortgage lending is on pace for its best year on record. Government assistance, combined with slowed spending, leftmany Americans with extra money in their pockets. This has brightened the consumer outlook as economies reopen, however, credit unions need to closely monitor asset quality moving forward.

This article appeared originally in Credit Union Strategy & Performance.